Enterprises Exploration from Governance to Prosperity: A Glimpse of Hong Kong's Entrepreneurial and Investment Environment

Abstract

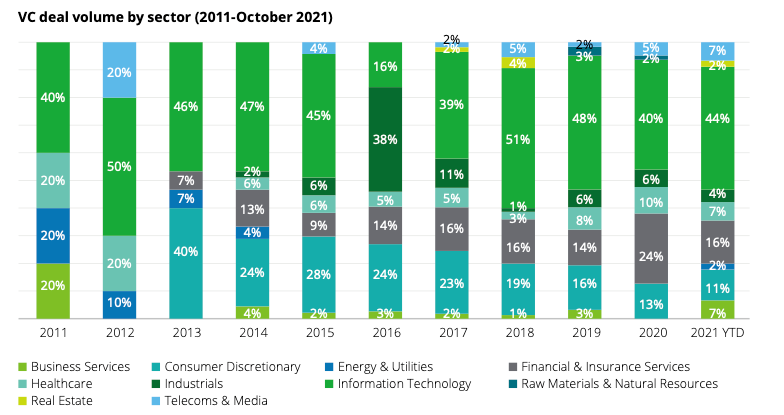

This paper provides a comprehensive analysis of Hong Kong's evolving entrepreneurial and investment landscape, charting its strategic pivot from a traditional, finance-centric economy towards an innovation and technology (I&T) hub. It examines the local venture capital (VC) environment, startup ecosystem dynamics, the structural composition of its listed companies, and the impact of recent transformative government policies, primarily focusing on the period from 2015 to 2022. The study reveals a critical dichotomy: while Hong Kong's VC industry is nascent compared to regional counterparts like Shenzhen, it demonstrates significant growth in both investment scale and its contribution to the regional GDP. However, this growth is heavily concentrated in fintech and service-oriented sectors, exposing a systemic underinvestment in deep-tech domains such as biotechnology, new materials, and advanced manufacturing. An analysis of Initial Public Offerings (IPOs) reinforces this observation, showing a market historically dominated by traditional industries, although a nascent and crucial shift towards new economy companies is emerging. The paper argues that a fundamental structural challenge persists in the form of a mid-stage funding gap (Series A/B), which stifles the growth of promising startups. We conclude that recent government initiatives, including the establishment of the Hong Kong Investment Management Co., Ltd. and substantial R&D support schemes, are vital catalysts for fostering a more diversified and resilient innovation ecosystem. However, sustained success will hinge on bridging the mid-stage financing chasm, cultivating a more risk-tolerant investment culture, and strategically aligning policy with the goal of building a globally competitive deep-tech sector.

References

[2] Chen, G., & Li, W. (2020). Venture capital and high-tech entrepreneurship in the Greater Bay Area: A comparative study of Hong Kong and Shenzhen. Journal of Asian Economics, 68, 101198. https://doi.org/10.1016/j.asieco.2020.101198

[3] Zhang, Y. (2019). Fintech development and regulation in Hong Kong [Doctoral dissertation, The Chinese University of Hong Kong]. The Chinese University of Hong Kong.

[4] InvestHK. (2022). 2022 startup survey. Hong Kong Special Administrative Region Government.

[5] Wright, M., & Stigliani, I. (2018). Entrepreneurial ecosystems and the role of government policy. Small Business Economics, 51(2), 291–306. https://doi.org/10.1007/s11187-017-9955-5

[6] HKSAR Government. (2022). The Chief Executive's 2022 policy address. https://www.policyaddress.gov.hk/2022/en/

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).