Analyzing the Effectiveness of China's Monetary Policy Transmission Channels through Financial Asset Prices Based on the VAR Model

Abstract

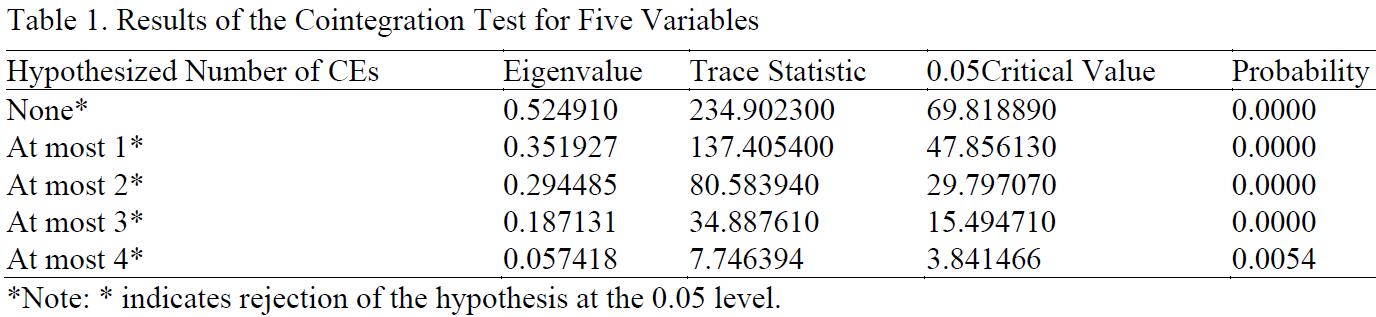

The effective transmission of monetary policy is critical to a country's economic development. This study empirically examines the transmission mechanism of monetary policy via financial asset prices by employing a Vector Autoregression (VAR) model. The findings reveal that the current relationship between China's stock market and economic fundamentals is weak, hindering the stock market's potential to serve as a robust transmission channel for monetary policy. Consequently, it is imperative to further advance interest rate liberalization and to foster the continued development and improvement of the capital market. Additionally, the study identifies a time lag in the transmission of monetary policy, highlighting the importance of expectation management by the central bank in the formulation of economic policy.

References

[2] Sun, H., & Ma, Y. (2003). The relationship between China's monetary policy and the stock market. Economic Research Journal, 2003(7), 44–53, 91.

[3] Yi, G., & Wang, Z. (2002). Monetary policy and financial asset prices. Economic Research Journal, 2002(3), 13–20, 92.

[4] He, Y. (2016). Research on the impact mechanism of monetary policy on corporate investment behavior (Doctoral dissertation). Soochow University, Suzhou.

[5] Zhang, K. (2015). Research on the effectiveness of China's monetary policy (Doctoral dissertation). Jilin University, Changchun.

[6] Zhang, P. (2010). Research on asset securitization of China's commercial banks (Doctoral dissertation). Party School of the Central Committee of the CPC, Yan'an.

[7] Zhang, W. (2021). Research on the credit transmission mechanism of China's monetary policy: Based on the VAR model. National Circulation Economy, 2021(8), 156–158.

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).