Research on the Impact of Fintech on Green Innovation of Enterprises

Abstract

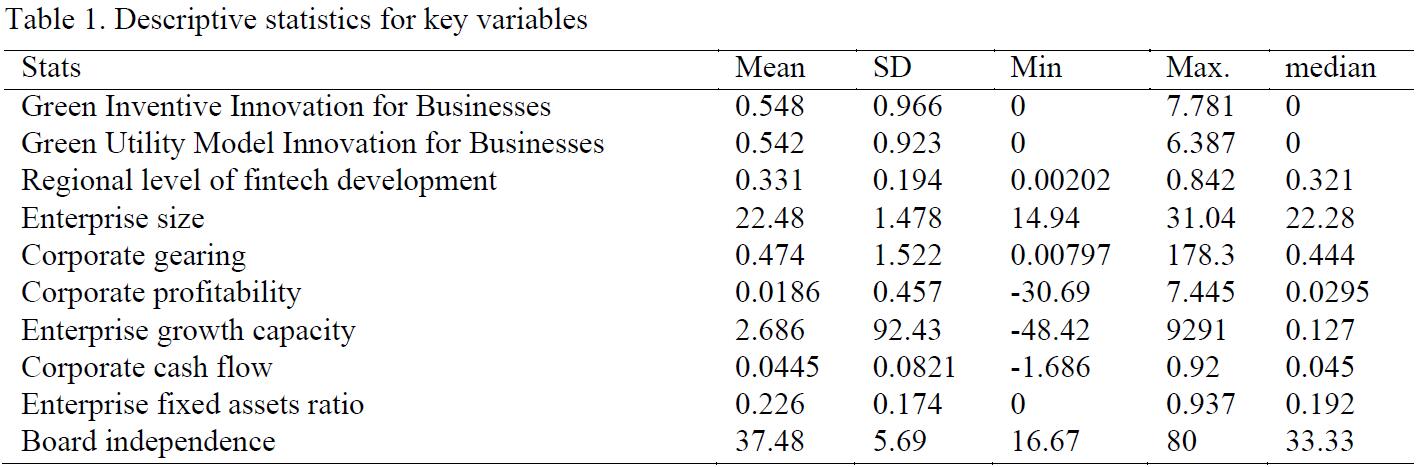

The study constructed regional fintech development level indicators based on the Baidu search index of fintech keywords in each province, and conducted an empirical analysis using relevant data of A-share listed companies from 2012 to 2021. It is found that the development of fintech significantly promotes corporate green innovation. This finding remains robust after changing the sample interval and the measurement regression, verifying the important role of fintech in promoting corporate green innovation. Meanwhile, the heterogeneity analysis finds that FinTech plays a more significant role in promoting corporate green innovation in the eastern region. Its development not only brings new opportunities for the financial industry in the east, but also provides a steady stream of innovation vitality for the real economy in the east. Continuously promoting the development of fintech and reshaping the ecological pattern of the financial industry is of great significance in stimulating the innovation vitality of the real economy and promoting the construction of an innovative country.

References

[2] Cao, Y., Li, X., Hu, H., et al. (2023). How can digitalization promote green transformation of manufacturing enterprises? An exploratory case study under the perspective of resource orchestration theory. Management World, 39(3), 96–112, 126, 113. https://doi.org/10.19744/j.cnki.11-1235/f.2023.0045

[3] Liu, J., Liu, J., & Chao, Y. (2024). Green credit and low-carbon transition: Capital integration or technological innovation? Evidence from a quasi-natural experiment. Research on Quantitative and Technical Economics, 41(6), 151–171. https://doi.org/10.13653/j.cnki.jqte.20240416.001

[4] Chen, Y., Chen, R., & Li, M. (2023). Impact of environmental protection assessment on the vitality of green innovation of various types of subjects. Research on Quantitative Economics and Technical Economics, 40(12), 194–214. https://doi.org/10.13653/j.cnki.jqte.20231025.001

[5] Wu, W., Cao, C., & Wang, X. (2024). Government procurement and innovation of "specialized, specialized and new" small and medium-sized enterprises—Based on the perspective of industrial chain supply chain modernization. Research on Quantitative and Technical Economics, 41(7), 113–133. https://doi.org/10.13653/j.cnki.jqte.20240531.002

[6] Tian, X., & Guo, K. (2023). The impact of green manufacturing technology innovation on the green development of manufacturing industry. Economic Theory and Economic Management, 43(8), 4–17.

