The Hypotheses Testing Method for Evaluation of Startup Projects

Abstract

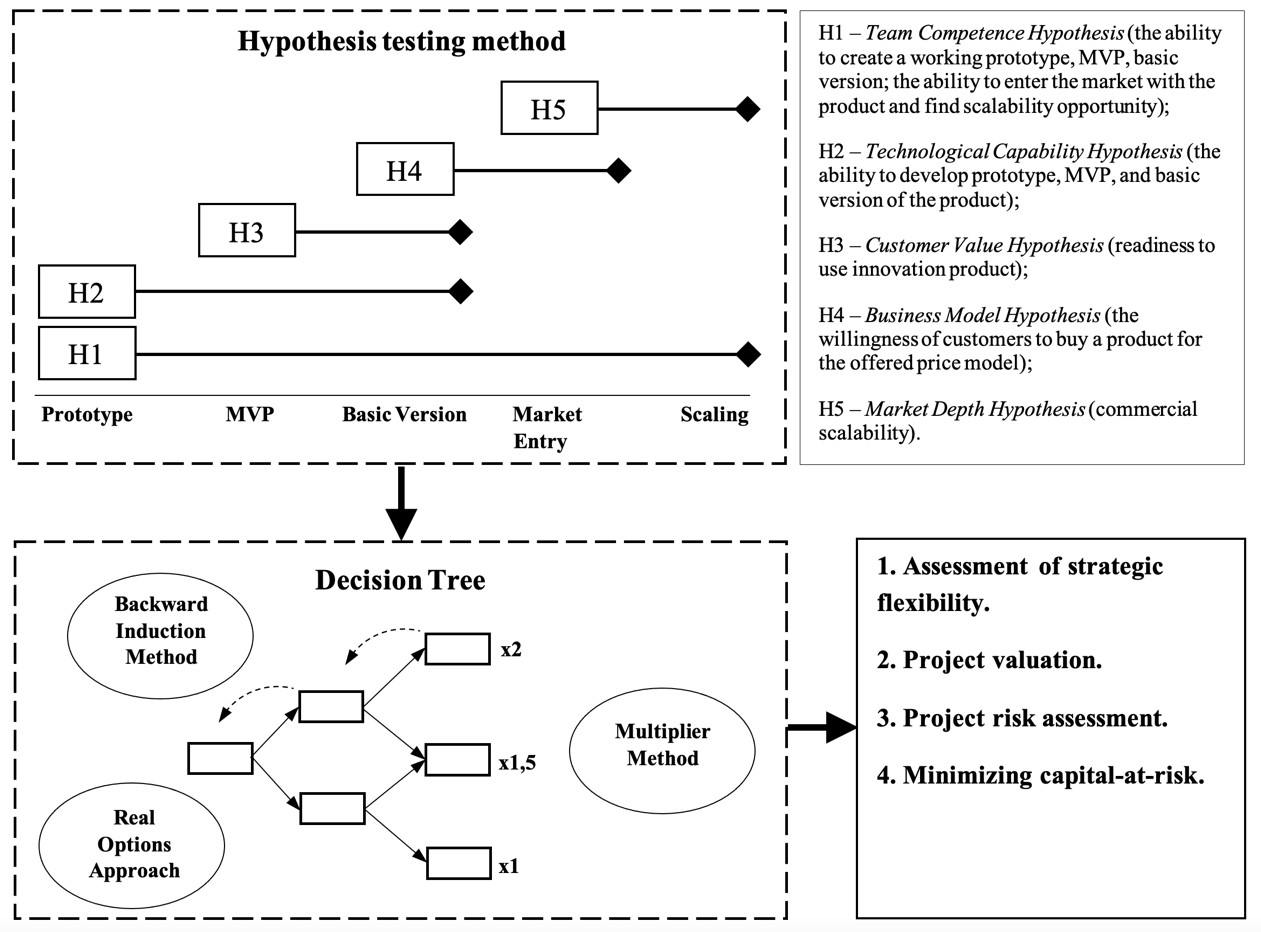

This paper suggests new perspective to evaluating innovation projects and understanding the nature of startup risks. Author consider five principal hypotheses that underlie every innovative project that comprise a bunch of respective assumptions to manage startup risks in a proactive manner. Suggested approach spots the light on a project’s uncertainties and risks, embedded investment and managerial options, and enables more comprehensive and accurate evaluation of innovation. The Hypotheses Testing Method enables to estimate risks and attractiveness of a startup project in a clear and fast manner. It replaces unclear traditional techniques like NPV and DCF, avoiding heavy cash flow modelling.

