Corporate Sustainable Practices and Profitability – Compatible?

Abstract

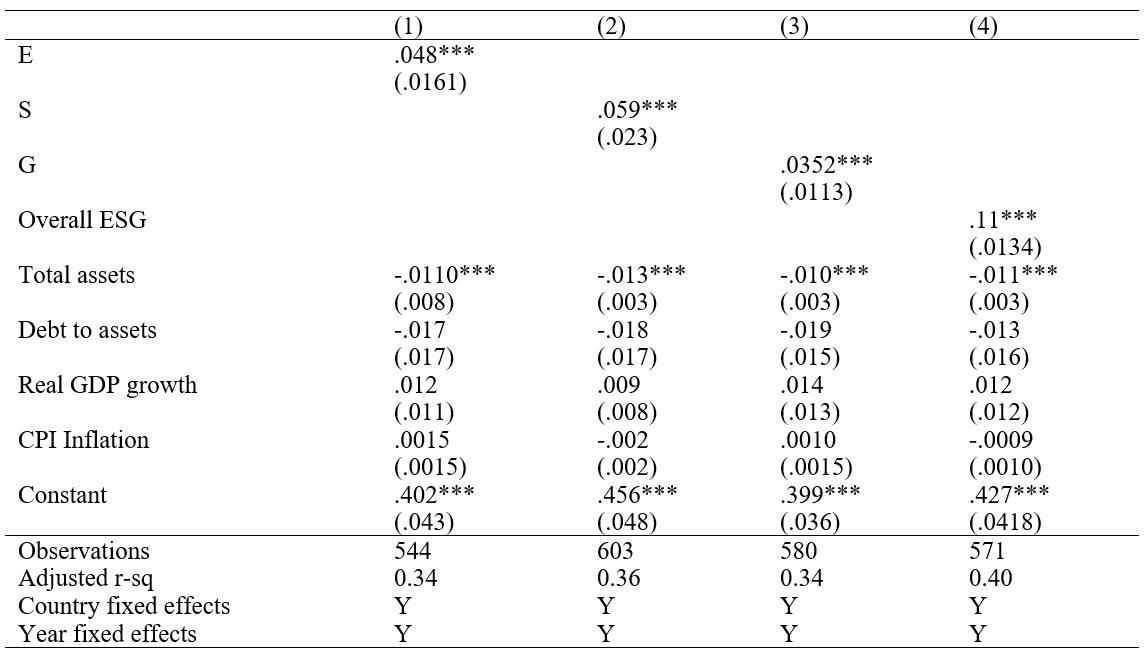

Carbon risks and corporate social responsibility have emerged as top priorities in the global climate change agenda, leading shareholders to exert greater pressure on corporations to adopt environmental, social and governance (ESG) practices and policymakers to consider regulatory actions on carbon disclosures. Proponents stress that ESG strategies will improve financial performance, while detractors focus on their large upfront costs. The literature is inconclusive in part because it has focused predominantly on the environmental pillar alone, or ESG as a combined strategy without clearly delineating how social and governance strategies also affect corporate profitability. Distinguishing between the three pillars of ESG, this paper finds that each of these strategies individually as well as jointly are positively associated with corporate profitability. The findings are robust to firm-level controls for size and access to capital markets, as well as macroeconomic variables, and unobserved country and year fixed effects that may reflect differences in tax jurisdictions and disclosure stringency.

References

Amel-Zadeh, A., & Serafeim, G. (2018). Why and how investors use ESG information: Evidence from a global survey. Financial Analysts Journal, 74(3), 87-103. https://doi.org/10.2469/faj.v74.n3.2

Atz, U., Holt, T., Liu, Z., & Bruno, C. (2022). Does Sustainability Generate Better Financial Performance? Review, Meta-analysis, and Propositions. Journal of Sustainable Finance and Investment. https://doi.org/10.2139/ssrn.3708495

Bertrand, M, Duflo, E., & Mullainathan, S. (2004). How much should we trust differences-in-differences estimates? The Quarterly Journal of Economics, 119(1), 249-275. https://doi.org/10.1162/003355304772839588

Bolton, P., & Kacperczyk, M. (2021). Do investors care about carbon risk? Journal of Financial Economics, 142, 517-549. https://doi.org/10.1016/j.jfineco.2021.05.008

Cameron, A. C., & Miller, D. (2015). A Practitioner’s Guide to Cluster-Robust Inference. https://doi.org/10.3368/jhr.50.2.317

Carbon Disclosure Project. (2021). Transparency to Transformation: A Chain Reaction, Global Supply Chain Report. Retrieved at: https://www.cdp.net/en/research/global-reports/transparency-to-transformation

Cornell, B., & Damodaran, A. (2020). Valuing ESG: Doing good or sounding good? https://doi.org/10.2139/ssrn.3557432

Das, M. (2022). Do Financial Markets Price Climate Change Risk? Risk and Financial Management, 4(1). https://doi.org/10.30560/rfm.v4n1p1

Delcoure, N. (2007). The determinants of capital structure in transitional economies. International Review of Economics and Finance, 16(3), 400-415. https://doi.org/10.1016/j.iref.2005.03.005

Hart, O., & Zingales, L. (2017). Companies should maximize shareholder welfare not market value. Journal of Law, Finance, and Accounting, 2(2), 247-274. https://doi.org/10.1561/108.00000022

Hsiao, C. (1986). Analysis of Panel Data. Cambridge University Press, United Kingdom.

