Analyzing the Impact of Macroeconomic Variables on Financial Stability: Evidence from South Asian Economies

Abstract

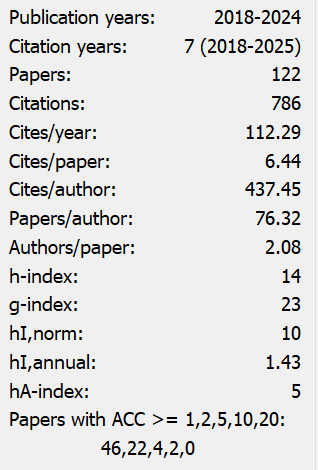

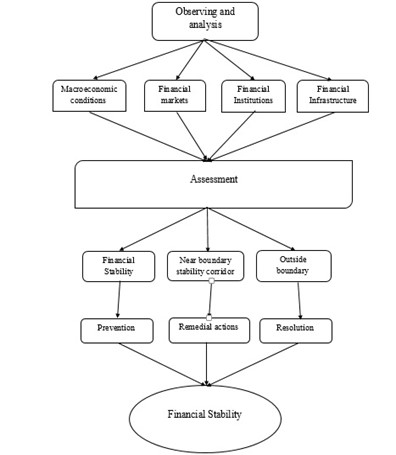

This research examines whether macroeconomic variables disturb the financial stability of SAARC countries in 1996-2022 using panel ARDL approach. We shape the financial stability as the dependent variable, and we have developed a PCA index of financial stability (principal component analysis). This study contains of macroeconomic models with a wide choice of possibly related variables for financial stability, using financial flows, financial openness, macroeconomic stability, exchange rate and economic growth on a sample of five countries between 1996 and 2022. Our experimental suggestion proposes that most of the macroeconomic variables have a positive impact on financial stability. Therefore, our outcomes support the view that the development of macro-economic policies and political programs should be part of financial improvement. All these variables may enhance the financial stability of the countries which are under consideration.

References

Almarzoqi, R. M., Naceur, S. B., & Kotak, A. (2015). What Matters for Financial Development and Stability? IMF Working Paper, 56. https://doi.org/10.2139/ssrn.2659531

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equetions. Review of Economic Studies 58, 277-297. https://doi.org/10.2307/2297968

Arnone, M., Laurens, B., Segalotto, J.-F., & Sommer, M. (2009). Central Bank Autonomy: Lesson from Global Trends. IMF Staff Pappers, 56(2), pp. 263-296. https://doi.org/10.1057/imfsp.2008.25

Arun, T., & Kamath, R. (2015). Financial Inclusion: Policies and Practice. IMB Management Review, 27, 267-287. https://doi.org/10.1016/j.iimb.2015.10.007

Bayd, J., & De Nikolo, G. (2005). The theory of bank risk taking and competiion revisited. J. Finance, 60(3), 1329-1343. https://doi.org/10.1111/j.1540-6261.2005.00763.x

Beck, T., & Feyen, E. (2013). Benchmarking Financial System: Intoductucing the Financial Possibility Frontier. World Bank Policy Research Working Paper. https://doi.org/10.1596/1813-9450-6684

Beck, T., Demirguc-Kunt, A., & Levine, R. (2006). Bank Concentration, Competition, and Crises: First Results. Journal of Banking & Finance, 30, 1581-1603. https://doi.org/10.1016/j.jbankfin.2005.05.010

Berdiev, A. N., & Saunoris, J. W. (2016). Financial Development and the shadow economy: A panel VAR analysis. Economic Modelling, 197-207. https://doi.org/10.1016/j.econmod.2016.03.028

Blejer, M. I. (2006). Economic growth and the stability and effeiciency of the Financial sector. Journal of Banking & Finance, 3429-3432. https://doi.org/10.1016/j.jbankfin.2006.06.001

Bouiyour, J., & Miftah, A. (2004). Why do migrants remit? An insightful analysis for Moroccan case. Research Gate.

Brave, S., & Butters, A. (2011). Monitoring Financial Stability: A Financial Conditions Index Approach. Economic Perspectives, 35(1), 22-43.

Caccioli, F., Farmer, J. D., & Rockmore, D. (2015). Overlapping portfolios, contagion, and financila stability. Journal of Economic Dynamics & Control, 50-63. https://doi.org/10.1016/j.jedc.2014.09.041

Chant, J. (September 2003). Financial Stability as a Policy Goal, in Essays on Financial Stability. Technical Report, 95, Bank of Canada.

Cheang, N., & Choy, I. (2011). Aggregate Financial Stability Index for an Early Warning System. 27-51.

