The Determinants of the use of Mobile Banking in Africa

Case of Burkina Faso

Abstract

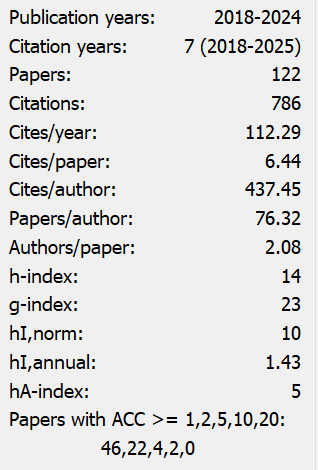

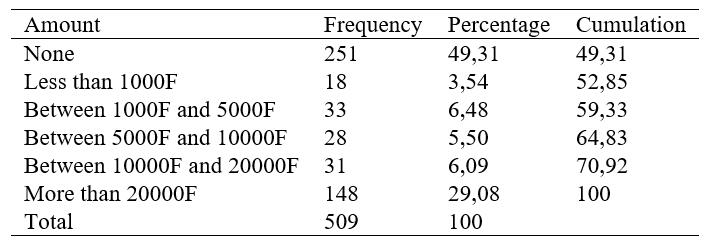

Since a few years, the banking sector in Africa has been transformed. The main factors that explain this transformation include the deleting of the regulatory measures of financial services, the effects of the globalising world and in particular the evolution of information technologies. It is now possible to offer alternative channels of distribution of services such as ATM and vending machines, credit cards and the mobile phone. The operators in the banking sector argue that the mobile bank would provide new opportunities for profits, cost reductions and a delivery of better services for customers. The objective of this paper is to analyse the determinants of the use of mobile banking in Burkina Faso. Taking into account the main variable of a qualitative nature, we used the logit model to perform the different estimates. Apart from the quality variables, gender, age, locality, it is that all the variables are significant to the thresholds of 1%, 5% and 10%.

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).