The Role of Big Data Finance in Supporting and Supervising Corporate Financial Decision-Making

Abstract

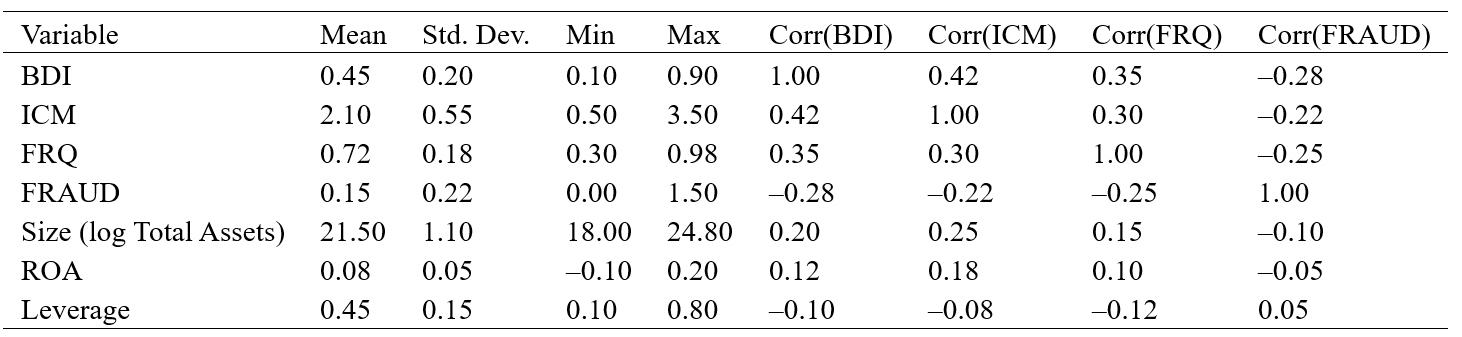

With the rapid adoption of big data technologies in finance, opportunities have emerged to enhance the transparency and compliance of corporate financial decision-making. This paper first reviews the concept and evolution of big data finance, then constructs a “supportive supervision–decision optimization–risk prevention” theoretical framework. Using panel data from representative listed firms, we select key variables and employ multivariate regression and robustness checks to empirically assess the supervisory effects of big data finance in the decision-making process. Our findings show that big data finance significantly strengthens firms’ real-time internal control monitoring capabilities, improves the accuracy of financial budgeting and forecasting, and enhances the quality of financial reporting. Moreover, its supervisory function has a pronounced positive impact on reducing financial fraud risk and boosting corporate performance. Finally, we offer management recommendations—such as improving big data platform infrastructure, reinforcing data governance and privacy protection, and fostering coordinated mechanisms between regulators and market participants—to provide practical guidance for more scientific financial decision-making and a more effective regulatory system.

References

[2] Hu, K.-H., Chen, F.-H., Hsu, M.-F., & Tzeng, G.-H. (2021). Identifying the key factors of subsidiary supervision and management using an innovative hybrid architecture in a big data environment. Financial Innovation, 7(1), 10. https://doi.org/10.1186/s40854-021-00234-2

[3] Adewale, T. T., Olorunyomi, T. D., & Odonkor, T. N. (2023). Big data-driven financial analysis: A new paradigm for strategic insights and decision-making. Journal of Financial Innovation and Analytics, 1(1), 1–15.

[4] Song, H., Li, M., & Yu, K. (2021). Big data analytics in digital platforms: How do financial service providers customise supply chain finance? International Journal of Operations & Production Management, 41(4), 410–435. https://doi.org/10.1108/IJOPM-08-2020-0530

[5] Nguyen, D. K., Sermpinis, G., & Stasinakis, C. (2023). Big data, artificial intelligence and machine learning: A transformative symbiosis in favour of financial technology. European Financial Management, 29(2), 517–548. https://doi.org/10.1111/eufm.12365

[6] Chen, X., & Metawa, N. (2020). Enterprise financial management information system based on cloud computing in big data environment. Journal of Intelligent & Fuzzy Systems, 39(4), 5223–5232. https://doi.org/10.3233/JIFS-189081

[7] Bisht, D., Singh, R., Gehlot, A., Akram, S. V., Singh, A., & Alshamrani, S. S. (2022). Imperative role of integrating digitalization in the firms finance: A technological perspective. Electronics, 11(19), 3252. https://doi.org/10.3390/electronics11193252

[8] Wang, F., Xu, L., He, Y., & Zhang, Y. (2020). Big data analytics on enterprise credit risk evaluation of e-Business platform. Information Systems and e-Business Management, 18(3), 311–350. https://doi.org/10.1007/s10257-020-00474-2

[9] Niu, Y., Ying, L., Yang, J., Bao, M., & Sivaparthipan, C. B. (2021). Organizational business intelligence and decision making using big data analytics. Information Processing & Management, 58(6), 102725. https://doi.org/10.1016/j.ipm.2021.102725

[10] Yang, J., Li, Y., Liu, Q., Li, L., & Wu, A. (2022). Big data, big challenges: Risk management of financial market in the digital economy. Journal of Enterprise Information Management, 35(4/5), 1288–1304. https://doi.org/10.1108/JEIM-01-2021-0031

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).