The Risk Spillover Effect of China's Financial Market and Real Economy——Based on Network Correlation Analysis

Abstract

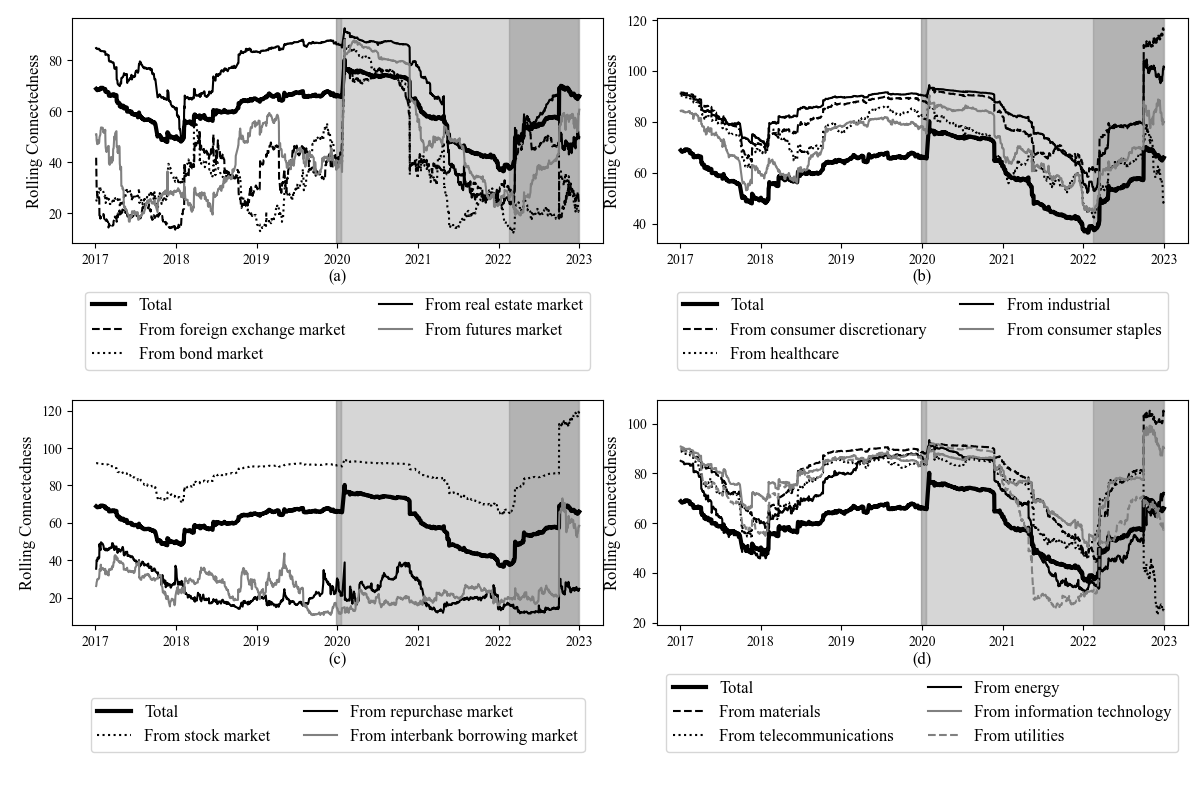

Financial security is crucial for the development of the Chinese economy owing to the complex interconnections between the financial market and the real economy. This study employs the generalized variance decomposition method to construct a two-way risk spillover model between China’s financial market and the real economy. It investigates the two-way risk spillover trans- 4 mission and risk hedging in different markets when facing external shocks over the past four years. Firstly, following external shocks, both the overall market’s total risk spillover and individual markets’ risk spillover exhibit different characteristics and effects across various periods. Secondly, convertible bonds in the bond market, along with the securities lending, margin trading and short selling in the stock market, are identified as key channels for cross-market financial transmission. This study underscores the importance of coordinated economic growth and financial risk management, thereby enhancing our understanding of the relationship between China’s financial markets and the real economy.