Cihak, M. (2007). Central bank independance and financial stability. IMF Mimeo. https://doi.org/10.2139/ssrn.920255

Cocris, V., & Nucu, A. E. (2013). Monitory policy and financial stability: empirical evidence from Central and Eastren European countries. Baltic Journal of Economics, 75-98. https://doi.org/10.1080/1406099X.2013.10840527

Creal, J., Hubert, P., & Labondance, F. (2015). Financial stability and economic performance. Economic Modelling, 25-40. https://doi.org/10.1016/j.econmod.2014.10.025

Crockett, A. (1996). The Theory and Practice of Finacial Stability. DE ECONOMIST. https://doi.org/10.1007/BF01371939

Crockett, A. (August, 1997). Why is Financial Stability a Goal of Public Policy?, in Maintaining Financial Stability in a Global Economy. Symposium Proceedings, Federal Reserve Bank of Kansas City.

Cukierman, A. (1992). Central Bank Strategy, Credibility and Independence: Theory and Evidence. MIT Press: Cambridge, MA. https://doi.org/10.1515/jeeh-1992-0410

Dattels, P., McCaughrin, R., Miyajima, K., & Puig, J. (n.d.). Can You Map Global Financial Stability? IMF Working Papers.

de Souza, S. S. (2015). Capital requirement, liquidity and financial stability: The case of Brazil. Journal of Financial Stability. https://doi.org/10.1016/j.jfs.2015.10.001

Deluna, R. J., & Chelly, A. (2014). Economic Growth, Financial and Trade Globalization in the Philippines: A Vector Autoregressive Analysis. University of Southeastern Philippines, School of Applied Economics, 18.

Demirguc-Kunt, A., & Detragiache, E. (1998). The Determinants of Banking Crises in Developing and Developed Countries. IMF Staff Papers, 45, 81-109. https://doi.org/10.2307/3867330

Estrada, G., Park, D., & Ramayandi, A. (2015). Financial Development, Financial Openess, And Economic Growth. ADB Economics Working Paper Series, 39. https://doi.org/10.2139/ssrn.2707518

Fiordelisi, F., & Mare, D. S. (2014). Compition and financial stability in European cooperative banks. Journal of International Money and Finance, 1-16. https://doi.org/10.1016/j.jimonfin.2014.02.008

Frank, M. (2000). Alternative panel estimates of alcohol demand, taxation, and the business cycle. Southern Economic Journal, 67, 325-344. https://doi.org/10.2307/1061473

Fu, X., Lin, Y., & Molyneux, P. (2014). Bank compition and financial stability in Asia Pacific. Journal of Banking and Finance, 54-77. https://doi.org/10.1016/j.jbankfin.2013.09.012

Gadanecz, B., & Jayaram, K. (2009). Measures of financial stability — A review. Irving Fisher Committee Bulletin No. 31 (Proceedings of the IFC Conference on "Measuring financial innovation and its impact", Basel, 26-27 August 2008), 365-383.

Gersl, A., & Hermanek, J. (2008). Indicators of Financial System Stability: Towards an Aggregate Financial Stability Indicator? Prague Economic Papers, 3, 127-142. https://doi.org/10.18267/j.pep.325

Goldstein, M., Kaminsky, L., & Reinhart, C. (2000). Assessing Financial Vulnerability: An Early Warning System for Emerging Markets. Institutional Economics, Washington.

Gracia Herrero, A., & Del Rio, P. (n.d.). Financial Stability and the Design of Monetary Policy. Banco de Espana Working Paper 0315.

Grauwe, P. D., & Foresti, P. (2016). Fiscal Rules, Financial Stability and Optimal Currency Areas. Economic Letters. https://doi.org/10.1016/j.econlet.2016.07.010

Hallak, I. (2013). Private sector share of external debt and financial stability: Evidence from bank loans. Journal of International Money and Finance, 17-41. https://doi.org/10.1016/j.jimonfin.2012.02.017

Herrero, A. G., & Rio, P. d. (2003). Financial Stability and the Design of Monetary Policy. 34.

Houben, A., Kakes, J., & Schinasi, G. (2004). Toward a Framework for Safeguarding Financial Stability. IMF Working Paper, WP/04/101. https://doi.org/10.5089/9781451852547.001

Im, K., Pesaran, M., & Shin, Y. (2003). Testing for unit roots in heterogeneous panels. Journal of econometrics, 115(1), 53-74. https://doi.org/10.1016/S0304-4076(03)00092-7

Im, K. S., M. H., Pesaran, & Shin, Y. (2003). Testing for unit roots in heterodeneous panels. Journal of Econometrics, 115, 53-74. https://doi.org/10.1016/S0304-4076(03)00092-7

Issing, O. (2003). Monetary and Financial Stability: Is There a Trade-off? Conference on monetary stability, financial stability and the Business Cycle, March 28-29,2003. Basle: Bank for International Settlements.

