Deposit Money Banks’ Credit and Agricultural Output in Nigeria

Abstract

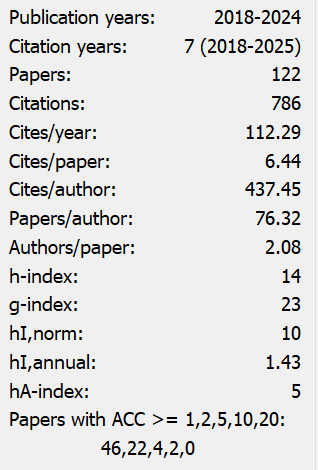

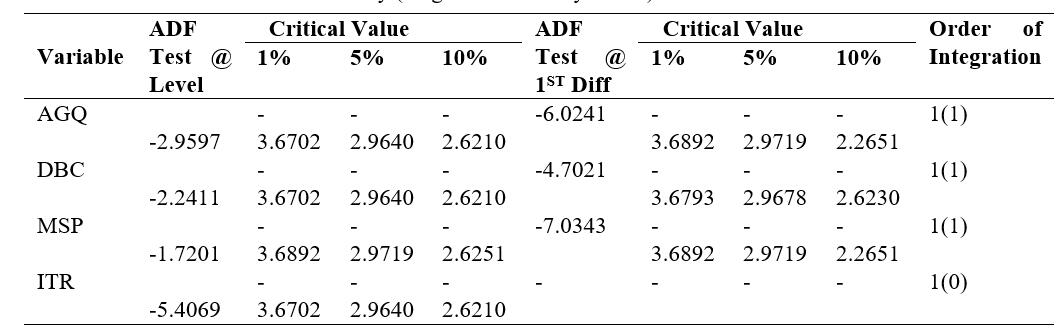

Agriculture was the mainstay of the Nigerian economy before the period of oil boom. But after the oil boom, growth and development in agriculture has been constrained by high interest rate by deposit money banks as well as in ability to access credit or loan by farmers. This scenario led to increase in unemployment, poverty and food shortage. Given these problems, the paper examined deposit money banks’ credit and agricultural sector output in Nigeria from 1985-2015. To this effect, secondary data on agricultural sector output, deposit money bank’s credit to agricultural sector, interest rate and money supply was collected from Central Bank of Nigeria Statistical Bulletin. The data collected was analyzed by the econometrics techniques of Augmented Dickey Fuller unit root test, co-integration test and parsimonious Error Correction Model. The unit root and co-integration tests show that all the variables were stationary and co-integrated. The parsimonious Error Correction Model results show that the regression coefficient of deposit money bank’s credit to agricultural sector in explaining its contribution to agricultural output is positive and statistically significant at 5 percent level. The regression coefficient of interest rate appeared with negative sign but statistically not significant. Also, the coefficient of money supply is positive and significantly related with agricultural output. Based on these findings, the paper recommends amongst others that; there should be continuity and consistency of macroeconomic policy measures in the agricultural sector especially in the area of sectorial allocation of credit as well as single digit interest rate target. Also, government should domesticate Food and Agriculture O’s recommendation of 25 percent of capital allocation to agricultural development in order to increase the agricultural production and hence economic growth and development.

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).