Required Practices for Successful Tax Amnesty

Kosovo Case

Abstract

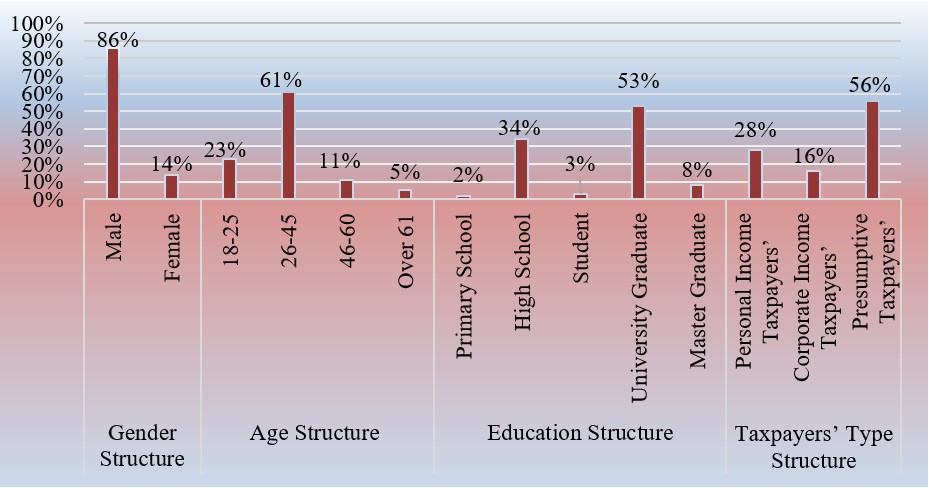

The tax amnesties have been used as economic performance tool to promote economic development, collection of public revenues in the short run and improvement of tax compliance in the country. The Republic of Kosovo has practiced their application twice during the past 10 years. The main purpose of this study is to provide practical guidance on the required actions for a successful tax amnesty. The survey method is used for data collection. Data processing is done through SPSS and statistical techniques. The major findings revealed key practices for a successful tax amnesty. Evidence has shown that most businesses which had previously evaded taxes are now regular taxpayers after the tax amnesty. Therefore, according to the results it is concluded that the success of tax amnesty depends on the fulfillment of certain conditions such as; the confidentiality of the tax amnesty beneficiaries, the time to take advantage from tax amnesty should be sufficient, facilitating tax amnesty procedures should encourage participation in the amnesty, it should be clear that no other tax amnesties will be repeated in the future, tax offices must be equipped with advanced technology and serious and strict sanctions must be applied after the tax amnesty.

References

Alm, J., & Beck, W. (1993). Tax amnesties and compliance in the long run: A time series analysis. National tax journal, 46(1), 53-60.

Argyropoulou, V. (2018). "Coming in from the cold” The latest tax amnesty in Greece and lessons for the future. Argyropoulou- Coming in Fromthe Cold, 24(2), 125-134.

Borgne, E. L. (2006). Economic and political determinants of tax amnesties in the U.S. states . International Monetary Fund Working Papers, 6(222), 2-13. https://doi.org/10.5089/9781451864823.001

Diamastuti, E., & Hardanti, N. K. (2019). The investigation of taxplayer compliance in tax amnesty. Journal Akuntansi, 10(2), 85-104. https://doi.org/10.26740/jaj.v10n2.p85-104

Doğan, Z. & Besen, R. (2008). Vergi aflarının mükellefler üzerindeki etkisinin tespitine ilişkin bir araştırma. Ankara: Maliyet ve Hukuk Yayınları.

Gerger, G. Ç. (2012). Tax amnesties and 2010 tax amnesty evaluation in Turkey. International Journal of Multidisciplinary Thought, 2(3), 107-113.

Hamid, A. N., & Hilmi, M. (2018). The influence of taxpayers’ tax liability, affordability and morality on tax amnesty program in Malaysia . Labuan e-Journal of Muamalat and Society, 12, 1-25.

Huda, K. M., & Hernoko, Y. A. (2017). Tax amnesties in Indonesia and other countries: opportunities and challenges. Asian Social Science, 13(7), 52-61. https://doi.org/10.5539/ass.v13n7p52

İpek, S., Öksüz, M., & Özkaya, S. (2012). Considerations of taxpayers according to situation of benefiting from tax amnesty: An empirical research. International Journal of Business and Social Science, 3(13).