[7] Xu, Z., Gong, B., Chen, Y., et al. (2023). Fintech, digital transformation and corporate breakthrough innovations—An analysis based on the complex network of global patent citations. Financial Research, 10, 47–65.

[8] Yang, M., Wang, Y., & Xia, X. (2023). Technical expert executives and green innovation in listed companies. Economic Theory and Economic Management, 43(6), 27–41. [No DOI available]

[9] Wang, X., Deng, X., & Li, N. (2023). Fintech, shadow banking and financing cost of small and medium-sized enterprises. Agricultural Technology Economics, 11, 110–127. https://doi.org/10.13246/j.cnki.jae.2023.11.003

[10] Zhang, Z., & Dong, J. (2023). Mechanisms and paths of fintech-enabled high-quality development of rural finance. Agricultural Economic Issues, 9, 81–95. https://doi.org/10.13246/j.cnki.iae.20230413.001

[11] Li, T., Shi, Z., Han, D., et al. (2023). Digital economy development and provincial innovation quality—Evidence from patent quality. Statistical Research, 40(9), 92–106. https://doi.org/10.19343/j.cnki.11-1302/c.2023.09.007

[12] Liu, X., & Hu, Z. (2024). Financial technology, executive environmental background and corporate green innovation. Economic System Reform, 3, 77–84.

[13] Wang, J., & Li, Z. (2023). Environmental regulation strategy interaction and green innovation—Evidence from market-based and command-based environmental regulation. Statistical Research, 40(12), 26–38. https://doi.org/10.19343/j.cnki.11-1302/c.2023.12.003

[14] Li, X., Xu, Q., & Wang, N. (2023). Enterprise digital transformation and green technology innovation. Statistical Research, 40(9), 107–119. https://doi.org/10.19343/j.cnki.11-1302/c.2023.09.008

[15] Zeng, P., & Xiao, J. (2023). Can the development strategy of the Yangtze River Economic Belt enhance regional green innovation capacity—Evidence based on quasi-natural experiments. Statistical Research, 40(6), 91–104. https://doi.org/10.19343/j.cnki.11-1302/c.2023.06.007

[16] Li, X., Sidenkui, & Wang, K. (2024). Can the liberalization of China's capital market promote the independent innovation of enterprises? Empirical evidence based on the trading system of "Shanghai-Shenzhen-Hong Kong Stock Connect". Statistical Research, 41(5), 51–63. https://doi.org/10.19343/j.cnki.11-1302/c.2024.05.005

[17] Yang, M., & Pu, Z. (2024). A study on the measurement of digital technology innovation level between provinces and regional differences in China. Statistical Research, 41(2), 15–28. https://doi.org/10.19343/j.cnki.11-1302/c.2024.02.002

[18] Yin, H., & Li, G. (2022). Has smart manufacturing empowered enterprise innovation? A quasi-natural experiment based on China's smart manufacturing pilot program. Financial Research, 10, 98–116.

[19] Ding, J., Li, Z. F., & Huang, G. B. (2022). Can green credit policy promote corporate green innovation? Based on the perspective of policy effect differentiation. Financial Research, 12, 55–73.

