Comparative Analysis of Banking System Profitability in Western Balkan Countries

Abstract

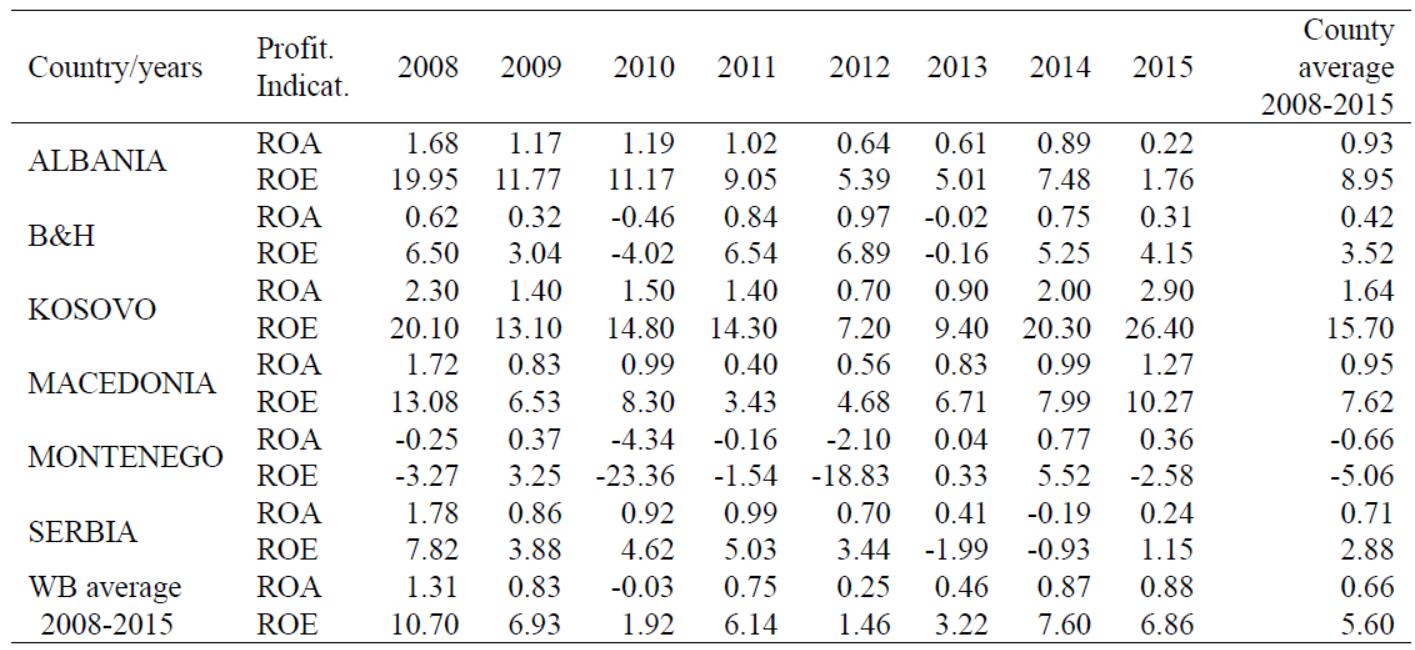

The aim of this paper is to analyze the profitability of the banking sector in the Western Balkan countries. (Note 1) This paper reviews return on assets (ROA) as an indicator of profit and return on equity (ROE) as an indicator of profitability in the banking systems of the respective countries, as well as some other macroeconomic variables that influence them. The main objective of this study is to identify the specific and macroeconomic variables of this industry, that have an impact on the profitability of commercial banks operating in the Western Balkan countries during the 2008-2015 period. Specifically, this paper addresses external indicators (gross domestic product, remittances, foreign direct investment, unemployment), and industry and bank specific indicators (assets, loans, loan-to-deposit ratio, non performing loans and interest rates) that affect the profitability of the banking system in respective countries.

Therefore, according to the data generated during the research and the literature review, the profitability of banks measured by the ROA and ROE indicators, regarding the analyzed countries, turns out to be extremely low, especially compared to EU countries where they strive.

