Research on the Introduction of Digital Tax in China Based on Tax Competition

Abstract

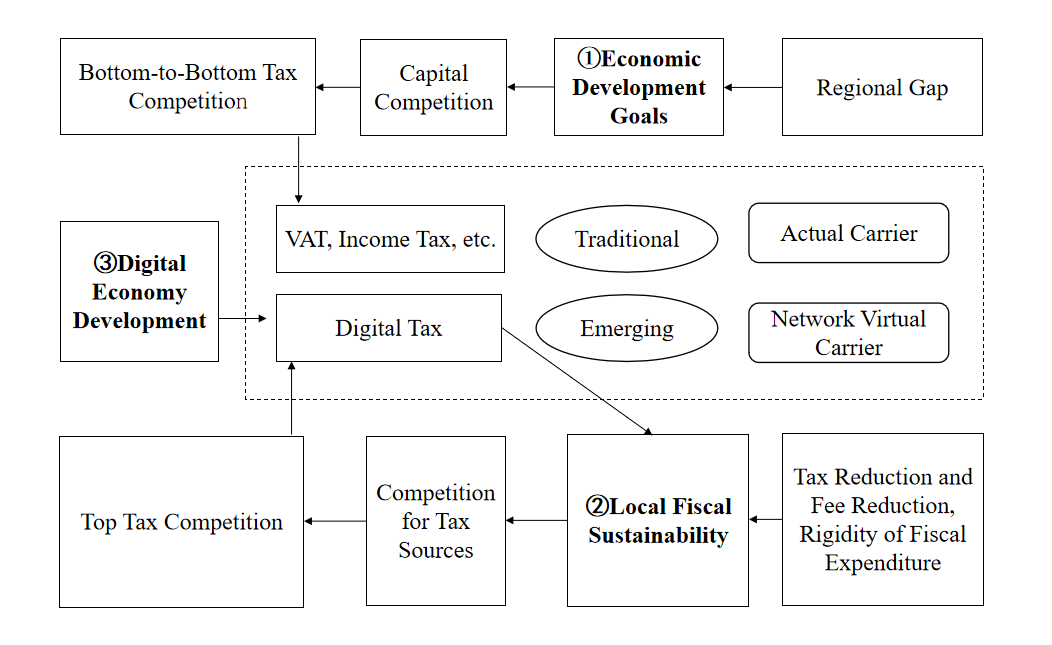

Distinguishing international tax competition from horizontal tax competition among domestic local governments, and analyzing economic development, local fiscal sustainability and digital economic industry development respectively. It is found that domestic local economic development and horizontal tax competition are conducted through top-by-top tax competition and bottom-by-bottom tax competition. Point to digital tax. Then, we discussed the necessity of levying digital tax in China from domestic and international perspectives, and judged the feasibility of levying digital tax and the setting of collection entities from the perspective of the government and the market. We believed that there was no strong need for levying digital tax for international entities for the time being, and it was necessary and initially feasible for domestic entities to levy digital tax, but long-term planning was needed. At the same time, it emphasizes the importance of the construction of supporting systems such as policy publicity, technology development, business environment, and international voice.

References

[2] Liu, Z. X., & Zhong, H. (2023). Fiscal decentralization, vertical fiscal imbalance and horizontal tax competition among local governments. Statistics and Decision, (19), 147–152.

[3] Wilson, J. D. (1986). A theory of interregional tax competition. Journal of Urban Economics, 19(3), 296–315. https://doi.org/10.1016/0094-1190(86)90045-7

[4] Liu, J. D., Xu, W. J., & Wang, J. H. (2023). Tax race to the top and tax stickiness: A perspective based on multi-dimensional performance evaluation. Journal of Shanghai University of Finance and Economics, 25(5), 32–45.

[5] Zodrow, G. R., & Mieszkowski, P. (1986). Pigou, Tiebout, property taxation, and the underprovision of local public goods. Journal of Urban Economics, 19(3), 356–370. https://doi.org/10.1016/0094-1190(86)90048-2

[6] Lejour, A. M., & Verbon, H. A. (1997). Tax competition and redistribution in a two-country endogenous-growth model. International Tax and Public Finance, 4(4), 485–497. https://doi.org/10.1023/A:1008622414948

[7] Gong, F., Tao, P., & Pan, X. Y. (2021). The impact of urban agglomerations on local tax competition: Evidence from a two-regime panel spatial Durbin model. Public Finance Research, (4), 17–33.

[8] Cheng, F. Y. (2021). Spatial spillover effects of local tax competition and regional economic growth in China's eight major urban agglomerations. Finance and Economy, (8), 46–53.

[9] Li, C. Q., & Peng, X. (2021). The effect and path analysis of tax competition on export product quality. Science Research Management, 42(9), 34–43.

[10] Fang, L. M., & Meng, T. G. (2023). Beyond state capacity: A political-economic analysis of international digital tax practices. Journal of Sichuan University (Philosophy and Social Science Edition), (5), 32–42, 191.

[11] Zhang, X. Q., & Zhao, X. Y. (2021). The development process, characteristics and trends of global digital tax and China's position. Globalization, (6), 44–56, 135.

[12] Tian, G. J., & Dan, S. X. (2020). The impact of digital tax on China's internet enterprises and countermeasures. Enterprise Management, (5), 121–123.

[13] Zhang, S. H., & Hu, Y. M. (2023). Should China postpone the implementation of digital service tax? Fujian Tribune (The Humanities & Social Sciences Monthly), (6), 100–111.

[14] Wang, Y. Z., & Gao, L. (2022). The motivation, dilemma and prospects of EU's promotion of digital service tax: With implications for China's digital tax governance from the perspective of EU's fiscal decentralization dilemma. German Studies, 37(6), 69–82, 122–123.

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).