Performance of Micro and Small Enterprises in the Philippine Setting

Abstract

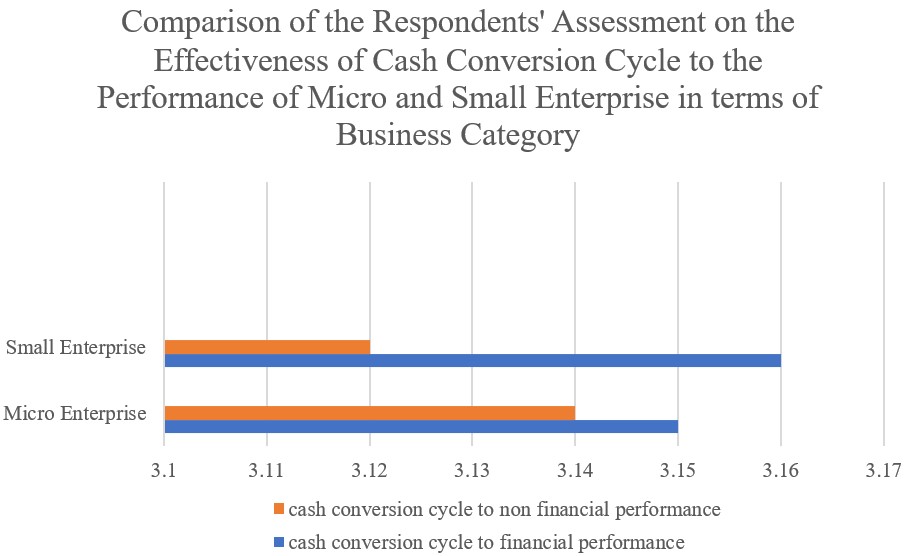

The study was conducted to assess the performance of micro and small enterprises in Lipa City, Philippines using Cash Conversion Cycle. It was conducted among 375 managers and business owners in the area. Descriptive method was to collect the data and test the null hypothesis. Frequency/percentage, weighted mean, and composite mean were used as statistical tools. Results reveal that majority of the respondents were micro enterprises with a 1-9 employees that have been operating for 1-3 years; that the cash conversion cycle and its comparison of responses to the performance of micro and small enterprises found to be effective; that the cash conversion cycle in terms of years of existence, business category and number of employees are effective; that the cash conversion cycle to the performance of micro and small enterprises in terms of cash to accounts payable, accounts payable to inventory, inventory to accounts receivable, and accounts receivable to cash are effective; that the comparison between the cash conversion cycle to the performance of micro and small enterprises and effectiveness when grouped according to years of existence, business category and number of employees were significant. Thus, the proposed extension activity can be considered and implemented by the concerned agency.

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).