Efficiency at the Core: How Working Capital Management Relates to Accounting Metrics and Market Performance in the Automotive Industry

Abstract

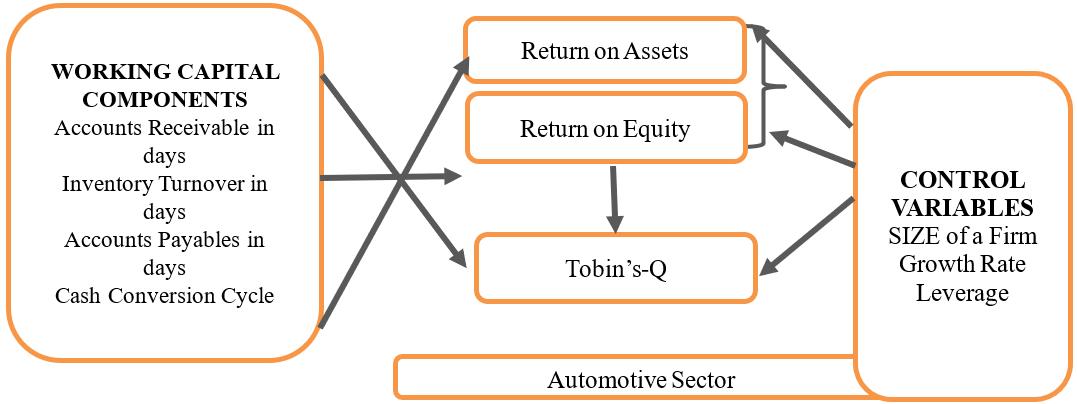

In today’s volatile automotive landscape, working capital management (WCM) functions not just as a back-office efficiency tool, but a strategic lever for financial and shareholder value. This study explores the relationship between WCM components and firm performance both from accounting and market valuation perspectives. It uses a panel dataset of the top ten publicly listed global automotive firms across multiple geographies over a ten-year period. Firm performance is assessed using accounting indicators of Return on Assets (ROA) and Return on Equity (ROE), and market valuation through Tobin’s Q (TOBQ). The analysis focuses on four WCM components: cash conversion cycle (CCC), average receivables days (ARD), average payables days (APD), and inventory days (ITD), employing multiple linear regression (MLR) for empirical testing. The results reveal that ARD and APD are the most influential components. ARD negatively affects both ROA and ROE, while APD has a positive impact, indicating that efficient receivables collection and extended payable terms improve profitability. ITD and CCC were found to be statistically insignificant in accounting performance models. In contrast, TOBQ is negatively affected by both ARD and CCC, implying that longer receivables periods and cash cycles diminish market valuation by heightening liquidity risk and financial leverage. Notably, ROA and not ROE, emerged as a significant predictor of TOBQ, reinforcing the view that operational efficiency, rather than equity-based returns, is more valued by investors. This research adds to the literature by quantifying the dual impact of WCM on internal performance and external valuation in a capital-intensive industry. Although centered on the automotive sector, the findings may be cautiously generalized to other manufacturing industries with similar operational frameworks. The study underscores WCM’s strategic importance as a lever for both internal performance enhancement and external value creation. Our findings offer actionable insights for operational managers and policymakers, emphasizing the need for optimized capital strategies that bridge operational finance and market performance for enhancing shareholder value.

References

Agarwal, P. K., & Varma, S. K. (2013). Working capital management and corporate performance: Evidence from a study of Indian firms. International Journal of Indian Culture and Business Management, 7(4), 552–571. https://doi.org/10.1504/IJICBM.2013.056662

Akbar, A., Akbar, M., Nazir, M., Poulova, P., & Ray, S. (2021). Does working capital management influence operating and market risk of firms?. Risks, 9(11), 201. https://doi.org/10.3390/risks9110201

Alavinasab, S. M., & Davoudi, E. (2013). Studying the relationship between working capital management and profitability of listed companies in Tehran stock exchange. Business Management Dynamics, 2(7), 1.

