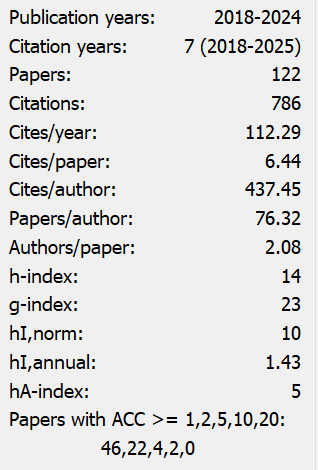

Ownership Structure and Financial Sustainability with Moderating Effect of Managerial Intention in Some Selected Emerging Economies. A Conceptual Review

Abstract

Purpose

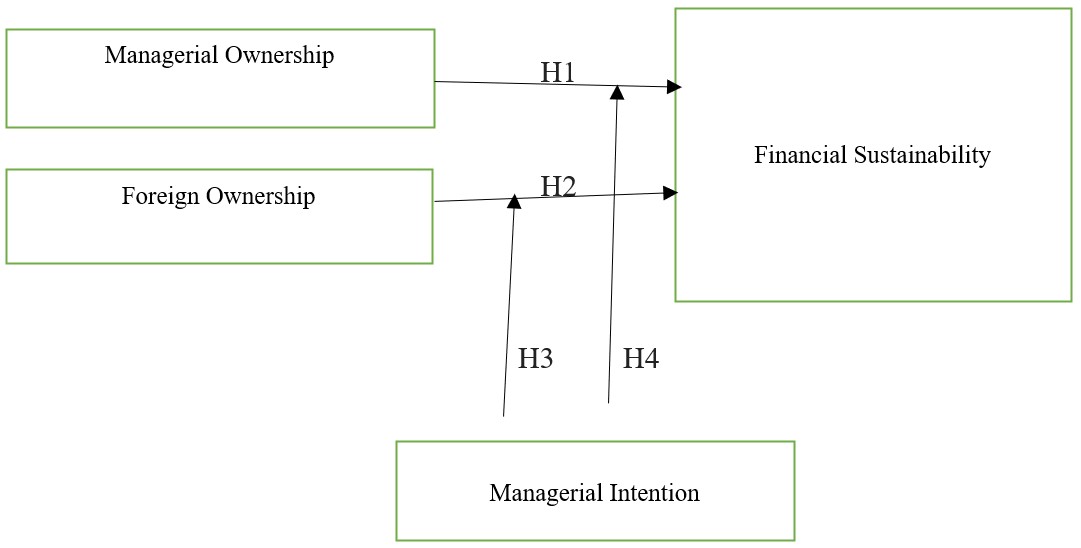

The purpose of this study is to explore a model to measure the money deposit bank financial sustainability based on ownership structure and to examine the moderating role of managerial intention on managerial ownership and foreign ownership.

Design/ Methodology/ Approach

An elaborate literature review was conducted to identify the variables and a proposed conceptual model was conceived.

Findings

A conceptual model was presented after the discussion of relationship and literature review that examined ownership structure, managerial intention and financial sustainability.

Originality/Value

Many scholars have investigated the different dimensions of ownership structure, managerial intention and performance, however little research has been done on the integration of ownership structure and financial sustainability. Furthermore, there is also a dearth in literature that examine the moderating role of managerial intention on the relationship between ownership structure and financial sustainability.

References

Alabdullah, T. T. Y. (2018). The relationship between ownership structure and firm financial performance. Benchmarking: An International Journal. https://doi.org/10.1108/BIJ-04-2016-0051

Al-Gamrh, B., Al-Dhamari, R., Jalan, A., & Jahanshahi, A. A. (2020). The impact of board independence and foreign ownership on financial and social performance of firms: Evidence from the UAE. Journal of Applied Accounting Research. https://doi.org/10.1108/JAAR-09-2018-0147

Altawalbeh, M. A. F. (2020). Corporate Governance Mechanisms and Firm’s Performance: Evidence from Jordan. Accounting and Finance Research, 9(11), 10-5430. https://doi.org/10.5430/afr.v9n2p11

Amankwah-Amoah, J., Khan, Z., & Wood, G. (2020). COVID-19 and business failures: The paradoxes of experience, scale, and scope for theory and practice. European Management Journal. https://doi.org/10.1016/j.emj.2020.09.002

Amin, A. A., & Hamdan, A. M. (2018). Evaluating the effect of ownership structure on firm performance: Evidence from Saudi Arabian listed companies. Journal of Economic Cooperation & Development, 39(3), 65-92.

Baron, R. M., & Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of personality and social psychology, 51(6), 1173. https://doi.org/10.1037/0022-3514.51.6.1173

Bartone, P. T., & Homish, G. G. (2020). Influence of hardiness, avoidance coping, and combat exposure on depression in returning war veterans: A moderated- mediation study. Journal of affective disorders, 265, 511-518. https://doi.org/10.1016/j.jad.2020.01.127

Berle, A. A., & Means, G. C. (1932). The Modern Corporation and private property. New Brunswick. NJ: Transaction.

