Financial Development and Economic Growth in Developing Countries

A New Empirical Evidence from Côte d’Ivoire

Abstract

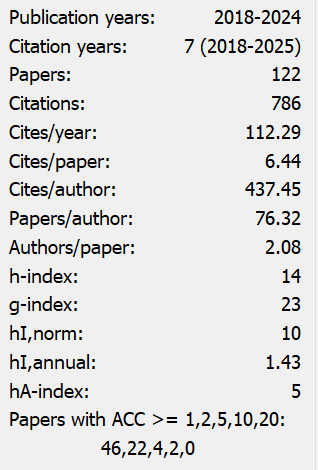

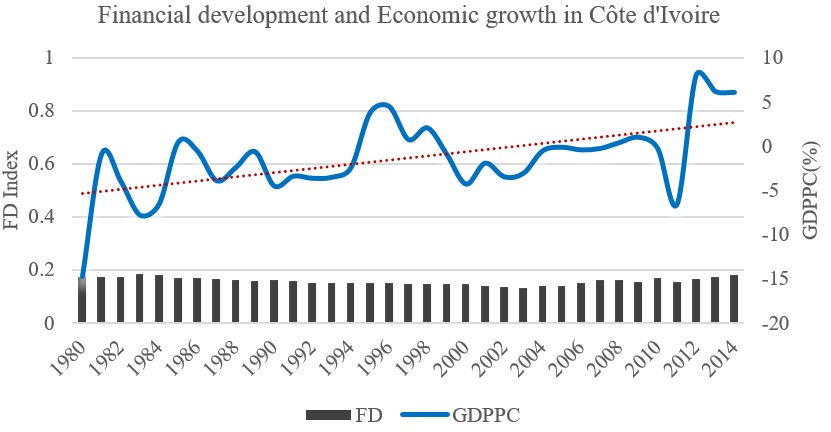

In this study, we concern mainly about the short and long-run relationship between economic growth and financial development. We use a multi-steps methodology, namely the Autoregressive Distributed Lag (ARDL) approach and the Vector Error Correction Model (VECM) approach to test this relationship in Côte d’Ivoire from 1980 to 2014. Following our results, we conclude that there is a unidirectional causal relationship, both long run and short run, between GDP per capita and financial development index in Côte d’Ivoire running from economic growth to financial development.

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).