Study on the Influence Mechanism of Digital Intellectualization on Accrual Surplus Management in Enterprises with Different Ownership Properties

Abstract

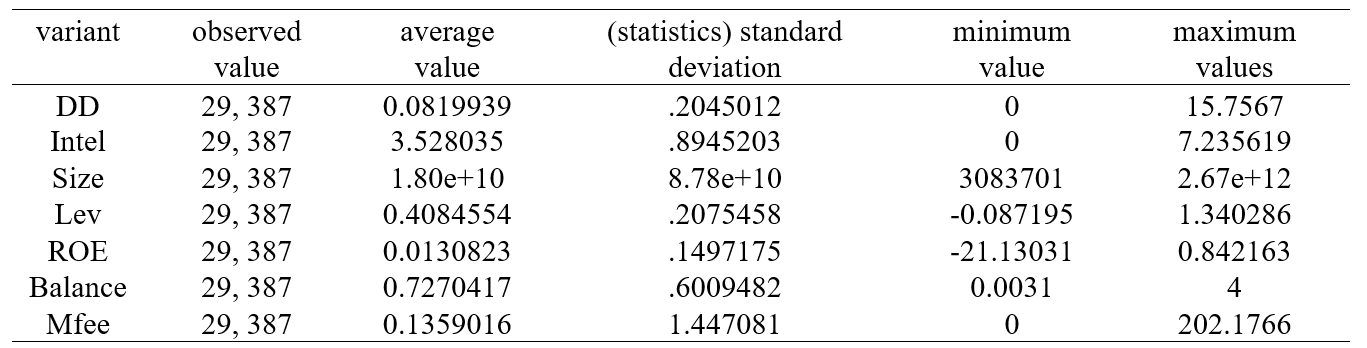

For a long time, information asymmetry has become a deep-rooted problem in modern enterprise management. It not only distorts market behavior, but also harms the value of the enterprise itself. With the rapid development of digital technology, enterprises have unprecedented opportunities to change financial information processing and disclosure, and digital technology such as big data and artificial intelligence is expected to alleviate the information asymmetry problem. In this study, we focus on the impact of digital intelligence on accruals management in firms with different ownership properties, and conduct an empirical analysis using panel data of Chinese A-share listed firms from 2012 to 2022. It is found that, firstly, Numerical Intelligence significantly inhibits firms' surplus management; secondly, with the addition of the moderating variable of property rights nature, Numerical Intelligence has a more significant inhibitory effect on firms' incentives to manage surplus; thirdly, heterogeneity analyses conclude that Numerical Intelligence's inhibitory effect on firms' surplus management is more pronounced in non-state-owned firms. Based on this, this study suggests that in order to further alleviate the problem of corporate information asymmetry, it is necessary to further deepen the level of enterprise's own Numerical Intelligence, improve the supervision of Numerical Intelligence, construct differentiated regulatory policies, and safeguard the rights and interests of the relevant stakeholders of the enterprise, so as to further optimize the synergistic development of corporate governance.

References

[2] Wang, X., & Liu, X. (2021). Impact of financial technology on financing constraints of small and medium-sized enterprises. Statistics and Decision Making, 37(13), 151–154.

[3] Fang, H. S., & Jin, Y. N. (2011). Can high-quality internal control inhibit surplus management? An empirical study based on voluntary internal control assurance reports. Accounting Research, (8), 53–60, 96.

[4] Su, D., & Lin, D. (2010). Equity incentives, surplus management and corporate governance. Economic Research, 45(11), 88–100.

[5] Yang, Z., & Wang, H. (2014). Intra-firm pay gap, equity concentration and surplus management behavior: A comparative analysis based on compensation within the executive team and between executives and employees. Accounting Research, (6), 57–65, 97.

[6] Liu, X., & Zhao, Y. (2024). VAT rate reduction, tax cost trade-off and corporate surplus management strategy. Economic Research, 59(8), 77–94.

[7] Ye, K., & Liu, X. (2011). Tax administration, income tax cost and surplus management. Management World, (5), 140–148. https://doi.org/10.19744/j.cnki.11-1235/f.2011.05.012

[8] Yu, Z., Ye, Q., & Tian, G. (2011). External supervision and surplus management: An examination of media attention, institutional investors and analysts. Journal of Shanxi University of Finance and Economics, 33(9), 90–99. https://doi.org/10.13781/j.cnki.1007-9556.2011.09.006

[9] Liu, Z. (2021). Main functions, risk characteristics and standardized regulation of financial technology. Southern Finance, (10), 63–71.

[10] Luo, J., & Wu, Y. (2021). Digital operation level and real surplus management. Management Science, (4), 318.

[11] Jiang, Y., & Chen, N. (n.d.). Research on the impact of corporate numerical intelligence level on surplus management. In Proceedings of the Academic Conference on "Low-altitude Economic Development and Audit Research" (pp. n/a). CPA Education Center, Xijing College; School of Accounting, Xijing College.

[12] Scott, W. R. (2015). Financial accounting theory (7th ed.). Pearson.

[13] Dechow, P. M., Sloan, R. G., & Sweeney, A. P. (1995). Detecting earnings management. The Accounting Review, 70(2), 193–225.

[14] Dechow, P. M., & Dichev, I. D. (2002). The quality of accruals and earnings: The role of accrual estimation errors. The Accounting Review, 77(s-1), 35–59.

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).