The Impact of FDI on Poverty Reduction in North Africa

Abstract

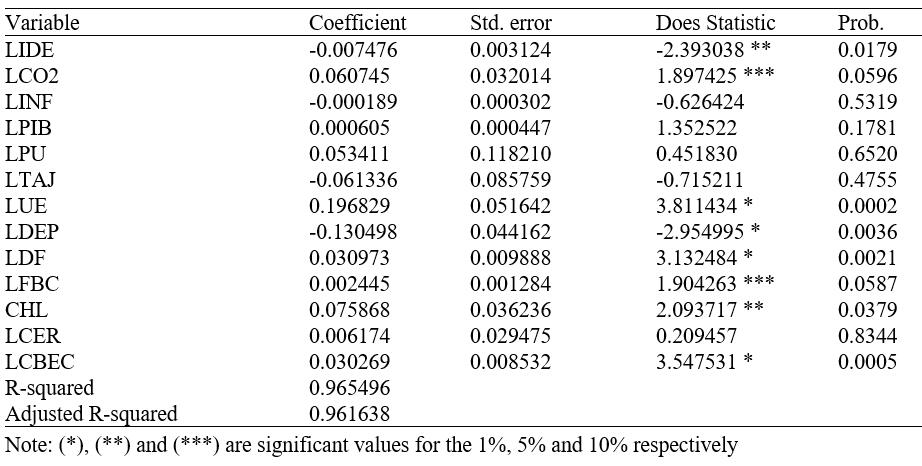

The aim of this paper is to study the impact of FDI on poverty in the case of the North African country during the period from 1985 to 2005. The sample used in this paper consists of 6 countries of North Africa during the period from 1985 to 2005. So we can use the cointegration test. For the cointegration test, we have certified the existence of a cointegration relationship between the different series studied in our paper. Indeed, the result of the null hypothesis test of no cointegration was rejected at the 5% threshold, which explains the presence of a cointegration relationship. Also, to test the effect of FDI on poverty in the countries of North Africa, we will perform a FMOLS estimate. Thus, for the short-term dynamics, we noticed that FDI have a positive and significant impact on a threshold of 1% on the GINI index for the case of the countries of North Africa and a significant negative a threshold of 1% for the other two indicators of poverty; LPOV1_91 $ and LPOV3_1 $. Then we found that is statistically significant and positive at a 1% level. The LIDE variable measuring foreign direct investment has a negative impact on the Gini index to a threshold of 5%.For the Granger causality test; we notice that there is a unidirectional relationship between the consumption of energy and poverty Granger. Only the GINI index can cause Granger consumption of energy.

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).