Kovačević, Ž. N., & Gadžo, S. (2017). Porezna amnestija kao instrument porezne politike. Drus. Istraz. Zagreb, 1, 101-122.

Mahestyanti, P., Juanda, B., & Anggraeni, L. (2018). The determinants of tax compliance in tax amnesty programs: Experimental approach. Etikonomi, 17(1), 93-110. https://doi.org/10.15408/etk.v17i1.6966

Mattiello, G. (2005). Multiple tax amnesties and tax compliance (Forgiving seventy times seven). Università Ca’Foscari, Venezia, Working paper. Retrieved from https://www.unive.it/media/allegato/DIP/Economia/Working_papers/Working_papers_2005/0506

Mikesell, J. L., & Ross, J. (2012). Fast money? The contribution of state tax. National Tax Journal, 65(3), 529-562. https://doi.org/10.17310/ntj.2012.3.02

Misey, R. J., & Cadenas, R. (1992). An international overview of tax amnesty; the experiences of different countries are lessons to all? Revista de Aministracion Tributaria, 11, 49-55.

Moser, C., & Kalton, G. (1979). Survey methods in social investigation ((3thd ed) ed.). UK: Darmouth Publishing Co. Ltd.

Mouloud, M. (2014). The tax amnesty program: as tool to adjust the shadow economy; the international experiences. Global Advanced Research Journal of Economics, Accounting and Finance, 3(2), 017-025.

Rahayu, T., & Wirawan. (2019). Tax amnesty and the impact on capital market reactions. International Journal of Business and Management Invention, 8(02), 24-30.

Sa’adah, N. (2018). Tax amnesty policy as an effort to improve state revenues and investment growth. IOP Conference Series: Earth and Environmental Science, 1-6. https://doi.org/10.1088/1755-1315/175/1/012206

Saraçoğlu, F. O., & Çaskurlu, E. (2011). Tax amnesty with effects and effecting aspects: Tax compliance, tax audits and enforcements around; The Turkish case. International Journal of Business and Social Science, 2(7), 95-103.

Sari, D., & Mulyati, Y. (2018). The impact of tax amnesty on tax revenue and tax ratio: Case in Indonesia. International Journal of Engineering & Technology, 7(4.34), 245-247. https://doi.org/10.14419/ijet.v7i4.34.23899

Sari, I. R., & Nuswantara, A. D. (2017). The influence of tax amnesty benefit perception to taxpayer compliance. Jurnal Dinamika Akuntansi, 9(2), 176-183. https://doi.org/10.15294/jda.v9i2.11991

Tepordei, A. (2018). Modern approaches to tax amnesty. The Journal Contemporary Economy, 3(3), 169-177.

Torgler, B., Schaltegger, C., & Schaffner, M. S. (2003). Is forgiveness divine? A cross-culture comparison of tax amnesties . Schweiz. Zeitschrift für Volkswirtschaft und Statistik, 139(3), 375-396.

Tota, I. (2018). The link between tax amnesty and financial statement fraud. International Journal of Economics, Commerce and Management, 6(7), 196-202.

Uchitelle, E. (1989). The effectiveness of tax amnesty programs in selected countries. FRBNY Quarterly Review, 48-53. Retrieved from https://www.newyorkfed.org/medialibrary/media/research/quarterlyreview/1989 v14/v14n3article5.pdf

Villalba, S. A. (2017). On the effects of repeated tax amnesties. Journal of Economics and Political Economy, 4(3), 287-301.

Wang, Y., & Hsieh, W. (2015). Is tax amnesty good for the tax evader? British Journal of Economics, Management & Trade, 6(4), 308-322. https://doi.org/10.9734/BJEMT/2015/15345

Yurdadoğ, V., & Karadağ, N. C. (2017 ). Evaluation of tax amnesties in the contex of empirical studies devoted to Turkey. Eurasian Academy of Sciences, 8(08), 134-164.

Yustiari, H. S. (2016). Tax amnesty dalam perspective good governance. Jurnal Ilmiah Administrasi Publik, 2(4), 169-174.

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).