Bitok, S. K., Cheboi, J., & Kemboi, A. (2020). Does Portfolio Quality Influence Financial Sustainability? A Case of Microfinance Institutions in Kenya. Journal of Economics and Financial Analysis, 3(2), 23-39. https://doi.org/10.13106/jbees.2020.vol10.no1.37

Birindelli, G., Ferretti, P., Chiappini, H., & Cosentino, A. (2020). Intellectual Capital Disclosure: Some Evidence from Healthy and Distressed Banks in Italy. Sustainability, 12(8), 3174. https://doi.org/10.3390/su12083174

Chang, J. (2006). Ownership Structure, Diversification Strategy, and Performance: Implications for Asian Emerging Market Multinational Enterprises'. Value Creation in Multinational Enterprise (International Finance Review, Volume 7). Emerald Group Publishing Limited, 125-148. https://doi.org/10.1016/S1569-3767(06)07006-3

Chung, L., Lo, C. W. H., & Li, P. H. Y. (2016). The interaction effects of institutional constraints on managerial intentions and sustainable performance. International Journal of Production Economics, 181, 374-383. https://doi.org/10.1016/j.ijpe.2016.01.001

Döttling, R., & Kim, S. (2020). Sustainability preferences under stress: Evidence from mutual fund flows during COVID-19. Available at SSRN 3656756. https://doi.org/10.2139/ssrn.3656756

Driffield, N., Sun, K., & Temouri, Y. (2018). Investigating the link between foreign ownership and firm performance–an endogenous threshold approach. Multinational Business Review. https://doi.org/10.1108/MBR-12-2017-0102

Faysal, S., Salehi, M., & Moradi, M. (2020). The impact of ownership structure on the cost of equity in emerging markets. Management Research Review. https://doi.org/10.1108/MRR-11-2019-0475

Hai, J., Min, H., & Barth, J. R. (2018). On Foreign Shareholdings and Agency Costs: New Evidence from China. Emerging Markets Finance and Trade, 54(12), 2815-2833. https://doi.org/10.1080/1540496x. 2017.1412949

Hamilton, J. (2020). The Strategic Change Matrix and Business Sustainability across COVID-19. Sustainability, 12(15), 6026. https://doi.org/10.3390/su12156026

Hutzschenreuter, T., Han, U. S., & Kleindienst, I. (2020). Exploring managerial intentionality. Managerial and Decision Economics, 41(3), 46-414z. https://doi.org/10.1002/mde.3109

Iona, A., Leonida, L., & Ventouri, A. (2017). Does executive ownership lead to excess target cash? The case of UK firms. Corporate Governance: The International Journal of Business in Society. https://doi.org/10.1108/CG-02-2017-0028

Ismail, S. M., Aris, N. M., Mohamed, A. S., Yusof, S. M., & Zaidi, N. S.(2020) Ownership Structure and Firms’ Performance: Evidence from Finance Sector in Malaysia. https://doi.org/10.6007/IJARBSS/v10-i7/7418

Joe, D. Y., Oh, F. D., & Yoo, H. (2019). Foreign Ownership and Firm Innovation: Evidence from Korea. Global Economic Review, 48(3), 284-302. https://doi.org/10.1080/1226508x.2019.1632729

Khoo, S. S. (2020). COVID-19 and Malaysian Banking Industry: Problems Faced by Bank Marketing and Strategies to Promote Services and Bank Brands. Available at SSRN 3653889. https://doi.org/10.2139/ssrn.3653889

Kruse, F. M., & Jeurissen, P. (2020). For-profit hospitals out of business? Financial sustainability during the COVID-19 epidemic emergency response. International Journal of Health Policy and Management, 9(10), 423-428. https://doi.org/10.34172/ijhpm.2020.67

Lakshan, A. M. I., & Wijekoon, W. M. H. N. (2012). Corporate governance and corporate failure. Procedia Economics and Finance, 2, 191-198. https://doi.org/10.1016/S2212-5671(12)00079-2

Masudin, I., Wastono, T., & Zulfikarijah, F. (2018). The effect of managerial intention and initiative on green supply chain management adoption in Indonesian manufacturing performance. Cogent Business & Management, 5(1), 1485212. https://doi.org/10.1080/23311975.2018.1485212

Moudud-Ul-Huq, S., Biswas, T., & Dola, S. P. (2020). Effect of managerial ownership on bank value: insights of an emerging economy. Asian Journal of Accounting Research. https://doi.org/10.1108/AJAR-03-2020-0016

Moudud-Ul-Huq, S., Zheng, C., Gupta, A. D., Hossain, S. A., & Biswas, T. (2020). Risk and performance in emerging economies: Do bank diversification and financial crisis matter? Global Business Review. https://doi.org/10.1177/0972150920915301

