Influence of Blockchain in the Real Estate Sector

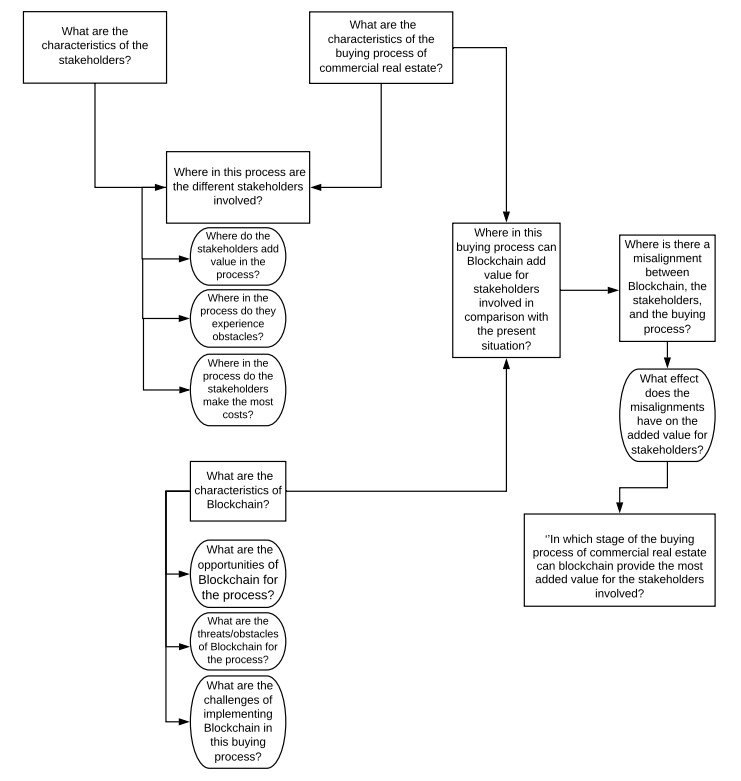

In Which Stage of the Buying Process of Commercial Real Estate can Blockchain Provide Added Value for the Stakeholders Involved?

Abstract

The two primary characteristics of real estate assets are their heterogeneity and immobility. Because of these two factors, the market for buying real estate tends to be illiquid, localized and highly segmented, with privately negotiated transactions and high transaction costs due to the involvement of a vast amount of trusted third parties (Ling & Archer, 2013). Because of these characteristics, and the opportunities Blockchain offers, the buying process of commercial real estate, and the involved stakeholders could be affected majorly by this technological phenomena. The lack of transparency, high transaction costs and the need for digitalization in commercial real estate companies give Blockchain its game-changing potential. The results have shown that the pre-marketing phase and due diligence phase are most suitable for the implementation of Blockchain. This due to the characteristics of the phases, characteristics of the stakeholders and the characteristics of Blockchain. The main aspect here can be focused on the added value of Blockchain as a data sharing program which could add value creating a more safe and secure way of sharing data. What should be mentioned is that the technology is in an early stage of development and therefore not (yet) suitable for the implementation in the real estate sector. Although multiple pilots and user cases could be mentioned, the technology needs to overcome some obstacles to be a beter success in the current buying process of commercial real estate.

References

Added Value Definition. (2018). Definition of added value. Retrieved January 7, 2017, from https://www.investopedia.com/terms/v/valueadded.asp

Barrington, T. (2016). Will Blockchain Smart Contracts Revolutionize Real Estate Transactions. Retrieved from https://cre.tech/will-Blockchain-smart-contracts-revolutionize-realestate-transactions/

Bhargava, M. (2016). The Use of Blockchain in Real Estate. Retrieved from https://medium.com/@marcbhargava/the-use-of-Blockchain-in-real-estate7fa22abdda65#.1xg7oz1v0

Buying Process Definition. (2018). Definition of buying process. Retrieved January 7, 2017, from http://www.businessdictionary.com/definition/buying-process.html

