Financial Dilemma and Countermeasures for Small and Micro Enterprises in the Establishment Period: A Case Study Based on a Certain Region

Abstract

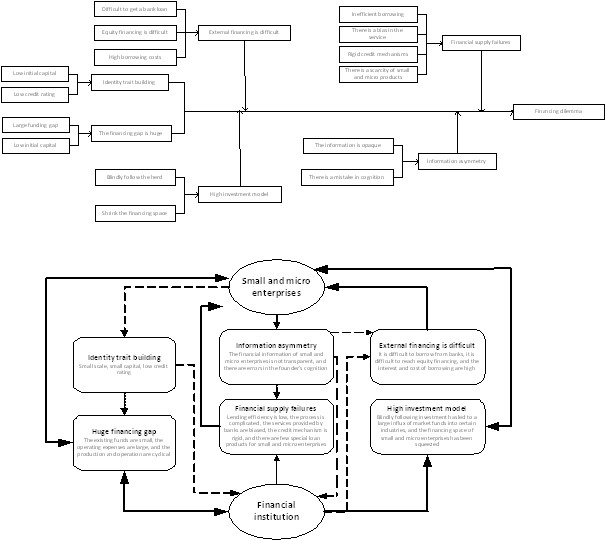

Both small micro enterprise financing difficulties research focus on small micro enterprises, financial technology, financing constraints, financing difficulties, etc., and this paper for the start-up period of small micro enterprise, combing the literature research status, on the basis of select representative samples: two initial small micro enterprise, research, the initial concept, and summarize and highly refined, form an open coding, spindle coding, finally form the dynamic perspective of small micro enterprise financing difficulties. According to the dynamic perspective of small micro enterprise financing dilemma analysis further analyze the particularity of the financing difficulties and related characteristics, the dilemma causes three aspects: initial small micro enterprise factors, financial supply system is not perfect, high investment growth model (existing research mostly ignored the important factors), and put forward the initial small micro enterprise own development, improve the financial supply system, transformation of economic growth pattern three levels of advice and strategy. Finally, I hope to provide some enlightenment for solving the financing difficulties of small and micro enterprises in the initial stage.

References

[2] Zhou, L., Yin, K., Ying, H., et al. (2024). Research on financing of small and micro enterprises: Take the first digital credit investigation experimental area for small and micro enterprises in China as an example. Southwestern Financial, 2024(01), 54-68.

[3] Xia, T., Zhang, Z., Wan, P., et al. (2022). Digital finance promotes financing mode innovation for small and micro enterprises. Research on Technical Economics and Management, 2022(05), 61-66.

[4] Yu, W. (2022). Innovative exploration of financing mode of small and micro enterprises in China: Research on financing mode of small and micro enterprises in China by China Finance Press. Price Theory and Practice, 2022(01), 180.

[5] Xiang, D., Tian, T., & Li, N. (2023). Digital inclusive finance, financing constraints and technology innovation of small, medium, and micro enterprises. Friends of the Accounting, 2023(19), 38-48.

[6] Wan, T., & He, R. (2023). The impact of special financial bonds for small and micro enterprises on the financing constraints for small and medium-sized enterprises. Statistics and Decision Making, 2023, 39(14), 173-177.

[7] Wang, R., Bian, Y., & Xiong, X. (2024). Analysis of the impact and impact of rare disaster risk on small and micro enterprises: A DSGE model based on vendor heterogeneous financing constraints. Journal of Management Engineering, 2024, 38(01), 179-192.

[8] Du, L., & Li, L. (2023). Analysis of the influence effect of macro policies on the financing gap of small and micro enterprises. Financial Forum, 2023, 28(05), 65-72.

[9] Sun, J., & Gao, L. (2023). Research on the practical challenges and optimization path of financing for small and micro enterprises. China Prices, 2023(11), 65-68.

[10] Lan, H. (2023). Solve the problem of financing mismatch of private small and micro enterprises. China Finance, 2023(19), 102.

[11] Mao, J., & Su, F. (2016). Theoretical contribution to case study: China Enterprise Management Case and Quality Research Forum (2015) Review. Manage World, 2016(02), 128-132.

[12] Mao, J., & Li, G. (2014). Reflection on the "Art" and "Tao" of case study: China Enterprise Management Case and Quality Research Forum (2013) Review. Manage World, 2014(02), 111-117.

[13] Li, Y., Chen, W., & Chen, J. (2017). Research on ecological network elements and capacity generation of maker-oriented platform organization. Economic Management, 2017, 39(06), 101-115.

[14] Wan, H., Wang, X., & Liu, X. (2012). A new way to broaden the financing channels for small and medium-sized enterprises: Project financing. Enterprise Economy, 2012, 31(08), 172-176.

[15] Su, N. (2009). Research on solving financial business barriers of small and medium-sized enterprises: Based on the perspective of ICBC credit mechanism reform. Contemporary Finance, 2009(04), 67-71.

[16] Han, X., & Jin, Y. (2014). Construction of China's rural financial credit guarantee system. Agricultural Economy Problem, 2014, 35(03), 37-43+110-111.

[17] Chen, X., Tan, H., & Chen, Y. (2023). Policy effect evaluation and improvement ideas to deal with the financing problems of small and micro enterprises: Based on the new theoretical framework of "three policies in one" of macro policy. Humanities Magazine, 2023(05), 117-127.

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).