Research on the Market Reaction to the Inclusion of Data Assets In the Balance Statements of China's Computer Industry

Abstract

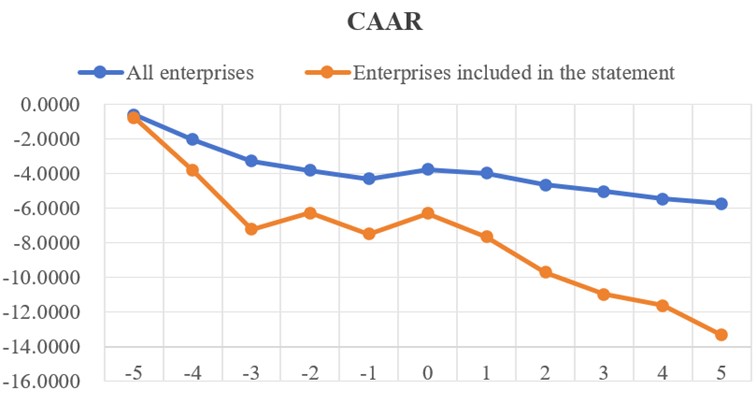

This article aims to explore the impact of the recognition of data assets in the balance sheets of the computer industry on the market. After the formal implementation of the Interim Provisions on the Accounting Treatment of Enterprise Data Assets issued by the Ministry of Finance of China, a large number of studies have selected the entire industry as the research object, lacking in - depth analysis of a single industry and ignoring the influence of industry characteristics on the research conclusions. Through the research in this article, we found that the recognition of data assets in the balance sheets of the computer industry in the third quarter showed a negative market reaction, which was contrary to the research conclusions of the semi - annual report data. Combining with industry characteristics, the research suggests that in the subsequent work of recognizing data assets in the balance sheets, the supervision of the quality of data assets shou·ld be strengthened, the work of enterprises in recognizing data assets in the balance sheets should be continuously promoted, and the relevant accounting treatment standards should be improved in a timely manner.

References

Endrikat, J. (2016). Market reactions to corporate environmental performance-related events: A meta-analytic consolidation of the empirical evidence. Journal of Business Ethics, 138(3), 535–548. https://doi.org/10.1007/s10551-015-2598-0

Fernandez, R. C., Subramaniam, P., & Franklin, M. J. (2020). Data market platforms: Trading data assets to solve data problems. Proceedings of the VLDB Endowment, 13(12), 1933–1947. https://doi.org/10.14778/3407790.3407800

Green, D. (1964). Towards a theory of interim reports. Journal of Accounting Research, (1), 35–49. https://doi.org/10.2307/2490154

Han, M., & Geum, Y. (2020). Roadmapping for data: Concept and typology of data-integrated smart-service roadmaps. IEEE Transactions on Engineering Management, 69(1), 142–154. https://doi.org/10.1109/TEM.2020.3013295

Hariri, R. H., Fredericks, E. M., & Bowers, K. M. (2019). Uncertainty in big data analytics: Survey, opportunities, and challenges. Journal of Big Data, 6(1), 1–16. https://doi.org/10.1186/s40537-019-0206-3

Li, W., Rong, M., Liu, Y., et al. (2024). Research on the micro-principle of the value formation of enterprise data assets and its valuation. Friends of Accounting, (23), 106–113.

Liu, F., Yuan, H., Suyala, B., et al. (2023). Re-discussion on the objectives of financial reporting: Also commenting on the Interim Provisions on Accounting Treatment Related to Enterprise Data Resources. Accounting Research, (04), 3–15.

Mandel, M. (2012). Beyond goods and services: The (unmeasured) rise of the data-driven economy [Research Report]. Washington: Progressive Policy Institute.

Mayer-Schönberger, V., & Cukier, K. (2013). Big data: A revolution that will transform how we live, work, and think. New York: Houghton Mifflin Harcourt.

Moody, D. L., & Walsh, P. (1999). Measuring the value of information—An asset valuation approach. In Proceedings of the Seventh European Conference on Information Systems (pp. 496–512). Copenhagen: ECIS.

Rassier, D. G., Kornfeld, R. J., & Strassner, E. H. (2019, May 1). Treatment of data in national accounts [EB/OL]. Retrieved April 20, 2025, from https://www.bea.gov/system/files/2019-05/Paper-on-Treatment-of-Data-BEA-ACM.pdf

Wang, J., & Gong, Z. (2024). Data asset inclusion in financial statements policy, transparency of enterprise information environment, and stock prices of digital enterprises. Statistics & Decision, 40(18), 155–160.

Wang, X. (2024). Confirmation of rights, valuation, and inclusion in financial statements: The assetization of enterprise data and its practical achievements in China. Journal of Shenzhen University (Humanities & Social Sciences), 41(06), 82–92.

Wu, X., & Zhu, W. (2025). The impact of new accounting regulations on data resources on the value of listed companies in the core industries of the digital economy—A study based on the event method. Financial Management Research, (01), 151–161.

Zhang, J., & Zhao, W. (2024). Research on the information disclosure of data resources of A-share listed companies based on the event-study method—Taking the first-quarter reports as an example. Henan Finance and Economics Journal, 38(03), 9–18.

Zhang, J., Zhao, W., & Wang, Q. (2024). The current situation of data asset inclusion in financial statements of listed companies and market reactions—Taking the interim reports of A-share listed companies as an example. Finance and Accounting Monthly, 45(24), 42–50.

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).