Carlozo, L. (2017, June 14). Why CPAs need to get a grip on Blockchain. Retrieved April 14, 2018, from https://www.journalofaccountancy.com/news/2017/jun/blockchain-decentralized-ledger-system-201716738. html

Credit Suisse. (2018). Blockchain 2.0 (Cryptocurrencies are only the beginning). Retrieved April 11, from https://plus.credit-suisse.com/rpc4/ravDocView?docid=V7b2NM2AF-e

Crosby, N., & McAllister, P. (2004). Liquidity in commercial property markets: Deconstructing the transaction process. Working Papers in Real Estate & Planning. 07/04. Working Paper. University of Reading, Reading. pp25. Retrieved from http://centaur.reading.ac.uk/21494/

Crosby, N., Pattanayak, P., Verma, P., & Kalyanaraman, V. (2016). Blockchain technology: Beyond bitcoin. Applied Innovation, 2, 6-10. Retrieved January 2, 2018, from http://scet.berkeley.edu/wp-content/uploads/AIR-2016-Blockchain.pdf

Cushman & Wakefield. (2017). Why Blockchain Will Change the Real Estate Industry Forever. Retrieved from http://blog.cushwake.com/boston/Blockchain-will-change-realestate-industry-forever.html

Deloitte (2016). Blockchain: the next game changer in real estate? Retrieved from https://www2.deloitte.com/nl/nl/pages/real-estate/articles/blockchain-technology-the-next-game-changer-in-real-estate.html

Deloitte. (2016). For the first time lease agreements are recorded in Blockchain. Retrieved from https://www2.deloitte.com/nl/nl/pages/about-deloitte/articles/for-the-first-timelease-agreements-are-recorded-in-Blockchain.html

Deloitte. (2017). Blockchain in commercial real estate: The future is here! Retrieved May 11, 2018, from https://www2.deloitte.com/content/dam/Deloitte/nl/Documents/finance/deloitte-nl-finance-Blockchain-in-re-report.pdf

Denzin, N. K. (1978). The research act: A theoretical introduction to sociological methods. New York: McGraw-Hill. Retrieved from https://www.taylorfrancis.com/books/9781315134543

Devaney, S., & Scofield, D. (2015). Liquidity and the drivers of search, due diligence and transaction times for UK commercial real estate investments. Journal of Property Research, 32(4), 362-383. https://doi.org/10.1080/09599916.2015.1089924

Dijkstra, M. (2017). Blockchain: Towards Disruption in the Real Estate Sector: An exploration on the impact of blockchain technology in the real estate management process. Retrieved from https://repository.tudelft.nl/islandora/object/uuid:b6ec7ece-e879-4ae3-8232-d8144ac2642d

European Union Agency for Network and Information Security (ENISA). (2016). Distributed Ledger Technology & Cybersecurity: Improving information security in the financial sector. Retrieved April 2 from https://www.enisa.europa.eu/publications/blockchain-security

Froystad, P., & Holm, J. (2015). Blockchain: Powering the Internet of Value. Retrieved November 11, 2017, from https://www.evry.com/globalassets/insight/bank2020/bank-2020---Blockchain-powering-the-internet-of-value---whitepaper.pdf

Hoefsmit, B. (2017). 3 Ways Blockchain Will Impact the Commercial Real Estate Market. Retrieved from NGKFGCS Blog http://www.ngkfgcs.com/Blog/August-2016/3-Ways-Blockchain-WillImpact-the-Commercial-Real

Hordijk, A., & Teuben, B. (2008). The liquidity of direct real estate in institutional investors' portfolios: The Netherlands. Journal of Property Investment & Finance, 26(1), 38-58. https://doi.org/10.1108/14635780810845154

JLL. (2017). Will Blockchain technology transform real estate? Hollingshead, E. Retrieved March 11, 2018, from https://www.jllrealviews.com/trends/innovation/will-Blockchain-technology-transform-real-estate/

Kaplan, M. (2016). 5 Ways Blockchain Technology could Change Real Estate. Retrieved from Bulletin Technology https://brevitas.com/bulletin/5-ways-Blockchain-technology-change-real-estate