Jacobson, T., Molin, J., & Vredin, A. (2001). How can central banks promote financial stability? Economic Review.

jeon, J. Q., & Lim, K. K. (2013). Bank Compitition and Financial Stability: A comparison of commercial banks and mutual savings banks in Korea. Pecific-Basin Fianance Journal, 253-272. https://doi.org/10.1016/j.pacfin.2013.10.003

Karadam, D. Y., & Ocal, N. (2014). Financial Integration and Growth: A Nonlinear Panel Data Analysis. ERC Working Papers in Economics, 35.

Kira, A. R. (2013). The Factors affecting Gross Domestic Produt (GDP) in Developing Countries: The Case of Tanzania. Eurpean Journal of Business and Management, 2222-2839.

Klomp, J., & De Haan, J. (2009). Central Bank Independance and financial Stability. Journal of Financial Stability, 321-338. https://doi.org/10.1016/j.jfs.2008.10.001

Krainer, R. E. (2013). Towards a program for financial stability. Journal of Economic Behaviour & Organization, 207-218. https://doi.org/10.1016/j.jebo.2011.10.011

Le, T. H., Kim, J., & Lee, M. (2015). Institutional Quality, Trade Openness, And Financial Development in Asia: An Empirical Investigation. ADB Economics Working Paper Series, 18. https://doi.org/10.2139/ssrn.2707547

Lee, C. C., & Hsieh, M. F. (2014). Bank reforms, foreign ownership, and financial stability. Journal of International Money and Finance, 204-224. https://doi.org/10.1016/j.jimonfin.2013.09.001

Levin, A., Lin, C., & Chu, C. (2002). Unit root tests in panel data: asymptotic and finite-sample properties. Journal of Econometrics, 108(1), 1-24. https://doi.org/10.1016/S0304-4076(01)00098-7

Ma, Y., & Lin, X. (2016). Financial development and the effectiveness of monetary policy. Journal of Bnaking and Finance, 1-11. https://doi.org/10.1016/j.jbankfin.2016.03.002

Mishkin, F. (1996). Understanding Financial Crisis: A developing country's perspective. NBER Working Paper 5600. National Bureau of Economics Research Cambridge, Mass. https://doi.org/10.3386/w5600

Mohr, B., & Wagner, H. (2011). A Structural Approach to Financial Stability: On the Beneficial Role of Regulatory Governance, 29.

Morales, M., & Estrada, D. (2010). A financial stability index for Colombia. A financial stability index for Colombia, 6, 555-581. https://doi.org/10.1007/s10436-010-0161-7

Morgan, P. J., & Pontines, V. (2014). Financial Stability and Financial Inclusion. ADBI Working Paper Series, 18. https://doi.org/10.2139/ssrn.2464018

Morgan, P. J., & Zhang, Y. (2015). Mortage Lending and Financial Stability in Asia. ADBI Working Paper Series, 18. https://doi.org/10.2139/ssrn.2672776

Moscone, F., Tosetti, E., & Canepa, A. (2014). Real estate market and financial stability in US metropolitan areas: A dynamic model with spatial effects. Regional Science and Urban Economics, 129-146. https://doi.org/10.1016/j.regsciurbeco.2014.08.003

Motelle, S., & Biekpe, N. (2015). Financial Integration and stability in the Southern Africa development community. Journal of Economics and Business, 79, 100-117. https://doi.org/10.1016/j.jeconbus.2015.01.002

Msrtinez-Zarzoso, I., & A. Bengochea-Morancho. (2004). Pooled mean group estimation of an environmental kuznets curve for CO2. Economics Letters, 82, 121-126. https://doi.org/10.1016/j.econlet.2003.07.008

Nier, E., Yang, J., Yorulmazer, T., & Alentorn, A. (2007). Network models and financial stability. Journal of Economic Dynamics & Control, 2033-2060. https://doi.org/10.1016/j.jedc.2007.01.014

Novajas, M. C., & Thegeya, A. (2013). Financial Soundness INdicators and Banking Crises. IMF Working Paper, 40.

Oosterloo, S., & De Haan, J. (2004). Central Banks and Financial Stability: A survey. Journal of Financial Stability, 257-273. https://doi.org/10.1016/j.jfs.2004.09.002

Ozkok, Z., & Francis Xavier University, S. (2012). Financial Harmonization and Industrial Growth: Evidence from Europe. Munich Personal Repec Archive, 39.

Padoa-Schioppa, T. (2002). Central banks and financial stability: exploring a land in between. paper presented at the Second ECB Central Banking Conference “The transformation of the European financial system”, Frankfurt am Main.

Padoa-Schioppa, T. (2002). Central Banks and Financial Stability: Exploring a Land in Between, paper presented at the Secong ECB Central Banking Conference. The transformation of the European finacial system, Frankfurt am Main, October 2002.

