Information Feedback Between Size Portfolios in Boursa Kuwait

Abstract

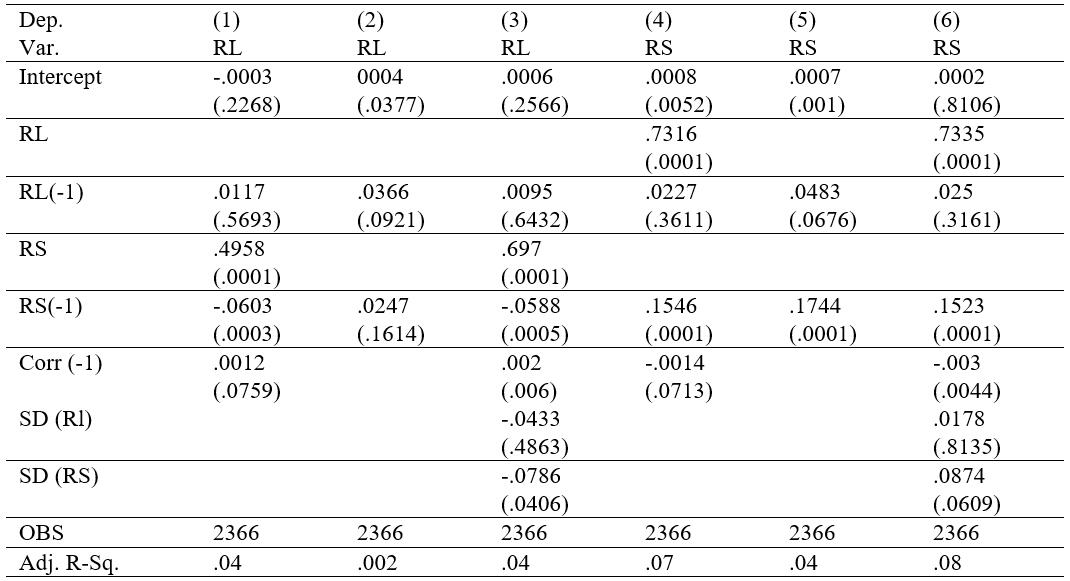

This paper examines the transmission of information between small and large sized portfolios within the Boursa Kuwait between 2011 and 2020. The study documents a constant and steady stream of feedback which demonstrates a sizeable and significant impact on market volatility; albeit at varying degrees of effect on smaller portfolios as compared with larger ones. Evidence suggests a more persistent volatility on larger portfolios, indicating a disparity on the interpretations of transmitted information between the varied styles of investors in the Kuwait Boursa.

References

Black, F. (1986). “Noise”. Journal of Finance, V(41), 529-543. https://doi.org/10.1111/j.1540-6261.1986.tb04513.x

Booth, G., Martikainen, T., & Tse, Y. (1997). Price and Volatility Spillovers in Scandinavian Stock Markets. Journal of Banking and Finance, V(21), 811-823. https://doi.org/10.1016/S0378-4266(97)00006-X

Butler, K., & Malaikah, S. (1992). Efficiency and Inefficiency in Thinly Traded Stock Market: Kuwait and Saudi Arabia. Journal of Banking and Finance, V(16), 197-210. https://doi.org/10.1016/0378-4266(92)90085-E

Darbar, S., & Deb, P. (1997). Co-Movements in International Equity markets. Journal of Financial Research, V(20), 305-322. https://doi.org/10.1111/j.1475-6803.1997.tb00251.x

Darbar, S., & Deb, P. (1990). Linkage Among Asset markets in The united States-tests in a Bivariate GARCH Framework. IMF Working Paper # 99/158.

Darbar, S., & Deb, P. (2000). Transmission of Information and Cross-market Correlation. Working paper, Indiana University and Purdue University, Indianapolis.

Grieb, T., & Mario, R. (2002). The Temporal relationship Between large and Small Capitalization Stock Returns: Evidence from the UK. Review of Financial Economics, V(11), 109-118. https://doi.org/10.1016/S1059-0560(02)00104-1

Hamao, Y., Masulis, R., & Ng, V. (1990). The Effects of the Stock Markets Crash on Financial Integration”, Review of Financial Studies, V(3), 281-307. https://doi.org/10.1093/rfs/3.2.281

King, M., & Wadhawani, S. (1990). Transmission of Volatility Between Stock markets. Review of Financial Studies, V(3), 5-33. https://doi.org/10.1093/rfs/3.1.5

Koutmos, G. (1996). Modeling the dynamic Interdependence of Major European Stock Markets. Journal of Business Finance and Accounting, V(23), 975-988. https://doi.org/10.1111/j.1468-5957.1996.tb01035.x

Lo, A., & MacKinlay, C. (1990). When are Contrarian Profits due to Stock Market Over Reaction”, Review of Financial Studies, V(3), 175-205. https://doi.org/10.1093/rfs/3.2.175

Longin, F., & Solnik, B. (1995). Is the Correlation in International Equity Returns Constant: 1960-1990?”, Journal of International Money and Finance, V(14), 3-26. https://doi.org/10.1016/0261-5606(94)00001-H

McQueen, G., Pinegar, M., & Thorely, S. (1996). Delayed Reaction to Good News and the Cross Autocorrelation of portfolio Returns, Journal of Finance, V(51), 889-919. https://doi.org/10.1111/j.1540-6261.1996.tb02711.x

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).