Research on Corporate Financial Strategy Transformation and Risk Management under the Reconstruction of Global Value Chain

Abstract

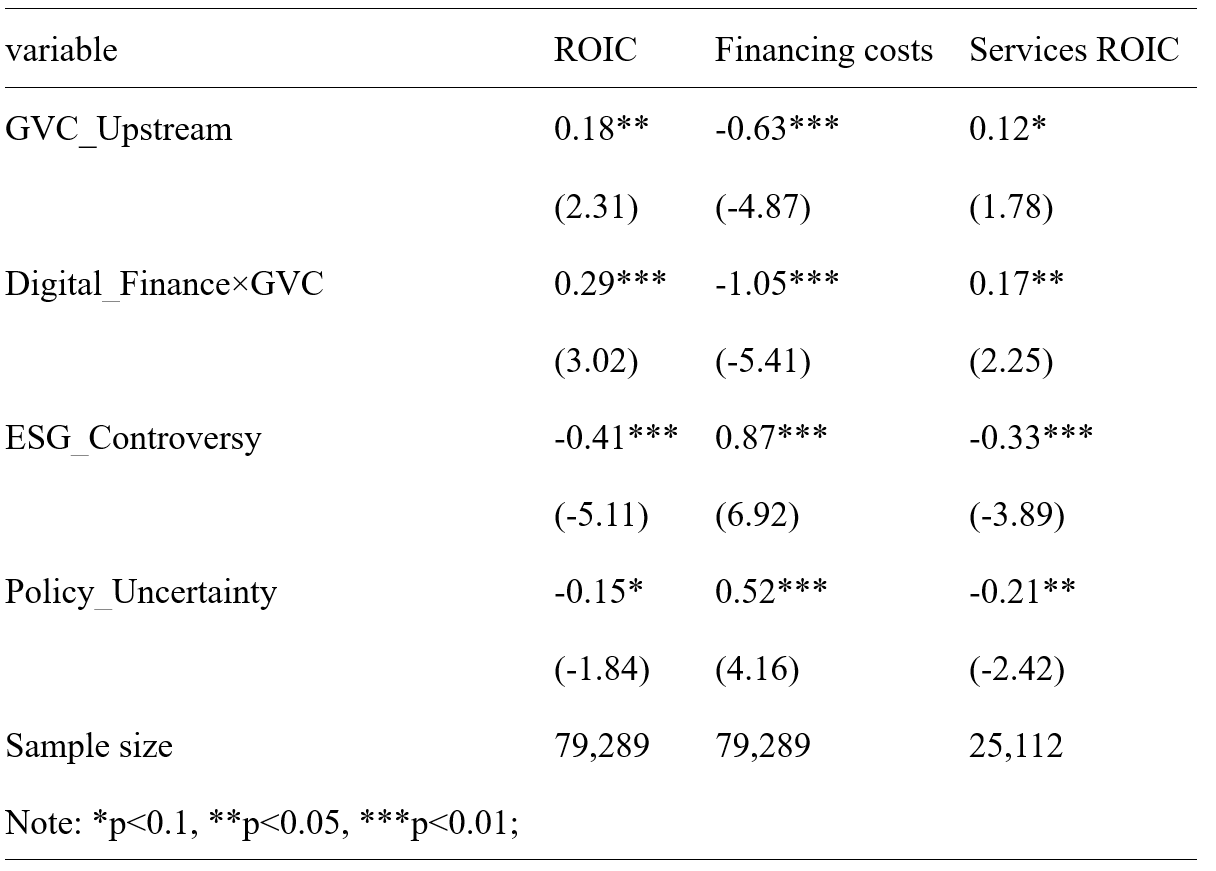

In the context of the accelerated restructuring of the global value chain (GVC), enterprises are facing the triple impact of geographical reallocation, technology chain disconnection, and carbon tariff. Based on the panel data of 52 enterprises from 2013 to 2022, this paper constructs a theoretical model of "Value Chain Potential-Financial Strategy-Risk Immunity" (GVC-FSM), and uses the simultaneous equation model (3SLS) and machine learning causal forest method to conduct an empirical test. The results show that every 0.1 unit increase in the upstream degree of value chain upgrading can reduce the financing cost by 1.8%;The probability of cash flow disruption in digital financial transformation enterprises decreased by 34% during the epidemic; ESG risk premiums in carbon-intensive industries amounted to a 12.7% difference in the cost of capital. Accordingly, a three-dimensional financial strategic framework of "strategic resilience-digital twin-ecological governance" is proposed to provide a systematic solution for enterprises to reconstruct their financial competitiveness in a multipolar world.

References

[2] Brigham, E. F., & Ehrhardt, M. C. (2020). Financial management: Theory and practice (16th ed.). Cengage Learning.

[3] Kaplan, R. S. (2021). Risk management and the strategy execution system (Working Paper No. 21-121). Harvard Business School.

[4] Teece, D. J. (2020). Hand in glove: Open innovation and the dynamic capabilities framework. Strategic Management Review, 1(1), 233–253. https://doi.org/10.1561/111.00000004

[5] Baldwin, R. (2010). Trade and industrialisation after globalisation’s 2nd unbundling (NBER Working Paper No. 17716). National Bureau of Economic Research. https://doi.org/10.3386/w17716

[6] Antràs, P., & Chor, D. (2013). Organizing the global value chain. Econometrica, 81(6), 2127–2204. https://doi.org/10.3982/ECTA10513

[7] Sanchez, R. (1995). Strategic flexibility in product competition. Strategic Management Journal, 16(S1), 135–159. https://doi.org/10.1002/smj.4250160906

[8] Simchi-Levi, D. (2015). Operations rules: Delivering customer value through flexible operations. MIT Press.

[9] Ross, S. A., Westerfield, R. W., & Jordan, B. D. (2013). Fundamentals of corporate finance (11th ed.). McGraw-Hill.

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).