[20] Lu, T., & Xu, Q. (2023). Green trade barriers and corporate green technology: Pushback effect or trap effect. Finance and Trade Economics, 44(12), 140–157. https://doi.org/10.19795/j.cnki.cn11-1166/f.20231205.007

[21] Wang, J., Xie, Q., & Shi, D. (2024). Research on the impact of green technology innovation on energy efficiency. Finance and Trade Economics, 45(6), 143–159. https://doi.org/10.19795/j.cnki.cn11-1166/f.20240613.007

[22] Wang, H., Guo, G., & Yin, J. (2023). How digital transformation empowers enterprises to develop green innovation. Economics Dynamics, 12, 76–91. [No DOI available]

[23] Yang, Z., Ling, H., & Chen, J. (2024). Urban green development concern and corporate green technology innovation. World Economy, 47(1), 211–232. https://doi.org/10.19985/j.cnki.cassjwe.2024.01.007

[24] Huang, S., & Zhu, G. (2023). A Chinese model of green development: Government procurement and corporate green innovation. World Economy, 46(11), 54–78. https://doi.org/10.19985/j.cnki.cassjwe.2023.11.002

[25] Chen, X., Ji, Z., & Xing, X. (2024). Functional division of labor and firm innovation in urban value chains: Evidence from firm patents. World Economy, 47(3), 94–123. https://doi.org/10.19985/j.cnki.cassjwe.2024.03.007

[26] Jia, D., & Han, H. (2023). Fintech and competitive liabilities of commercial banks. World Economy, 46(2), 183–208. https://doi.org/10.19985/j.cnki.cassjwe.2023.02.017

[27] Yang, R., & Hou, X. (2024). "Fish" and "bear palm" cannot be combined—The impact of fintech policy on the credit restructuring of commercial banks. Economist, 6, 55–65. https://doi.org/10.16158/j.cnki.51-1312/f.2024.06.004

[28] Zhou, S., Ye, N., & Zhan, W. (2023). A study on the impact of pilot policies of combining science and technology and finance on regional innovation—Based on the perspective of financial technology. Economist, 8, 95–106. https://doi.org/10.16158/j.cnki.51-1312/f.2023.08.010

[29] Li, J., & Yao, Y. (2024). The internal mechanism and realization path of digital economy empowering innovation in state-owned enterprises. Economist, 6, 95–106. https://doi.org/10.16158/j.cnki.51-1312/f.2024.06.007

[30] Gao, Y., Li, Z., & Li, J. (2024). Fintech and technological innovation path—Based on the perspective of green transformation. China Industrial Economy, 2, 80–98. https://doi.org/10.19581/j.cnki.ciejournal.2024.02.006

[31] Zhou, X. X., Jia, M., & Zhao, X. (2023). Evolutionary game dynamic analysis and empirical research on green finance boosting corporate green technology innovation. China Industrial Economy, 6, 43–61. https://doi.org/10.19581/j.cnki.ciejournal.2023.06.002

[32] Feng, L., Yuan, F., & Liu, X. (2023). Industrial robots and firm innovation—Evidence from Chinese manufacturing firms. Economics (Quarterly), 23(4), 1264–1282. https://doi.org/10.13821/j.cnki.ceq.2023.04.02

[33] Deng, Z., & Yang, P. (2023). Fintech and corporate green innovation—An analysis based on the perspective of financing constraints. Industrial Innovation Research, 15, 124–126.

[34] Xu, H., & Zhang, H. (2024). Female executives, government and media supervision and corporate green innovation—A risk analysis based on heavily polluting listed companies in Shanghai and Shenzhen A-shares in China. Modern Business, 16, 96–100. https://doi.org/10.14097/j.cnki.5392/2024.16.018

[35] Yuan, X., & Lu, J. (2024). Female executives, environmental regulation and corporate green innovation. Technology Entrepreneurship Monthly, 37(7), 43–48.