Aldubhani, M. A., Wang, J., Gong, T., & Maudhah, R. A. (2022). Impact of working capital management on profitability: Evidence from listed companies in Qatar. Journal of Money and Business, 2(1), 70–81. https://doi.org/10.1108/JMB-08-2021-0032

Ali, B., Ali, M., Shah, S., & Arif, M. (2018). Does cash conversion cycle affect corporate performance? Evidence from manufacturing sector of Pakistan. Research Journal of Finance and Accounting, 9(23), 1–7. https://doi.org/10.5171/2018.859648

Al-Qudah, A. A., & Al-Afeef, M. A. M. (2015). The relationship between the investment in current assets and profitability & liquidity. Journal of Finance and Investment Analysis, 4(4), 11–22.

Bagh, T., Nazir, M. I., Khan, M. A., Khan, M. A., & Razzaq, S. (2016). The impact of working capital management on firms financial performance: Evidence from Pakistan. International Journal of Economics and Financial Issues, 6(3), 1097–1105.

Bell, J., Monaco, L., & Mondliwa, P. (2021). Leveraging plastics linkages for diversification: An assessment of backward linkages from polymers and forward linkages to the automotive industry. In Leveraging Plastics Linkages for Diversification (pp. 78–99). Oxford University Press. https://doi.org/10.1093/oso/9780192894311.003.0004

Boisjoly, R. P., Conine Jr, T. E., & McDonald IV, M. B. (2020). Working capital management: Financial and valuation impacts. Journal of Business Research, 108, 1–8. https://doi.org/10.1016/j.jbusres.2019.09.025

Deari, F., Kukeli, A., Barbuta-Misu, N., & Virlanuta, F. O. (2024). Does working capital management affect firm profitability? Evidence from European Union countries. Journal of Economic and Administrative Sciences, 40(5), 1060–1080. https://doi.org/10.1108/JEAS-11-2021-0222

Deloof, M. (2003). Does working capital management affect profitability of Belgian firms?. Journal of Business Finance & Accounting, 30(3‐4), 573–588. https://doi.org/10.1111/1468-5957.00008

Demiraj, R., Dsouza, S., & Abiad, M. (2022). Working capital management impact on profitability: Pre-pandemic and pandemic evidence from the European automotive industry. Risks, 10(12), 236. https://doi.org/10.3390/risks10120236

El-Ansary, O., & Al-Gazzar, H. (2021). Working capital and financial performance in MENA region. Journal of Humanities and Applied Social Sciences, 3(4), 257–280. https://doi.org/10.1108/JHASS-02-2020-0036

Fan, W., & Iqbal, M. (2022). Economic, Social, and Environmental Determinants of Automotive Industry Competitiveness. Journal of Energy and Environmental Policy Options, 5(4), 36–43.

Filbeck, G., & Krueger, T. M. (2005). An analysis of working capital management results across industries. American Journal of Business, 20(2), 11–20. https://doi.org/10.1108/19355181200500007

Forghani, M., Shirazipour, M., & Hosseini, A. (2013). Impact of working capital management on firms performance. Journal of Basic and Applied Scientific Research, 3(7), 943–947.

Freeman, R. E. (2010). Strategic management: A stakeholder approach. Cambridge University Press. https://doi.org/10.1017/CBO9781139192675

García‐Teruel, P. J., & Martínez‐Solano, P. (2007). Effects of working capital management on SME profitability. International Journal of Managerial Finance, 3(2), 164–177. https://doi.org/10.1108/17439130710738718

Garg, A. K., & Gumbochuma, M. I. (2015). Relationship between working capital management and profitability in JSE listed retail sector companies. Investment Management and Financial Innovations, 12(2), 127–135.

Garg, M. C., & Meentu. (2022). Impact of Working Capital Management on Firm's Profitability of Automobile Sector Firms in India. Asia-Pacific Journal of Management Research and Innovation, 18(3-4), 107–119. https://doi.org/10.1177/2319510X221145249

Ghosh, S. (2008). Do leverage, dividend policy and profitability influence future value of firm? Evidence from India. Available at SSRN 1158251. https://doi.org/10.2139/ssrn.1158251

Gill, A., Biger, N., & Mathur, N. (2010). The relationship between working capital management and profitability: Evidence from the United States. Business and Economics Journal, 10(1), 1–9.