References

Alper, D., & Anbar, A. (2011). Bank Specific and Macroeconomic Determinants of commercial bank Profitability: Empirical Evidence from Turkey. Business and economics Research Journal, 2(2), 139-152. Retrieved from https://ssrn.com/abstract=1831345

Angbazo, L. (1997). Commercial bank net interest margins, default risk, interest-rate risk, and off-balance sheet banking. Journal of Banking & Finance, 21, 55-87. https://doi.org/10.1016/S0378-4266(96)00025-8

Atasoy, H. (2007). Expenditure-income analysis in turkish banking sector and determinants of profitability. Unpublished Dissertations of Senior Specialists, Central Bank of Turkey, Ankara.

Athanasoglou, P., Delis, M., & Staikouras (2006). Determinants of Banking Profitability in the South Eastern European Region. Online at http://mpra.ub.unimuenchen.de/10274/MPRA Paper No. 10274, posted 20. September 2008 04:31 UTC.

Berger, A. (1995). The Profit Structure relationship in Banking Tests of Market Power and Efficient Structure Hypotheses. Journal of Money, Credit, and Banking, 27(2), 404-431. https://doi.org/10.2307/2077876

Bolt, W., de Haan L., Hoeberichts, M., van Oordt M. R. C., & Swank, J. (2012) . Bank Profitability during recession. Journal of Banking and Finance, 36. https://doi.org/10.1016/j.jbankfin.2012.05.011

Bourke, P. (1989). Concentration and other determinants of bank profitability in Europe, North America and Australia. Journal of Banking and Finance, 13. https://doi.org/10.1016/0378-4266(89)90020-4

Caruntu, G. A., & Romanescu, M. L. (2008). The Assessment of Banking Performances-Indicators of Performance in Bank Area. MPRA Paper No. 1160, 2008, October. 4. Retrieved from http://mpra.ub.uni-muenchen.de/11600/

Cyrak, M., Popovski, K., & Pepur, S. (2011). Profitability Determinants of the Macedonian Banking Sector in Changing Environment. Procedia Social and Behaviour Science. https://doi.org/10.1016/j.sbspro.2012.05.045

Demirguç-Kunt, A., & Harry, H. (1999). Determinants of Commercial Bank Interest Margins and Profitability: Some international Evidence. The World Bank Review 13(2), 379-408. https://doi.org/10.1596/1813-9450-1900

Dietrich, A., & Wanzenried, G. (2011). Determinants of bank profitability before and during the crisis: Evidence from Switzerland. Journal of International Financial Markets, Institutions and Money, https://doi.org/10.1016/j.intfin.2010.11.002

Dotsey, M., & Sarte, G. (2000). Inflation Uncertainty and Growth in a Cash-In-Advance Economy. Journal of onetary Economics, 45(3), 631-655. https://doi.org/10.1016/S0304-3932(00)00005-2

Duraj, B., & Moci, E. (2015). Factors Influecing the Bank Profitabiliy-Empirical Evidence from Albania. Asian Economic and Financial Review, 5(3), 483. https://doi.org/10.18488/journal.aefr/2015.5.3/102.3.483.494

Flamini, V., McDonald, C. A., & Schumacher, L. B. (2009). The determinants of commercial bank profitability in Sub-Saharan Afric. IMF Working Papers, (9), 1-30. https://doi.org/10.5089/9781451871623.001

Goddard, J. Molyneux, P., & Wilson, J. (2004). The Profitability of the European Banks: A cross -sectional and dynamic panel analysis. Manchester School, 72(3). https://doi.org/10.1111/j.1467-9957.2004.00397.x

Goddard, J., Molyneux, P., & Wilson, J. (2004). Dynamics of growth and profitability in Banking. Journal of Money, Credit and Banking, 16, 1069-1090. https://doi.org/10.1353/mcb.2005.0015

Gremi, E. (2013). International Factors Affecting Albanian Banking Profitability. Academic Journal of Interdisciplinary Studies , II(9). https://doi.org/10.5901/ajis.2013.v2n9p19

Güngör, B. (2007). Türkiye’de faaliyet gösteren yerel ve yabancı bankaların kârlılık seviyelerini Etkileyen faktörler: Panel veri analizi. Iktisat Isletme ve Finans, Bilgesel Yayincilik, 22(258), 40-63. https://doi.org/10.3848/iif.2007.258.1464

Hannan, T. H., & Prager, R. A. (2009). The Profitability of a Small Single-Market Banks in an Era of Multimarket Banking. Journal of Banking & Finance, 33(2), 263-271. https://doi.org/10.1016/j.jbankfin.2008.07.018

Hassan, M. K., & Bashir, A. H. M. (2003). Determinants of Islamic Banking Profitability. International Seminar on Islamic Wealth Creation. University of Durham, 7-9.