Hull, C., & Rothenberg, S. (2008). Firm performance: the interactions of corporate social performance with innovation and industry differentiation. Strategic Management Journal, 29(7), 781-789. https://doi.org/10.1002/smj.675

Ilhan, E., Sautner, Z., & Vilkov, G. (2021). Carbon tail risk. The Review of Financial Studies, 34(3), 1540-1571. https://doi.org/10.1093/rfs/hhaa071

IPCC. (2018). Mitigation pathways compatible with 1.5c in the context of sustainable development. World Meteorological Organization, 1, 93-174.

Fama, E. F., & Jensen, M. C. (1983). Separation of ownership and control. Journal of Law and Economics, 26, 301-349. https://doi.org/10.1086/467037

Flugum, R., & M. Southern (2022). Stakeholder Value: A convenient excuse for underperforming Managers? SSRN Working Paper. https://doi.org/10.2139/ssrn.3725828

Gibson, R., Glossner, S., Krueger, P., Matos, P., & Steffen, T. (2020). Responsible institutional investing around the world. https://doi.org/10.2139/ssrn.3525530

Gibson, R., Krueger, P., & Mitali, S. F. (2020). The sustainability footprint of institutional investors: Esg driven price pressure and performance. https://doi.org/10.2139/ssrn.2918926

Gillingham, K., & Stock, J. H. (2018). The cost of reducing greenhouse gas emissions. Journal of Economic Perspectives, 32(4), 53-72. https://doi.org/10.1257/jep.32.4.53

Hart, O., & Zingales, L. (2017). Companies should maximize shareholder welfare not market value. Journal of Law, Finance, and Accounting, 2(2), 247-274. https://doi.org/10.1561/108.00000022

Hong, H., Wang, N., & Yang, J. (2021). Welfare consequences of sustainable finance, NBER Working Paper w28595. https://doi.org/10.2139/ssrn.3805189

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behaviour, agency costs and ownership structure. Journal of Financial Economics, 3, 305-360. https://doi.org/10.1016/0304-405X(76)90026-X

Krueger, P., Sautner, Z., & Starks, L. T. (2020). The importance of climate risks for institutional investors. The Review of Financial Studies, 33(3), 1067-1111. https://doi.org/10.1093/rfs/hhz137

Lyon, T. P., & Montgomery, A. W. (2015). The means and end of greenwash. Organization and Environment, 28(2), 223-249. https://doi.org/10.1177/1086026615575332

Matos, P. (2020). ESG and responsible institutional investing around the world: Literature review. CFA Institute Research Foundation. https://doi.org/10.2139/ssrn.3668998

Nordhaus, W. (2015). Climate clubs: Overcoming free-riding in international climate policy. American Economic Review, 105(4), 1339-1370. https://doi.org/10.1257/aer.15000001

OECD. (2021). ESG Investing Practices: Progress and Challenges. Retrieved from https://www.oecd.org/finance/ESG-Investing-Practices-Progress-Challenges.pdf

Prasetyantoko, A., & Parmono, R. (2009). Does firm size matter? An empirical study of firm performance in Indonesia. International Research Journal of Business Studies, 2(2), 87-97.

Rajan, R. G., & Zingales, L. (1995). What do we know about capital structure? Some evidence from international data. Journal of Finance, 50, 1421-1460. https://doi.org/10.1111/j.1540-6261.1995.tb05184.x

Seltzer, L., Starks, L., & Zhu, Q. (2020). Climate regulatory risks and corporate bonds. https://doi.org/10.2139/ssrn.3563271

Sovereign Wealth Fund Institute. (2020). ESG Grows in Internet Search. Retrieved from https://www.swfinstitute.org/news/85840/esg-grows-in-internet-search-starting-in-2019

Thomson Reuters Eikon. (2022). Refinitiv ESG Scores Methodology. Retrieved from https://www.refinitiv.com/content/dam/marketing/en_us/documents/methodology/refinitiv-esg-scores-methodology.pdf

UNFCCC. (2021). COP26 Reaches Consensus on Key Actions to Address Climate Change. Retrieved at: https://unfccc.int/news/cop26-reaches-consensus-on-key-actions-to-address-climate-change

Voulgaris, F., & Lemonakis, C. (2014). Competitiveness and profitability: The case of chemicals, pharmaceuticals and plastics. The Journal of Economic Asymmetries, 11, 46-57. https://doi.org/10.1016/j.jeca.2014.04.003

Yang, Z., Nguyen, T. T. H., Nguyen, H. N., Nguyen, T. T. N., & Cao, T. T. (2020). Greenwashing behaviours: causes, taxonomy and consequences based on a systematic literature review. Journal of Business Economics and Management, 21(5), 1486-1507. https://doi.org/10.3846/jbem.2020.13225

Yu, E. P. Y., Van Luu, B., & Chen, C. H. (2020). Greenwashing in environmental, social and governance disclosures. Research in International Business and Finance, 52, 101-192. https://doi.org/10.1016/j.ribaf.2020.101192

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).