Howorth, C., & Westhead, P. (2003). The focus of working capital management in UK small firms. Management Accounting Research, 14(2), 94–111. https://doi.org/10.1016/S1044-5005(03)00022-2

Hsiao, C. (2005). Why panel data?. The Singapore Economic Review, 50(2), 143–154. https://doi.org/10.1142/S0217590805001937

Hutchison, T. (1976). Adam Smith and the wealth of nations. The Journal of Law and Economics, 19(3), 507–528. https://doi.org/10.1086/466885

Jafari, F., & Rao, D. P. (2015). Study the Relation between Working Capital System and Profitability in Auto Manufacturing Industry in India. Journal of Resources Development and Management, 6, 14–25.

Jensen, M. C., & Smith, C. W. (1984). Stockholder, manager, and creditor interests: Applications of agency theory. University of Rochester, Managerial Economics Research Center, Graduate School of Management.

Kasozi, J. (2017). The effect of working capital management on profitability: A case of listed manufacturing firms in South Africa. Investment Management and Financial Innovations, 14(2-2), 336–346. https://doi.org/10.21511/imfi.14(2-2).2017.05

Kaushik, N., & Chauhan, S. (2019). The role of financial constraints in the relationship between working capital management and firm performance. IUP Journal of Applied Finance, 25(1), 60–82.

Komara, A., Ghozali, I., & Januarti, I. (2020). Examining the firm value based on signaling theory. In 1st International Conference on Accounting, Management and Entrepreneurship (ICAMER 2019) (pp. 1–4). Atlantis Press. https://doi.org/10.2991/aebmr.k.200305.001

Kwenda, F., & Matanda, E. (2015). Working capital management in liquidity-constrained economy: A case of Zimbabwe stock exchange listed firms in the multiple currency era. Public and Municipal Finance, 4(1), 55–65.

Kumar, V. (2008). Managing customers for profit: Strategies to increase profits and build loyalty. Prentice Hall Professional.

Lazaridis, I., & Tryfonidis, D. (2006). Relationship between working capital management and profitability of listed companies in the Athens stock exchange. Journal of Financial Management and Analysis, 19(1).

Malik, M. S., & Bukhari, M. (2014). The impact of working capital management on corporate performance: A study of firms in cement, chemical and engineering sectors of Pakistan. Pakistan Journal of Commerce and Social Sciences (PJCSS), 8(1), 134–148.

Mandipa, G., & Sibindi, A. B. (2022). Financial performance and working capital management practices in the retail sector: Empirical evidence from South Africa. Risks, 10(3), 63. https://doi.org/10.3390/risks10030063

Mitnick, B. M. (2019). Origin of the theory of agency: an account by one of the theory's originators. Available at SSRN 1020378.

Moradi, A., & Paulet, E. (2019). The firm-specific determinants of capital structure-An empirical analysis of firms before and during the Euro Crisis. Research in International Business and Finance, 47, 150–161. https://doi.org/10.1016/j.ribaf.2018.07.007

Naz, M. A., Ali, R., Rehman, R. U., & Ntim, C. G. (2022). Corporate governance, working capital management, and firm performance: Some new insights from agency theory. Managerial and Decision Economics, 43(5), 1448–1461. https://doi.org/10.1002/mde.3466

Nguyen, A. H., Pham, H. T., & Nguyen, H. T. (2020). Impact of working capital management on firm's profitability: Empirical evidence from Vietnam. The Journal of Asian Finance, Economics and Business, 7(3), 115–125. https://doi.org/10.13106/jafeb.2020.vol7.no3.115

Nurhidayat, D., & Thamrin, H. (2023). The impact of working capital management on financial performance, evidence from automotive & components industry. Journal of Economics, Finance and Management Studies, 6(2), 993–1004. https://doi.org/10.47191/jefms/v6-i2-44

Ogundipe, S. E., Idowu, A., & Ogundipe, L. O. (2012). Working capital management, firms' performance and market valuation in Nigeria. World Academy of Science, Engineering and Technology, 61(1), 1196–1200.

Okpala, K. E., Osanebi, C., & Irinyemi, A. (2019). The impact of credit management strategies on liquidity and profitability. Journal of Behavioural Studies, 1(1), 1–14.