Nguyen, T. X. H., Pham, T. H., Dao, T. N., Nguyen, T. N., & Tran, T. K. N. (2020). The Impact of Foreign Ownership and Management on Firm Performance in Vietnam. The Journal of Asian Finance, Economics and Business (JAFEB), 7(9), 409-418. https://doi.org/10.13106/jafeb.2020.vol7.no9.409

Nidar, S. R., Anwar, M., Komara, R., & Layyinaturrobaniyah, L. (2020). Determinant of regional development bank efficiency for their sustainability issues. Entrepreneurship and Sustainability Issues, 8(1), 1133-1145. https://doi.org/10.9770/jesi.2020.8.1(76)

Nofal, M. (2020). The Effect of Foreign Ownership on Firm Performance: Evidences from Indonesia. In 3rd Asia Pacific International Conference of Management and Business Science (AICMBS 2019) (pp. 237-242). Atlantis Press. https://doi.org/10.2991/aebmr.k.200410.037

Noor, Z. M., & Iskandar, T. M. (2012). Corporate governance and corporate failure: A survival analysis. Prosiding Persidangan Kebangsaan Ekonomi Malaysia Ke VII, Malaysia.

Nurleni, N., & Bandang, A. (2018). The effect of managerial and institutional ownership on corporate social responsibility disclosure. International Journal of Law and Management. https://doi.org/10.1108/IJLMA-03-2017-0078

O’Callaghan, S., Ashton, J., & Hodgkinson, L. (2018). Earnings management and managerial ownership in private firms. Journal of Applied Accounting Research. https://doi.org/10.1108/JAAR-11-2017-0124

Osazefua Imhanzenobe, J. (2020). Managers’ financial practices and financial sustainability of Nigerian manufacturing companies: Which ratios matter most? Cogent Economics & Finance, 8(1), 1724241. https://doi.org/10.1080/23322039.2020.1724241

Rustam, A., Wang, Y., & Zameer, H. (2019). Does foreign ownership affect corporate sustainability disclosure in Pakistan? A sequential mixed method approach. Environmental Science and Pollution Research, 26(30), 31178-31197. https://doi.org/10.1007/s11356-019-06250-3

Shan, Y. G. (2019). Managerial ownership, board independence and firm performance. Accounting Research Journal. https://doi.org/10.1108/ARJ-09-2017-0149

Shrivastav, S. M., & Kalsie, A. (2017). The Relationship between Foreign Ownership and Firm Performance in India: An Empirical Analysis. Artha Vijnana, 59(2), 152-162. https://doi.org/10.21648/arthavij/2017/v59/i2/164448

Tran, D. V. (2020). Bank business models and liquidity creation. Research in International Business and Finance, 53, 101205. https://doi.org/10.1016/j.ribaf.2020.101205

Vinh, V. X. (2019). Foreign Ownership and Firm Performance-Evidence in Vietnam. Journal of Economic Development, 85-104.

Wójcik, D., & Ioannou, S. (2020). COVID‐19 and Finance: Market Developments So Far and Potential Impacts on the Financial Sector and Centres. Tijdschrift voor economische en sociale geografie, 111(3), 387-400. https://doi.org/10.1111/tesg.12434

Yasser, Q. R., Al Mamun, A., & Rodrigs, M. (2017). Impact of board structure on firm performance: evidence from an emerging economy. Journal of Asia Business Studies. https://doi.org/10.1108/JABS-06-2015-0067

Yavas, C. V., & Erdogan, S. B. (2017). The effect of foreign ownership on firm performance: Evidence from emerging market. Australian Academy of Accounting and Finance Review, 2(4), 363-371.

Zraiq, M. A. A., & Fadzil, F. H. B. (2018). The impact of ownership structure on firm performance: Evidence from Jordan. International Journal of Accounting, Finance and Risk Management, 3(1), 1-4. https://doi.org/10.11648/j.ijafrm.20180301.12

Zulaecha, H. E. (2019). Foreign ownership and sustainability performance in Indonesia. International Journal of Financial, Accounting, and Management, 1(1), 1-15. https://doi.org/10.35912/ijfam.v1i1.39

World Commission on Environment and Development (1987). Our common future. Retrieved from https://sustainabledevelopment.un.org/content/docum ents/5987our-common-future.pdf. Accessed 5 January 2021.

Jeong, H., Shin, K., Kim, E., & Kim, S. (2020). Does open innovation enhance a large firm’s financial sustainability? A case of the Korean food industry. Journal of Open Innovation: Technology, Market, and Complexity, 6(4), 101. https://doi.org/10.3390/joitmc6040101

Tarasenko, O. Y., Derhaliuk, M. O., Blaga, N. V., Derkach, E. M., & Budnyk, V. А. (2020). The Impact of Globalization on the Financial Sustainability and Logistics Infrastructure of Transition Economies. International Journal of Management (IJM), 11(4).

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).