[36] Luo, W., & Lu, A. (2024). Does fintech affect corporate green innovation—Based on the perspective of green credit. Modern Finance, 3, 11–18, 25. [No DOI available]

[37] Chan, S., & Ji, Y. (2025). Do interest rate liberalization and fintech mix? Impact on shadow deposits in China. Social Science Electronic Publishing. https://doi.org/10.1111/cwe.12304

[38] Pham, T. P., Pavelkova, D., Popesko, B., et al. (2024). Relationship between fintech by Google search and bank stock return: A case study of Vietnam. Financial Innovation, 10(1), Article 44. https://doi.org/10.1186/s40854-023-00576-1

[39] Antonio, B. O., Juan, L. R., Irimia-Diéguez, A., et al. (2024). Examining user behavior with machine learning for effective mobile peer-to-peer payment adoption. Financial Innovation, 10(1), Article 76. https://doi.org/10.1186/s40854-024-00625-3

[40] Liu, Q., Chan, K. C., Chimhundu, R., et al. (2024). Fintech research: Systematic mapping, classification, and future directions. Financial Innovation, 10(1), Article 19. https://doi.org/10.1186/s40854-023-00524-z

[41] Rjoub, H., Adebayo, T. S., Zhao, J. L., et al. (2023). Blockchain technology-based fintech banking sector involvement using adaptive neuro-fuzzy-based K-nearest neighbors algorithm. Financial Innovation, 9(1), 1765–1787. https://doi.org/10.1186/s40854-023-00469-3

[42] Irimia-Diéguez, A., Velicia-Martín, F., & Aguayo-Camacho, M. (2023). Predicting fintech innovation adoption: The mediator role of social norms and attitudes. Financial Innovation, 9(1), Article 36. https://doi.org/10.1186/s40854-022-00434-6

[43] Mikhaylov, A., Zhao, J. L., & Zongyi. (2023). Analysis of financial development and open innovation oriented fintech potential for emerging economies using an integrated decision-making approach of MF-X-DMA and golden cut bipolar q-ROFSs. Financial Innovation, 9(1), 1–34. https://doi.org/10.1186/s40854-022-00399-6

[44] Xiao, Y., Lin, M., Wang, L., et al. (2024). Impact of green digital finance on sustainable development: Evidence from China’s pilot zones. Financial Innovation, 10(1), Article 37. https://doi.org/10.1186/s40854-023-00552-9

[45] Li, Y., Sun, G., Gao, Q., et al. (2023). Digital financial inclusion, financial efficiency and green innovation. Sustainability, 15(3), Article 1879. https://doi.org/10.3390/su15031879

[46] Sheng, J., & Ding, R. (2024). Is proximity better? The geographical proximity of financial resources and green innovation. Journal of Product Innovation Management, 41(1), 21–43. https://doi.org/10.1111/jpim.12702

[47] Yan, K., Zhang, Z., Yang, L., et al. (2024). Capital generates green: Evidence from China’s national innovation system policy. International Review of Financial Analysis, 91, Article 103033. https://doi.org/10.1016/j.irfa.2023.103033

[48] Song, Z., Zhu, J., & Shi, J. (2023). Evolution analysis of green innovation in small and medium-sized manufacturing enterprises. Systems, 11(2), Article 95. https://doi.org/10.3390/systems11020095

[49] Gomes, S., Pinho, M., & Lopes, J. M. (2025). From environmental sustainability practices to green innovations: Evidence from small and medium-sized manufacturing companies. Corporate Social Responsibility and Environmental Management, 31(2), 1677–1692. https://doi.org/10.1002/csr.2657

[50] Cheng, P., Wang, X., Choi, B., et al. (2023). Green finance, international technology spillover and green technology innovation: A new perspective of regional innovation capability. Sustainability, 15(2), Article 1112. https://doi.org/10.3390/su15021112

[51] Yu, H., Jiang, Y., Zhang, Z., et al. (2022). The impact of carbon emission trading policy on firms’ green innovation in China. Financial Innovation, 8(1), Article 55. https://doi.org/10.1186/s40854-022-00359-0

[52] Li, W., Yüksel, S., & Dinçer, H. (2022). Understanding the financial innovation priorities for renewable energy investors via QFD-based picture fuzzy and rough numbers. Financial Innovation, 8(1), Article 67. https://doi.org/10.1186/s40854-022-00372-3

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).