Özkaya, H., & Yaşar, Ş. (2023). Working capital management in the food and beverage industry: Evidence from listed European companies. Agricultural Economics (Zemědělská Ekonomika), 69(2), 78–88. https://doi.org/10.17221/383/2022-AGRICECON

Pirttilä, M., Virolainen, V. M., Lind, L., & Kärri, T. (2020). Working capital management in the Russian automotive industry supply chain. International Journal of Production Economics, 221, 107474. https://doi.org/10.1016/j.ijpe.2019.08.009

Prihartono, A. G., Sumarwan, U., Achsani, N. A., & Kirbrandoko, K. (2015). The Significance Of Loyalty On Consumer Credit Profitability. International Research Journal of Business Studies, 5(1).

Rahman, M. J., & Yilun, L. (2021). Firm size, firm age, and firm profitability: evidence from China. Journal of Accounting, Business and Management (JABM), 28(1), 101–115. https://doi.org/10.31966/jabminternational.v28i1.829

Rey-Ares, L., Fernández-López, S., & Rodeiro-Pazos, D. (2021). Impact of working capital management on profitability for Spanish fish canning companies. Marine Policy, 130, 104583. https://doi.org/10.1016/j.marpol.2021.104583

Ross, S. A. (1977). The determination of financial structure: The incentive-signalling approach. The Bell Journal of Economics, 8(1), 23–40. https://doi.org/10.2307/3003485

Ruf, B. M., Muralidhar, K., Brown, R. M., Janney, J. J., & Paul, K. (2001). An empirical investigation of the relationship between change in corporate social performance and financial performance: A stakeholder theory perspective. Journal of Business Ethics, 32, 143–156. https://doi.org/10.1023/A:1010786912118

Seth, H., Chadha, S., Ruparel, N., Arora, P. K., & Sharma, S. K. (2020). Assessing working capital management efficiency of Indian manufacturing exporters. Managerial Finance, 46(8), 1061–1079. https://doi.org/10.1108/MF-02-2019-0076

Shah, M. H., & Khan, A. (2017). Factors determining capital structure of Pakistani non-financial firms. International Journal of Business Studies Review, 2(1), 46–59.

Sturgeon, T. J., Memedovic, O., Van Biesebroeck, J., & Gereffi, G. (2009). Globalisation of the automotive industry: Main features and trends. International Journal of Technological Learning, Innovation and Development, 2(1-2), 7–24. https://doi.org/10.1504/IJTLID.2009.021954

Sudrajat, J., & Setiyawati, H. (2021). Role of firm size and profitability on capital structures and its impact over firm value. Dinasti International Journal of Economics, Finance & Accounting, 2(1), 13–27. https://doi.org/10.38035/dijefa.v2i1.737

Toušek, Z., Hinke, J., Gregor, B., Prokop, M., & Streimikiene, D. (2022). Shareholder value creation within the supply chain-working capital perspective. Polish Journal of Management Studies, 26. https://doi.org/10.17512/pjms.2022.26.1.19

Ukaegbu, B. (2014). The significance of working capital management in determining firm profitability: Evidence from developing economies in Africa. Research in International Business and Finance, 31, 1–16. https://doi.org/10.1016/j.ribaf.2013.11.005

Umar, U. H., & Al-Faryan, M. A. S. (2024). The impact of working capital management on the profitability of listed halal food and beverage companies. Managerial Finance, 50(3), 534–557. https://doi.org/10.1108/MF-12-2022-0606

Viskari, S., Lind, L., Kärri, T., & Schupp, F. (2012). Using working capital management to improve profitability in the value chain of automotive industry. International Journal of Services and Operations Management, 13(1), 42–64. https://doi.org/10.1504/IJSOM.2012.048275

Wang, Y. J. (2002). Liquidity management, operating performance, and corporate value: evidence from Japan and Taiwan. Journal of Multinational Financial Management, 12, 159–169. https://doi.org/10.1016/S1042-444X(01)00047-0

Wooldridge, J. (2002). Econometric Analysis of Cross Section and Panel Data. The MIT Press.

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).