Herrero, A., Gavila, S., & Santabarbara, D. (2009). What explains the low profitability of Chinese banks? Journal of Banking and Finance, 33, 2009, 2080-2090. https://doi.org/10.1016/j.jbankfin.2009.05.005

Javaid, S., Anwar, J., Zaman, K., & Gafoor, A. (2011). Determinants of Bank Profitability in Pakistan:Internal factor Analysis. Mediterranean Journal of Social Sciences, 2(1), January, ISSN.2039-2117.

Kalluci, I. (2011). Analysis of the Albanian banking System in a Risk-Performance Framework. Working paper, 03 (26) Research Department, Bank of Albania.

Kosak, M., & Zajc, P. (2006). Determinants of bank efficiency differences in the new EU member countries. Financial Stability report, Expert Papers. Ljubljana. Bank of Slovenija.

Kosmidou, K. (2008). The Determinants of Banks’ Profits in Greece during the Period of EU Financial Integration. Managerial Finance, 34(3), 146-159. https://doi.org/10.1108/03074350810848036

Lartey, V., Antwi, S., & Boadi, E. (2013). The Relationship between Liquidity and Profitability of Listed Banks in Ghana. International Journal of Business and Social Science, 4(3), 48-56.

Lui, H., & Wilson, J. (2010). The Profitability of Banks in Japan. Applied Financial Economics, 20, 1851-1866. https://doi.org/10.1080/09603107.2010.526577

Luo, X. (2003). Evaluating the Profitability and Marketability Efficiency of Large Banks. An Application of Data Envelopment Analysis. Journal of Business Research, 56(8), 627-635. https://doi.org/10.1016/S0148-2963(01)00293-4

Lupu, V. (2012). The Correlation between Inflation and Economic Growth in Romania. Lucrări Ştiinţifice, (5), Seria Zootenhie, 359-363.

Martin Gächter, Macki, P., Isabella Moder, I., Polgár, E. K., Li Savelin, L., & Żuk, P. (2017). Financial stability assessment of EU candidate and potential candidate countries Developments since 2014. European Central Bank, Occasional Paper Series No 190 / May 2017.

Matthew, N. G., & Laryea, A. E. (2012). A financial performance comparison of foreign vs local banks in Ghana. International Journal of Business and Social Science, 3(21), 82-87.

Molyneux, P., & Thorton, J. (1992). Determinants of European Bank profitability; A Note. Journal of Banking and Finance, 16, 1173-1178. https://doi.org/10.1016/0378-4266(92)90065-8

Ramlall, I. (2009). Bank-specific, industry-specific and macroeconomic determinants of profitability in Taiwanese banking system: under panel data estimation. International Research Journal of Finance and Economics, 34, 160-167.

Rose, P., & Hudgins, S. (2012). Bank Management and Financial Services.

Saeed, M. S. (2014). Bank-related, Industry-related and Macroeconomic Factors Affecting Bank Profitability: A Case of the United Kingdom. Research Journal of Finance and Accounting, 5, 42-50. ISSN (Paper)2222-1697 ISSN (Online)2222-2847.

Sufian, F., & Mzafar, S. H. (2009). Determinants of Bank Profitability in a Developing Economy: Evidence from Bangladesh. Journal of Business Economics and Management, 10(3), 91-112. https://doi.org/10.3846/1611-1699.2009.10.207-217

Tmava, Q., & Jakupi, S. (2019). Comparative Analysis of Interest Rates in Western Ballkan Countries, Kosova Perspective. International Journal of English Literature and Social Sciences (IJELS), 4(1), Jan - Feb, https://doi.org/10.22161/ijels.4.1.4

Topak, S. M., & Talu, H. N. (2017). Bank Specific and Macroeconomic Determinants of Commercial Bank Profitability: Empirical Evidence from Turkey. Business and Economics Research Journal, 2(2), 139-152.

Trujillo-Ponce, A. (2013). What determines the profitability of banks? Evidence from Spain. Accounting and Finance, 53, 561-586. https://doi.org/10.1111/j.1467-629X.2011.00466.x

Yuksel, M., Mukhtarov, S., Mammadov, E., & Özsarı, M. (2018). Determinants of Profitability in the Banking Sector: An Analysis of Post-Soviet Countries. Economies, MDPI, Open Access Journal, 6(3), 1-15, July. https://doi.org/10.3390/economies6030041

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).