Research on the Impact of Economic Policy Uncertainty on Short Term Interest Rate Fluctuations

Abstract

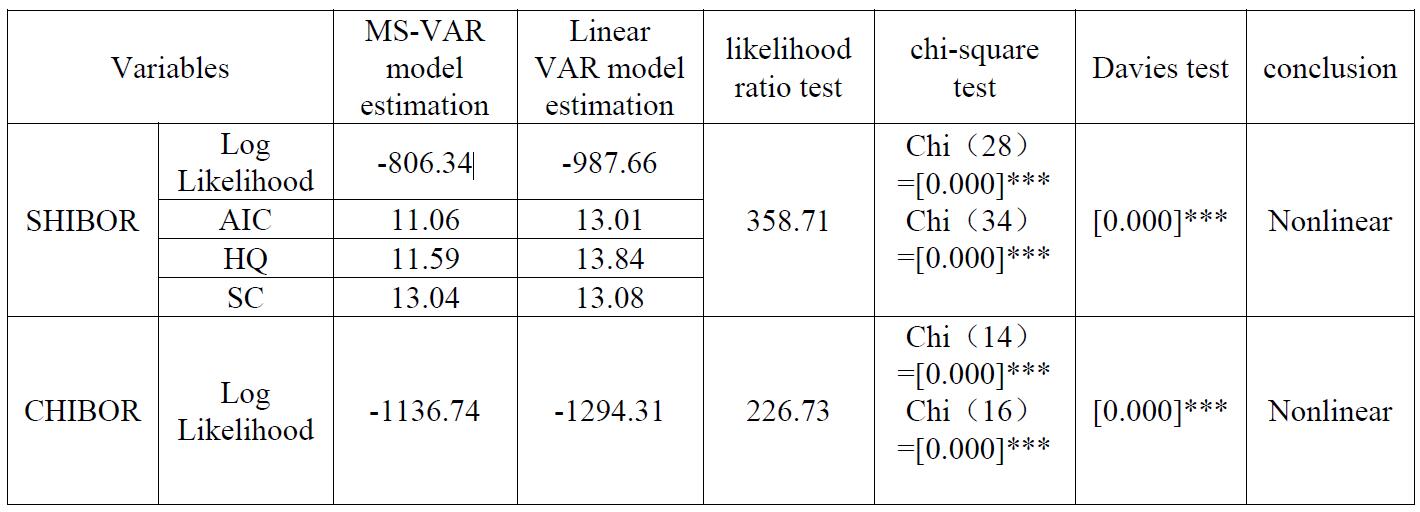

Research has shown that economic policy uncertainty is widespread. This article selects the Economic Policy Uncertainty Index, SHIBOR, and CHIBOR as proxy indicators for China's economic policy uncertainty and short-term interest rates. From 2006 to 2023, the MS-VAR model is used to explore the dynamic impact mechanism of economic policy uncertainty on short-term interest rate fluctuations. Research has found that the impact of economic policy uncertainty on short-term interest rate fluctuations is "widespread" and may have an impact on several major short-term interest rate fluctuations; When economic policy uncertainty increases, several major short-term interest rates may decline, and the magnitude of the decline in interest rates with longer maturities is relatively greater. The phenomenon of positive feedback effects is also more evident in times of crisis; In the stage where the national economic development tends to be stable and economic policy expectations are relatively clear, the impact of economic policy uncertainty on short-term interest rate fluctuations is more easily absorbed by economic entities.

References

[2] Bloom, N. (2009). The impact of uncertainty shocks. Econometrica, 77(3), 623–685. https://doi.org/10.3982/ECTA6248

[3] Jurado, K., Ludvigson, S. C., & Ng, S. (2015). Measuring uncertainty: Supplementary material. American Economic Review, 105(3), 1177–1216. https://doi.org/10.1257/aer.20131193

[4] Baker, S. R., Bloom, N., & Davis, S. J. (2016). Measuring economic policy uncertainty. The Quarterly Journal of Economics, 131(4), 1593–1636. https://doi.org/10.1093/qje/qjw024

[5] Huang, Y., & Luk, P. (2020). Measuring economic policy uncertainty in China. China Economic Review, 62(2), 1–18. https://doi.org/10.1080/17538963.2019.1710058

[6] Bentolila, S., & Bertola, G. (1990). Firing costs and labour demand: How bad is Eurosclerosis? Review of Economic Studies, 57(3), 381–402. https://doi.org/10.2307/2298020

[7] Connolly, R., Srivers, C., & Sun, L. (2005). Stock market uncertainty and the stock-bond return relation. Journal of Financial and Quantitative Analysis, 40(1), 161–194. https://doi.org/10.1017/S0022109000001782

[8] Pastor, L., & Veronesi, P. (2012). Uncertainty about government policy and stock prices. The Journal of Finance, 67(4), 1219–1264. https://doi.org/10.1111/j.1540-6261.2012.01746.x

[9] Kelly, B., Pastor, L., & Veronesi, P. (2016). The price of political uncertainty: Theory and evidence from the option market. The Journal of Finance, 71(5), 2417–2480. https://doi.org/10.1111/jofi.12406

[10] Gulen, H., & Ion, M. (2015). Political uncertainty and corporate investment. The Review of Financial Studies, 28(3), 523–564. https://doi.org/10.1093/rfs/hhv050

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).