Kennedy, P. (2009). How to combine multiple research methods: Practical triangulation. Jonny Holland Magazine. Retrieved from http://johnnyholland.org/2009/08/20/practical-triangulation

Kumar, R. (2011). RESEARCH METHODOLOGY a step-by-step guide for beginners. Retrieved May 5, 2018, from http://www.sociology.kpi.ua/wp-content/uploads/2014/06/Ranjit_Kumar-Research_Methodology_A_Step-by-Step_G.pdf

Lachance, N. (2016, May 4). Not Just Bitcoin: Why The Blockchain Is A Seductive Technology To Many Industries. NPR all things considered. Retrieved April 4, 2018, from https://www.npr.org/sections/alltechconsidered/2016/05/04/476597296/not-just-bitcoin-why-Blockchain-is-a-seductive-technology-to-many-industries?t=1533647507543

Lifthrasir, R. (2016). What is Blockchain And How Does It Apply To Real Estate. Retrieved from Realcomm: http://www.realcomm.com/advisory/738/1/what-is-Blockchain-and-how-doesit-apply-to- real-estate

McNamara, P. (1998, November). Exploring liquidity: recent survey findings. In The 7th Investment Property Databank Conference (pp. 27-28).

Morabito, V. (2017). Business Innovation Through Blockchain. Cham: Springer International Publishing. https://doi.org/10.1007/978-3-319-48478-5

Nakomoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System. Retrieved December 12, 2017, from https://bitcoin.org/bitcoin.pdf

Nijland, M. (2018). The influence of Blockchain in the Real Estate Sector. In which stage of the buying process of commercial real estate can Blockchain provide added value for the stakeholders involved? Master Thesis. Saxion University of Applied Sciences and University of Greenwich.

Patton, M. Q. (2001). Qualitative evaluation and research methods (3rd ed.). Thousand Oaks, CA: Sage Publications, Inc.

Ray, J. (2015). Blockchain and CRE: It's All About Speed To Transact. Retrieved from Linkedin https://www.linkedin.com/pulse/Blockchain-cre-its-all-speed-transact-jason-ray

Spielman, A. (2016). Blockchain: Digitally rebuilding the real estate industry (Doctoral dissertation, Massachusetts Institute of Technology).

Straub, D. (2018). Vastgoed en Blockchain: is de rol van de notaris nog wel veilig? Retrieved May 11, 2018, from https://www.businessinsider.nl/vastgoed-Blockchain-bitcoin-huis-kopen-2018/

Swan, M. (2015). Blockchain: Blueprint for a new econoour. " O'Reilly Media, Inc.".

Tapscott, A. (2016). Blockchain is a disruption we simply have to embrace. Retrieved from The Globe and Mail http://www.theglobeandmail.com/report-on-business/rob-commentary/Blockchain-is-a-disruption-we-simply-have-to-embrace/article29936789/

Tapscott, D., & Tapscott, A. (2016). Blockchain revolution: how the technology behind bitcoin is changing money, business, and the world. Penguin.

University of Greenwich. (2015). The Lifecycle of Real Estate as Investment Model. Deventer, The Netherlands Interviewee X. Retrieved June 1, 2018.

Veuger, J. (2017). A viable real estate economy with disruption and blockchain. Lectoraat Vastgoed. Groningen: Hanzehogeschool Groningen. ISBN 978-90-827076-0-1.

Veuger, J. (2018). Trust in a viable real estate economy with disruption and blockchain. Journal Facilities, subject area: Property Management & Build Environment. CiteScoreTracker 2017: 1.14, Impactfactor 2017: 0.90. UK: Emarald. The fulltext of this document has been downloaded 2.245 times since 2018. https://doi.org/10.1108/F-11-2017-0106

Winter, G. (2000). A comparative discussion of the notion of validity in qualitative and quantitative research. The Qualitative Report, 4(3&4). Retrieved February 25, 1998, from http://www.nova.edu/ssss/QR/QR4-3/winter.html

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

1.png)