References

Berglund, H., & Sandström, C. (2013). Business Model Innovation from an Open Systems Perspective: Structural Challenges and Managerial Solutions. International Journal of Product Development, 18(3/4), 274-285. https://doi.org/10.1504/IJPD.2013.055011

Bowers, J. A., Khorakian, A. (2014). Integrating risk management in the innovation project. European Journal of Innovation Management, 17(1), 25-40. https://doi.org/10.1108/EJIM-01-2013-0010

Brandão, L., Dyer, J. S. (2005). Decision Analysis and Real Options: A Discrete Time Approach to Real Option Valuation. Annals of Operations Research, 1-25. https://doi.org/10.1007/s10479-005-6233-9

Casadesus‐Masanell, R., & Zhu, F. (2013). Business model innovation and competitive imitation: The case of sponsor‐based business models. Strategic Management Journal, 34(4), 464-482. https://doi.org/10.1002/smj.2022

Cassia, L., Plati, A., & Vismara, S. (2007). Equity valuation using DCF: A theoretical analysis of the Long Term hypotheses. Investment Management and Financial Innovations, 4(1), 91-107.

Cesário, M., & Fernandes, S. (2019). Smart innovation strategy and innovation performance: An empirical application on the Portuguese small and medium‐sized firms. Regional Science Policy & Practice, 11(6), 969-982. https://doi.org/10.1111/rsp3.12149

Chambers, C. P., & Echenique, F. (2018). On Multiple Discount Rates. Econometrica, 86(4), 1325-1346. https://doi.org/10.3982/ECTA14866

Chappin, M. M. H., Faber, J., & Meeus, M. T. H. (2019). Learning patterns in early-stage R&D projects: empirical evidence from the fibre raw material technology project in the Netherlands. R&D Management, 49(4), 684-695. https://doi.org/10.1111/radm.12358

Chesbrough, H. (2010). Business Model Innovation: Opportunities and Barriers. Long Range Planning, 43(2), 354-363. https://doi.org/10.1016/j.lrp.2009.07.010

Chesbrough, H., Lettl, C., & Ritter T. (2018). Value Creation and Value Capture in Open Innovation. Journal of Product Innovation Management, 35(6), 930-938. https://doi.org/10.1111/jpim.12471

Cooper, R. G. (2010). The Stage‐Gate Idea to Launch System. Wiley International Encyclopedia of Marketing: 1-9. https://doi.org/10.1002/9781444316568.wiem05014

Cooper, R. G. (2011). Winning at new products: Creating value through innovation (4th ed.). New York: Basic Books.

Cooper, R. G. (2014). What’s next? After Stage-Gate. Research-Technology Management, 157(1), 20-31. https://doi.org/10.5437/08956308X5606963

Cooper, R. G. (2016). Agile-Stage-Gate hybrids: The next stage for product development. Research-Technology Management, 159(1), 21-29. https://doi.org/10.1080/08956308.2016.1117317

Cooper, R. G., & Sommer, A. F. (2016). The Agile–Stage‐Gate Hybrid Model: A Promising New Approach and a New Research Opportunity. Journal of Product Innovation Management, 33(5), 1-14. https://doi.org/10.1111/jpim.12314

Correia, C., Flynn, D., Uliana. E., & Wormald, M. (2007). Financial management. 6th edition. Cape Town: Juta.

Damodaran, A. (2002). Investment Valuation: Tools & Techniques for Determining Any Asset. New York: John Wiley & Sons.

Drucker, P. F., Christensen, C. M., & Govindarajan, V. (2013). HBR's 10 Must Reads on Innovation. Harvard Business Review.

