Analysis on the Evolution Path and Influencing Factors of Financial Governance Mechanism of Manufacturing Enterprises Under the Background of Digital Transformation

Abstract

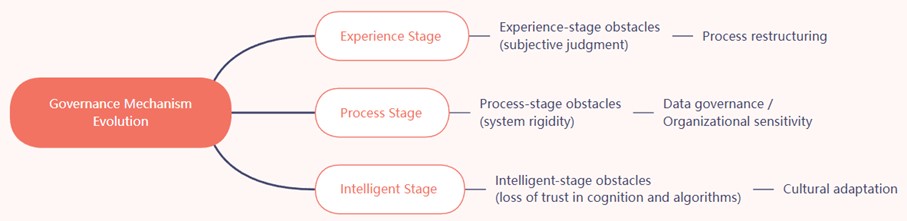

Amid the accelerating digital economy, financial governance in manufacturing enterprises is shifting from experience-driven to data-driven models. The traditional model has encountered structural bottlenecks in terms of collaborative efficiency and process consistency. This paper constructs a three-stage financial governance evolution framework, comprising the stages of experience, process, and intelligence and identifies three key influencing factors, including technology integration, data governance and organizational change. By introducing typical enterprise cases such as Huawei, Midea and Haier, this paper explores their practical approaches to process reconstruction, master data governance, and cognitive transformation, further discusses the systematic obstacles in the transformation process, and proposes an improvement path with process collaboration, data integration, cognitive reshaping and dynamic response as the core, aiming to provide theoretical support and practical reference for manufacturing enterprises to build a highly adaptable and intelligent financial governance system.

References

[2] Bhimani, A., & Willcocks, L. (2014). Digitisation, ‘Big Data’ and the transformation of accounting information. Accounting and Business Research, 44(4), 469–490. https://doi.org/10.1080/00014788.2014.910051

[3] Corporate governance mechanisms in light of the COVID‐19 crisis: How financial information and regulation, managerial decision‐making, and policy intervention can shape the economic recovery. (2020). Corporate Governance: An International Review, 28(5), 335–339. https://doi.org/10.1111/corg.12341

[4] Hussain, R. T., Akhtar, K., Ahmad, F., Salman, A., & Malik, S. (2023). Examining the intervening effect of earning management in governance mechanism and financial misstatement with lens of SDG and ESG: A study on non-financial firms of Pakistan. Environmental Science and Pollution Research, 31(34), 46325–46341. https://doi.org/10.1007/s11356-023-30128-0

[5] Zampella, A., Campanella, F., Serino, L., & Spignese, A. (2024). Do effective and sustainable corporate governance mechanisms affect the relevance of non-financial information? Corporate Social Responsibility and Environmental Management, 32(1), 741–756. https://doi.org/10.1002/csr.2989

[6] Shashikala, W. H., Niluka, A., & Roshan, A. (2024). Do selected board governance mechanisms strengthen the link between institutional and macroeconomic variables and the financial flexibility of corporations? Journal of Asia Business Studies, 18(2), 412–429. https://doi.org/10.1108/JABS-06-2023-0219

[7] Li, Y. L., & Yang, M. F. (2023). Research on enterprise big data governance mechanism based on financial sharing. Price Theory and Practice, (04), 104–108.

[8] Li, J. H. (2023). Exploring effective paths for optimizing enterprise financial governance structure. Finance & Economy, (29), 105–107.

[9] Luo, S. Y. (2023). Research on the path of enterprise financial digital transformation. China Management Informatization, 26(04), 95–97.

[10] Zhang, X. Q. (2024). Tightening the "safety valve" of enterprise group finance companies. China Accounting News, 2024-05-17(001).

[11] Wang, C. J. (2024). Research on the optimization of corporate governance mechanism under financial supervision management. Finance News, (23), 33–35.

[12] Li, B. X., Lin, B. H., & Zhang, T. (2025). The influence of managerial risk preference on corporate financial distress: Mediating path and governance mechanism. Journal of Systems Management, 34(01), 241–256.

[13] Teece, D. J., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 18(7), 509–533. https://doi.org/10.1002/(SICI)1097-0266(199708)18:7<509::AID-SMJ882>3.0.CO;2-Z

[14] Nelson, R. R., & Winter, S. G. (1982). An evolutionary theory of economic change. Cambridge, MA: Harvard University Press.

[15] Donaldson, L. (2001). The contingency theory of organizations. Thousand Oaks, CA: Sage Publications. https://doi.org/10.4135/9781452229249

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).