Parveen, S., Khan, A., & Ismail, M. (2012). ANALYSIS OF THE FACTORS AFFECTING EXCHANGE RATE VARIABLITY IN PAKISTAN. Academic Research International, 2223-9944.

Pesaran, M., & R.P. Smith. (1995). Estimation long-run relationships from dynamic hetrogeneous panels. Journal of Econometrics, 68, 79-113. https://doi.org/10.1016/0304-4076(94)01644-F

pesaran, M.H., Shin, & Smith. (2001). Boundsesting to the analusis of level relationships. Journal of Applied Econometrics, 16(3), 289-326. https://doi.org/10.1002/jae.616

Pesaran, M.H., Y. Shin, & R.P. Smith. (1999). Pooled mean group estimation of dynamic heterogeneous panels. Journal of the American Statistical Association 94, 621-634. https://doi.org/10.1080/01621459.1999.10474156

Pesaran, M. H., Shin, Y., & Smith, R. P. (1997). Estimating long-run relationships in dynamic hetrogeneous panels. DAE Working Papers Amalgamated Series 9721.

Phillips, M.H., & H.R. Moon. (1995). Estimating long-run relationships from dynamic heterogeneous panels. Journal of Econometrics, 68, 79-113. https://doi.org/10.1016/0304-4076(94)01644-F

Poloz, S. S. (2006). Financial stability:A worthy goal, but hoe feasible. Journal of Banking & Finance, 3423-3427. https://doi.org/10.1016/j.jbankfin.2006.06.002

Popovska, J. (2014). Modeling Financial Stability: The Case of the Banking Sector In Macedonia. Journal of Applied Economics and Business, 24.

Quintyn, M., & Taylor, M. (2003). Regulatory and Supervisory Independence and Financial Stbility. CESifo Economic studies, 249-294. https://doi.org/10.1093/cesifo/49.2.259

Rehman, S., & Wadud, D. (2014). Macroeconomic Determinants of Remittances in South Asian countries: A Dynamic Panel. Biennial Conference on “Rethinking Political Economy and Development”. Dhaka: Bangladesh Economic Association (BEA) .

Rubio, M., & Carrsco-Gallego, J. A. (2014). Macroprudential and monetary policies: Implications for financial Stability and welfare. Jouranl of Banking & Finance, 326-336. https://doi.org/10.1016/j.jbankfin.2014.02.012

Salmanpur, A., & Branch, M. (2011). Inflation, Inflation Unertainty and Factors Affecting Inflation in Iran. World Applied Scienes Journal, 14(8), 1225-1239.

San Jose, A., Krueger, R., & Khay, P. (2008). The IMF’s work on financial soundness indicators. Irving Fisher Committee Bulletin No. 28 (The IFC's contribution to the 56th ISI Session, Lisbon, August 2007), 33-40.

Schinasi, G. (December 2009). Defining Financial Stability and a Framework for Safeguarding It. Central Bank of Chile, Working paper no. 550.

Schinasi, G. J. (2004). Defining Financial Stability. IMF Working Paper, 16. https://doi.org/10.5089/9781451859546.001

Schonchoy, A. S. (2006). Determinants of Government Consumption Expendiures in Developing Countries: A panel Data Analysis. Institute of Developing Economy.

Schwartz, A. (1995). Systemic Risk and the Maceoeconomy. in: G. Kaufman (ed.), Serving Private and Public Policy. JAI Press, CT.

Shinagawa, Y., & Che, N. X. (2014). Financial Soundness Indicators and the Characteristics of Financial Cycles. IMF Working Paper, 26.

Singh, R. J., Kpodar, K., & Ghuro, D. (2009). Financial Deepening in the CFA Franc Zone: The Role of Institutions. IMF Working Papers, 18. https://doi.org/10.2139/ssrn.1415170

Tabak, B. M., Fazio, D. M., & Cajueiro, D. O. (2013). Systamically important banks and financial stability: The case of Latin America. Journal of Banking & Finance, 3855-3866. https://doi.org/10.1016/j.jbankfin.2013.06.003

Tabak, B. M., Fazio, D. M., C., K., & Pavia, d. (2016). Financial stability and bank supervision. Finance Research Letters, 1-6. https://doi.org/10.1016/j.frl.2016.05.008

Valencia, F. (2014). Monetary policy,bank leverage, and finacial stability. Journal of Economics Dynamics & Control, 20-38. https://doi.org/10.1016/j.jedc.2014.07.010

Volcker, P. (1984). The Federal Reserve Position on Restructuring of Financial Regulation Responsibilities. Federal Reserve Bulletin.

Weber, A. (2008). Financial market stability. London School of Economics, London.

Xafa, M. (2007). Globel imbalaces and financial stability. Journal of Policy Making, 29, 783-796. https://doi.org/10.1016/j.jpolmod.2007.06.012

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).