Ettlie, J. E., & Elsenbach, J. M. (2006). Modified Stage‐Gate® Regimes in New Product Development. Journal of Product Innovation Management, 24(1), 20-33. https://doi.org/10.1111/j.1540-5885.2006.00230.x

Frank, A. G., Ribeiro, J. L. D., Cortimiglia, M. N., & Oliveira, L. S. (2016). The effect of innovation activities on innovation outputs in the Brazilian industry: Market-orientation vs. technology-acquisition strategies. Research Policy, 45, 577-592. https://doi.org/10.1016/j.respol.2015.11.011

Furr, N., & Dyer, J. (2014). The Innovator's Method: Bringing the Lean Start-up into Your Organization. Brighton: Harvard Business Review.

Gans, J. (2016). The disruption dilemma. Cambridge, MA: The MIT Press. https://doi.org/10.7551/mitpress/9780262034487.001.0001

Garcia, R., & Calantone R. (2002). A critical look at technological innovation typology and innovativeness terminology: a literature review. The Journal of Product Innovation Management, 19, 110-132. https://doi.org/10.1111/1540-5885.1920110

Goffin, K., & Mitchell R. (2017). Innovation Management: Effective strategy and implementation. London, UK: Palgrave Macmillan. https://doi.org/10.1057/978-1-137-37344-1

Hartwig, S., & Mathews, S. (2020). Innovation Project Risk Analytics: A Preliminary Finding. Research-Technology Management, 63, 19-23. https://doi.org/10.1080/08956308.2020.1733901

Hurst, P. (1982). Ideas into action development and the acceptance of innovations. International Journal of Educational Development, 1, 79-102. https://doi.org/10.1016/0738-0593(82)90046-3

Keller, R. T. (2017). A longitudinal study of the individual characteristics of effective R&D project team leaders. R&D Management, 47(5), 741-754. https://doi.org/10.1111/radm.12272

Kerzner, H. (2019). Innovation Project Management: Methods, Case Studies, and Tools for Managing Innovation Projects. Wiley. https://doi.org/10.1002/9781119587408

Kock, A., & Gemünden, H. G. (2020). How entrepreneurial orientation can leverage innovation project portfolio management. R&D Management, 1-17. https://doi.org/10.1111/radm.12423

Kodukula, P., & Papudesu, C. (2006). Project Valuation Using Real Options: a Practitioner's Guide. Florida: J. Ross Publishing, Inc.

Latimore, D. (2002). IBM Institute for Business Value. NY: IBM Corporation.

Loch, C. H., Solt, M. E., & Bailey, E. M. (2007). Diagnosing Unforeseeable Uncertainty in a New Venture. The Journal of Product Innovation Management, 7, 28-46. https://doi.org/10.1111/j.1540-5885.2007.00281.x

Marion, T. J., & Fixson, S. K. (2020). The Transformation of the Innovation Process: How Digital Tools are Changing Work, Collaboration, and Organizations in New Product Development. Journal of Product Innovation Management. https://doi.org/10.1111/jpim.12547

Mathews, S., & Russell, P. (2020). Risk Analytics for Innovation Projects. Research-Technology Management, 63, 58-63. https://doi.org/10.1080/08956308.2020.1707012

McGrath, R. G. (2010). Business Models: A Discovery Driven Approach. Long Range Planning, 43(2-3), 247-261. https://doi.org/10.1016/j.lrp.2009.07.005

Melkas, H., & Harmaakorpi, V. (2011). Practice-Based Innovation: Insights, Applications and Policy Implications. Springer. https://doi.org/10.1007/978-3-642-21723-4

Nagji, B., & Tuff, G. (2012). Managing your Innovation Portfolio. Harvard Business Review, 66-74.

Ohlson, J. A. (2003). Positive (Zero) NPV Projects and the Behavior of Residual Earnings. Journal of Business Finance & Accounting, 30(1), 7-16. https://doi.org/10.1111/1468-5957.00480

Ohlson, J. A. (2003). Positive (Zero) NPV Projects and the Behavior of Residual Earnings. Journal of Business Finance & Accounting, 30(1‐2), 7-16. https://doi.org/10.1111/1468-5957.00480

Paulsen, N., Maldonado, D., Callan, V. J., & Ayoko, O. (2009). Charismatic leadership, change and innovation in an R&D organization. Journal of Organizational Change Management, 22(5), 511-523. https://doi.org/10.1108/09534810910983479

