Do FDI Inflows Encourage Domestic Currency Appreciation in Nigeria? Revisiting the Aliber’s Theory

Abstract

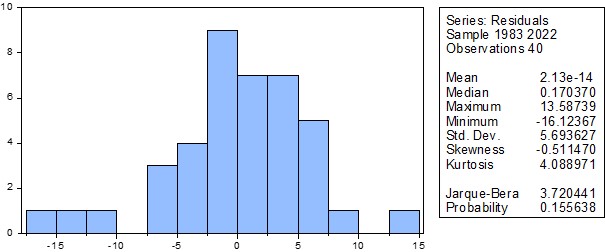

Using annual series that span the period from1981-2022 and employing the ARDL framework, this study examines if FDI inflows lead to domestic currency appreciation in Nigeria. Finding indicates that in the short-run and the long-run, FDI inflows impacted negatively and significantly on exchange rate. Also, one period lag of interest rate impacted positively on exchange rate in the short-run but in the long-run the impact was negative. Net barter terms of trade also impacted exchange rate positively. The significant impact of FDI inflows on exchange rate provides an alternative view of the link between the two variables different from the postulation of Aliber’s hypothesis. Consequently, policymakers should weigh the benefits and costs of FDI inflows bearing in mind that continuous appreciation of the domestic currency occasioned by FDI inflows could adversely affect the terms of trade position.

References

[2] Akpan, E. O., & Atan, J. A. (2012). Effect of exchange rate movements on economic growth in Nigeria. CBN Journal of Applied Statistics, 2(2), 1-14.

[3] Akanji, B. (2006). The achievement of convergence in Nigeria foreign exchange market. Central Bank of Nigeria Bullion, 30(3), 10-16.

[4] Otiwu, K. C. (2018). Foreign exchange rate policies and economic growth nexus in Nigeria. Emerald International Journal of Scientific and Contemporary Studies, 1(1), 84-112.

[5] Okoukoni, V., & Oyekan, M. (2023, August). Nigeria’s floating exchange rate regime: Potential tax implications and management strategies for businesses. BusinessDay. https://ng.andersen.com/nigerias-floating-exchange-rate-regime-potential-tax-implications-management-strategies-for-businesses/

[6] Aliber, R. Z. (1970). A theory of direct foreign investment. In C. P. Kindleberger (Ed.), The international corporation, a symposium. MIT Press.

[7] Mannathoko, I. (2020). Sterilization in Botswana: Cost, sustainability and efficiency (Policy Review No. 690).

[8] Ali, S., & Nazar, R. (2017). Impact of foreign capital inflows and money supply on exchange rate: A case study of Pakistan. Review of Economics and Development Studies, 3(1), 83-90.

[9] Kilicarslan, Z. (2018). The relationship between exchange rate volatility and foreign direct investment in Turkey: Toda and Yamamoto causality analysis. International Journal of Economics and Financial Issues, 8(4), 61-67.

[10] Mokuolu, J. O. (2018). Effect of exchange rate and interest rate on FDI and its relationship with economic growth in Nigeria. European Journal of Economic and Financial Research, 3(1), 33-47.

[11] Aribatise, A., Adeyemi, G., & Adeseke, A. S. (2019). The causal relationship between foreign direct investment and exchange rate in Nigeria (1986-2017). International Journal of Innovative Finance and Economics Research, 7(2), 67-75.

[12] Siddiqui, F., & Siddiqui, D. A. (2019). Causality between tourism and foreign direct investment: An empirical evidence from Pakistan. Asian Journal of Economic Modelling, 7(1), 27-44.

[13] Mostafa, M. M. (2020). Impacts of inflation and exchange rate on foreign direct investment in Bangladesh. International Journal of Science and Business, 4(11), 53-69.

[14] Adebayo, T. S., Abolaji, A., Akinsola, G. D., & Olanrewaju, V. O. (2020). Asymmetric impact of inflation on foreign direct investment in Nigeria: An application of the non-linear autoregressive distributed lag (NARDL) model. Timisoara Journal of Economics and Business, 13(2), 87-106.

[15] Jannat, Z. (2020). The impact of exchange rate volatility on foreign direct investment inflows: Evidence from South Asia. International Journal of Finance, Insurance and Risk Management, 10(3), 101-116.

[16] Akinlo, A. E., & Onatunji, O. G. (2021). Exchange rate volatility and foreign direct investment in selected West African countries. The International Journal of Business and Finance Research, 15(1), 77-88.

[17] Tan, L., Xu, Y., & Gashaw, A. (2021). Influence of exchange rate on foreign direct investment inflows: An empirical analysis based on co-integration and Granger causality test. Hindawi Mathematical Problems in Engineering, 2021. https://doi.org/10.1155/2021/7280879

[18] Zhao, Y., Li, X., & de Haan, J. (2022). The time varying causal relationship between international capital flows and the real effective exchange rate: New evidence for China. The Singapore Economic Review, 67(4), 1253-1274.

[19] Qabhobho, T., Amoah, E. V., & Doku, I. (2022). Linkages between foreign direct investment, trade openness and economic growth in South Africa: Does exchange rate regime choice matter? Latin American Journal of Trade Policy, 13, 60-86.

[20] Nwagu, K. (2023). The impact of macroeconomic variables on foreign direct investment in Nigeria. Journal of Accounting, Business and Finance Research, 16(1), 30-35.

[21] Sultana, M., Rahman, H., & Zimon, G. (2024). The impact of external debt and exchange rate on foreign direct investment in emerging investment markets: New evidence using a PMG-ARDL panel data analysis. Cogent Economics and Finance, 12(1).

[22] Adewale, A. M., Olopade, B. C., & Ogbaro, E. O. (2024). Effect of exchange rate on foreign direct investment in Nigeria. ABUAD Journal of Social and Management Sciences (AJSMS), 5(2), 302-318. https://doi.org/10.53982/ajsms.2024.0502.05-j

[23] Lajevardi, H., & Chowdhury, M. (2024). How does the exchange rate and its volatility influence FDI to Canada? A disaggregated analysis. Journal of Risk and Financial Management, 17(2), 88. https://doi.org/10.3390/jrfm17020088

[24] Ullah, S., & Nobanee, H. (2025). Decoding exchange rate in emerging economy: Financial and energy dynamics. Heliyon, 11(2), e41995. https://doi.org/10.1016/j.heliyon.2025.e41995

[25] Masengesho, E. J., Dada, S., & Ogboi, C. (2025). Effect of monetary policy on foreign direct investment (FDI) inflows in East African countries: The moderating impact of institutional quality. Archives of Business Research, 13(3), 44-57.

[26] Clark, P. B., & MacDonald, R. (2000). Filtering the BEER: A permanent and transitory decomposition (IMF Working Paper 00/144).

[27] Sanusi, A. R. (2015). Foreign aid inflows and the real exchange rate: Are there Dutch disease effects in Ghana? The UIP Journal of Financial Economics, 9(4), 1-25.

[28] Williamson, J. (1994). Estimating long-run equilibrium real exchange rates. Institute for International Economics.

[29] Elbadawi, I. (1994). Estimating long-run equilibrium exchange rates: Estimating equilibrium exchange rates. Institute for International Economics.

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).