Optimal Technology License Contracts with Quality Improvement Under Stackelberg Competition

Abstract

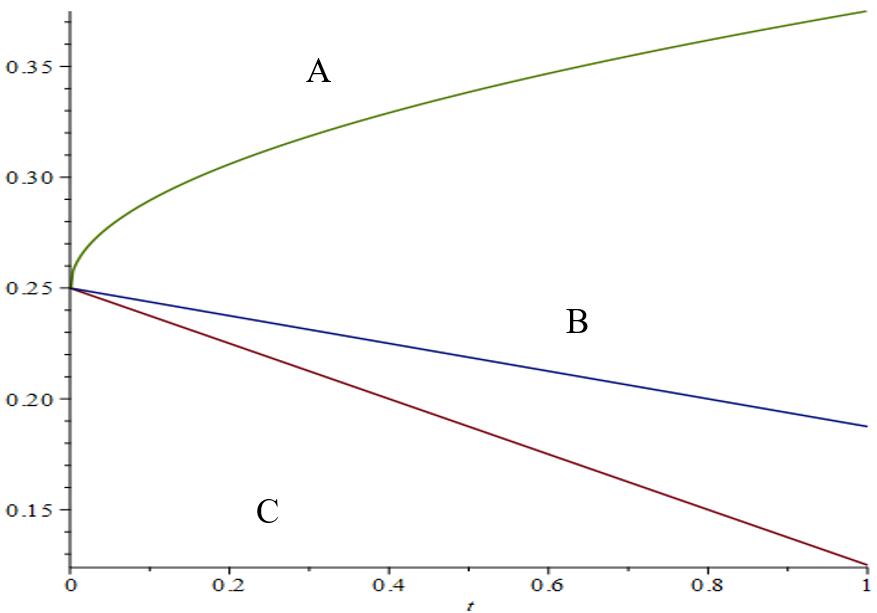

As society develops, the phenomenon of technology licensing is becoming more prevalent. This paper analyzes the optimal licensing contract for the patentor with a quality improvement innovation in a Stackelberg duopoly market. We examine and compare two licensing contracts (fixed-fee licensing and royalty licensing) in terms of the patent-holding firm’s profit, consumer surplus, and social welfare. We also study the impact of quality differences on the choice of licensing contract. One might expect that consumer surplus and social welfare are greater under fixed-fee licensing. However, we show that this conclusion seems to be untrue under quality improvement technology licensing. Moreover, we find that (1)A royalty fee is always better than a fixed-fee authorization for the innovator’s profits; (2) Relative to social welfare, there is a threshold between fixed-fee authorization and concession authorization, and when this threshold is exceeded, concession fees are adopted, and vice versa for fixed-fee authorization.

References

Arora, A., & Rønde, T. (2013). Managing licensing in a market for technology. Management Science, 59(5), 1092-1106. https://doi.org/10.1287/mnsc.1120.1628

Clark, G. L., &Monk, A.H.B. (2014). The production of investment returns in spatially extensive financial markets. Social Science Electronic Publishing, 67(4), 1-13. https://doi.org/10.2139/ssrn.2501912

Grindley, P. C., & Teece, D. J. (1997). Licensing and cross licensing in semiconductors and electronics. California Management Review, 40(3), 55-79.

Hong, X. P., Govindan, K., Xu, L., & Du, P. (2017). Quantity and collection decisions in a closed-loop supply chain with technology licensing. European Journal of Operational Research, 256(3), 820-829. https://doi.org/10.1016/j.ejor.2016.06.051

Kamien, M. L., & Y. Tauman (1986). Fees Versus Royalties and the Private Value of a Patent. Quarterly Journal of Economics, 101(3), 471-491. https://doi.org/10.2307/1885693

Wang, X. H. (2002). Fee versus Royalty Licensing in a Differentiated Cournot Duopoly. Journal of Economics and Business, 54(2), 253-266. https://doi.org/10.1016/S0148-6195(01)00065-0

Xuan, N., Sgro, P., & Nabin, M. (2014). Licensing under vertical product differentiation: Price vs. Quantity competition. Economic Modelling, 36(1), 600-606. https://doi.org/10.1016/j.econmod.2013.10.013

Zhu, K., Zhang, R. Q., & Tsung, F. (2007). Pushing quality improvement along supply chains. Management Science, 53(3), 421-436. https://doi.org/10.1287/mnsc.1060.0634

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).