Pinto, J., & Mantel, S. (1990). The Cause of Project Failure. IEEE Transactions on Engineering Management, 37, 269-276. https://doi.org/10.1109/17.62322

Que, J., & Zhang, X. (2020). The role of foreign and domestic venture capital in innovation: evidence from China. Accounting & Finance, 60(51), 1077-1110. https://doi.org/10.1111/acfi.12401

Rong, Z., & Xiao, S. (2016). Innovation‐Related Diversification and Firm Value. European Financial Management, 23(3), 475-518. https://doi.org/10.1111/eufm.12110

Sánchez-Fernández, Raquel, M., Ángeles, I. B., & Morris, B. H. (2009). The Conceptualisation and Measurement of Consumer Value in Services. International Journal of Market Research, 51, 93-113. https://doi.org/10.1177/147078530905100108

Sandström, C., Berglund, H., & Magnusson, M. (2014). Symmetric Assumptions in the Theory of Disruptive Innovation: Theoretical and Managerial Implications. Creativity and Innovation Management, 23(4), 1-28. https://doi.org/10.1111/caim.12092

Shestakov, D. (2018). Understanding Innovation: Process, Project and Product-Centric Views. Efektyvna ekonomika, 12, 1-10. https://doi.org/10.32702/2307-2105-2018.12.209

Shestakov, D., & Poliarush, O. (2019). The degree of innovation: through incremental to radical. Investytsiyi: praktyka ta dosvid, 11, 66-75. https://doi.org/10.32702/2306-6814.2019.11.66

Sick, G., & Gamba A. (2005). Some Important Issues Involving Real Options. Finance, 14(1), 1-45.

Smit, H. T. J., & Trigeorgis, L. (2004). Strategic Investment: Real Options and Games. Princeton: Princeton University Press. https://doi.org/10.1515/9781400829392

Smit, H. T. J., & Trigeorgis, L. (2017). Strategic NPV: Real Options and Strategic Games under Different Information Structures. Strategic Management Journal, 38(13), 2555-2578. https://doi.org/10.1002/smj.2665

Spanjol, J., Mühlmeier, S., & Tomczak, T. (2012). Strategic Orientation and Product Innovation: Exploring a Decompositional Approach. Journal of Product Innovation Management, 29(6), 967-985. https://doi.org/10.1111/j.1540-5885.2012.00975.x

Taylor, J. E., & Levitt, R. (2007). Innovation alignment and project network dynamics: An integrative model for change. Project Management Journal, 38(3), 22-35. https://doi.org/10.1002/pmj.20003

Tohidi, H. (2012). Different Stages of Innovation Process. Procedia Technology, 1, 574-578. https://doi.org/10.1016/j.protcy.2012.02.125

Trimi, S., & Berbegal-Mirabent, J. (2012). Business Model Innovation in Entrepreneurship. International Entrepreneurship and Management Journal, 8(4), 449-465. https://doi.org/10.1007/s11365-012-0234-3

Tsang, E. W. K. (2006). Behavioral assumptions and theory development: The case of transaction cost economics. Strategic Management Journal, 27(11), 999-1011. https://doi.org/10.1002/smj.553

Wang, J. (2017). Structuring innovation funnels for R&D projects under uncertainty. R&D Management, 47(1), 127-140. https://doi.org/10.1111/radm.12183

Young, K. M. (2020). Long-Term R&D Strategy and Planning. Research-Technology Management, 63, 18-26. https://doi.org/10.1080/08956308.2020.1707002

Zawislak, P. A., Alves, A., Tello-Gamarra, J., Barbieux, D., & Reichert, F. M. (2012). Innovation capability: from technology development to transaction capability. Journal of Technology Management & Innovation, 7(2), 14-27. https://doi.org/10.4067/S0718-27242012000200002

Zhou, K., & Li, C. (2012). How knowledge affects radical innovation: Knowledge base, market knowledge acquisition, and internal knowledge sharing. Strategic Management Journal, 33(9), 1090-1102. https://doi.org/10.1002/smj.1959

Zizlavsky, O. (2014). Net Present Value Approach: Method for Economic Assessment of Innovation Projects. Procedia - Social and Behavioral Sciences, 156, 506-512. https://doi.org/10.1016/j.sbspro.2014.11.230

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).