The Impact of Digital Financial Literacy on Older Households' Pension Financial Asset Allocation—Evidence from China

Abstract

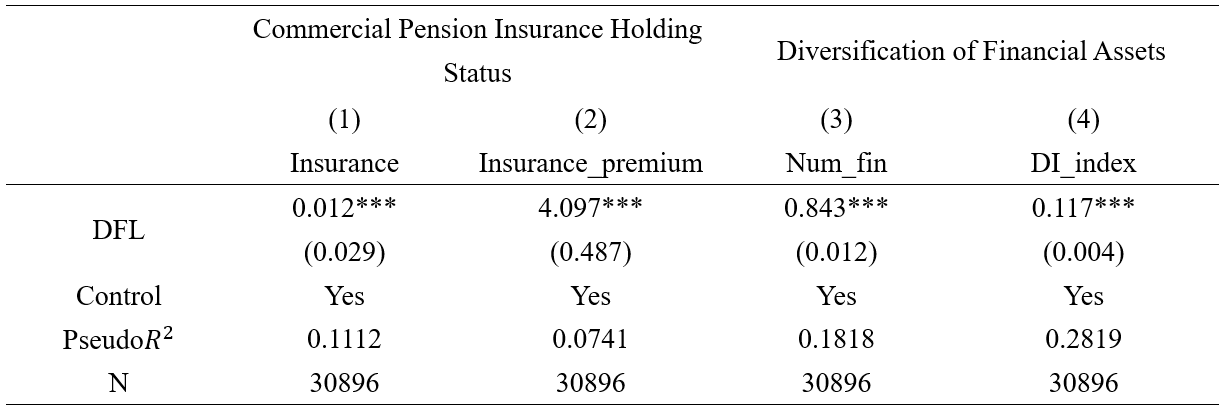

With the population aging, the importance of pension finance has become increasingly prominent. However, Chinese elderly households' participation in the pension finance market is relatively low, with a single asset allocation structure. Based on data from the China Household Finance Survey, this paper examines the impact of digital financial literacy on the allocation of Pension financial assets of elderly households. The study found that increased digital financial literacy significantly promotes older households' participation in the pension finance market, allocation of commercial pension insurance, and a more diversified portfolio of financial assets. In addition, digital financial literacy influences older households' pension financial asset allocation behavior by increasing their financial accessibility and enhancing social interactions. The study also found that digital financial literacy contributes more strongly to allocating financial assets for retirement in older urban households.

References

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263–291. https://doi.org/10.2307/1914185

Li, D., Ding, J., & Ma, S. (2019). The impact of social interaction on household participation in commercial insurance—An empirical analysis based on data from the China Household Finance Survey. Journal of Financial Research, (7), 96–114.

Liang, L., & Ju, Z. (2025). Digital finance and retirement planning: The role of information cost reduction and trust enhancement channels. Economic Modelling, 144, Article 106989. https://doi.org/10.1016/j.econmod.2024.106989

Lu, J., & Wei, X. (2021). Analytical framework, concepts, and pathways for addressing the digital divide among the elderly—From the perspectives of digital divide and knowledge gap theories. Population Research, 45(3), 17–30.

Lu, T., & Tang, N. (2019). Social interactions in asset allocation decisions: Evidence from 401(k) pension plan investors. Journal of Economic Behavior & Organization, 159, 1–14. https://doi.org/10.1016/j.jebo.2019.01.009

Markowitz, H. M. (1952). Portfolio selection. The Journal of Finance, 7(1), 77–91. https://doi.org/10.2307/2975974

Morgan, P. J., Huang, B., & Trinh, L. Q. (2019). The need to promote digital financial literacy for the digital age. In Realizing education for all in the digital age (T20 Report, pp. 40–46).

Prasad, H., & Meghwal, D. (2018). Digital financial literacy: A study of households of Udaipur. Global Journal of Advanced Research, 4(5), 201–209.

Setiawan, M., Effendi, N., Santoso, T., Dewi, V. I., & Sapulette, M. S. (2022). Digital financial literacy, current behavior of saving and spending, and its future foresight. Economics of Innovation and New Technology, 31(4), 320–338. https://doi.org/10.1080/10438599.2020.1792596

Tony, N., Desai, et al. (2020). Impact of digital financial literacy on digital financial inclusion. International Journal of Scientific and Technology Research, 9(1), 1911–1915.

van Rooij, M. C. J., Lusardi, A., & Alessie, R. J. M. (2012). Financial literacy, retirement planning and household wealth. The Economic Journal, 122(560), 449–478. https://doi.org/10.1111/j.1468-0297.2012.02501.x

Wu, X., & Liu, B. (2024). Does social interaction influence the allocation of pension financial assets among residents?—From the perspectives of the socio-interactive economic decision-making model and the I-C-I model. Wuhan Finance, (12), 65–72+88.

Wu, Y., & Zhang, M. (2024). Financial literacy, risk attitude, and individual pension participation behavior. Journal of Northwest University (Philosophy and Social Sciences Edition), 54(3), 148–159.

Yang, J., Shi, J., & Xu, L. (2025). Effect of digital finance on household financial asset allocation: A social psychology perspective. The North American Journal of Economics and Finance, 78, Article 102427. https://doi.org/10.1016/j.najef.2024.102427

Yi, X., Lai, K., Li, J., et al. (2025). Pension insurance policy reform and financial vulnerability of elderly households: Empirical evidence based on CHFS. Finance Theory and Practice, 46(1), 27–35.

Yin, Z., & Zhang, H. (2018). Financial accessibility, internet finance, and household credit constraints—An empirical study based on CHFS data. Journal of Financial Research, (11), 188–206.

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).