References

Adekoya, O. B., & Oliyide, J. A. (2021). How COVID-19 drives connectedness among commodity and financial markets: Evidence from TVP-VAR and causality-in-quantiles techniques. Resources Policy, 70, Article 101898. https://doi.org/10.1016/j.resourpol.2020.101898

Bai, L., Zhang, X., Liu, Y., & Wang, Q. (2019). Economic risk contagion among major economies: New evidence from EPU spillover analysis in time and frequency domains. Physica A: Statistical Mechanics and its Applications, 535, Article 122431. https://doi.org/10.1016/j.physa.2019.122431

Bai, X., & Wang, X. L. (2024). Two-way risk spillovers between China’s financial market and the real economy – Based on the perspective of exogenous event shocks. Journal of Jilin College of Commerce and Industry, 40(1), 94–103. https://kns.cnki.net/kcms2/article/abstract?v=5MjHqO3BiXURYMXRcCK1pCCWI1gBg8TJhe5Z0t6bPqd3eArdnH8ucDjaBv4D__WZOeLBTKW-ecwgJXJHZq5B5vyXkFv900KZNSsS7jMEecSngZHzwxn8Efckc1FbHyVc_EE3gw5IiBJYhxaiHVxb9L0qrT0-1V2ROgoRi8rDSOlXxsjeCSaXF7FHLLihjBmx-UPrEq36ENE=&uniplatform=NZKPT&language=CHS

Billio, M., Getmansky, M., Lo, A. W., & Pelizzon, L. (2012). Econometric measures of connectedness and systemic risk in the finance and insurance sectors. Journal of Financial Economics, 104(3), 535–559. https://doi.org/10.1016/j.jfineco.2011.12.010

Bosca, J. E., Domenech, R., Ferri, J., et al. (2021). The stabilizing effects of economic policies in Spain in times of COVID-19. Applied Economic Analysis, 29(85), 4–20. https://doi.org/10.1108/AEA-11-2020-0165

Chakrabarty, K. C. (2012). Systemic risk assessment – The cornerstone for the pursuit of financial stability. In Inaugural at the International Seminar on Operationalizing Tools for Macro Financial Surveillance: Country Experiences. Reserve Bank of India, Financial Stability Unit. https://rbidocs.rbi.org.in/rdocs/Bulletin/PDFs/01SPC090512.pdf

Chao, L., Junhui, X., & Wenwen, Z. (2017). Study on risk spillover effect of financial markets in China based on methods of spillover index and complex network. Systems Engineering - Theory & Practice, 37(12), 12–23. https://kns.cnki.net/kcms2/article/abstract?v=RyaFSLOYMk4Fz_VGG1fvYe9OTDsD4DtEqY-pZSHUuYz8WAwP0lYV6jIztjxW0Nuud1J3_Kt3ei6ORfIvrq2gH5F-bXXq8BL1kwWZ40SsY8Ef0QbICC_eg5FbpSM_Ic1dJRfZzfl2nAie2RAjwiu-CA==&uniplatform=NZKPT&language=CHS

Cheng, Y., Liu, J., Liu, J., & Sriboonchitta, S. (2021). Risk spillovers between China and other BRICS countries during COVID-19 pandemic: A CoVaR-copula approach. IOP Conference Series: Earth and Environmental Science, 1978(1), Article 012043. https://doi.org/10.1088/1742-6596/1978/1/012043

China Securities Regulatory Commission. (2015). Notice of the CSRC on measures for the administration of financing and short selling business of securities companies. http://w.csrc.gov.cn/csrc/c106256/c1653885/content.shtml

China Securities Regulatory Commission. (2020). Provisional measures for the supervision and administration of margin trading and securities lending business. http://www.csrc.gov.cn/csrc/c106256/c1653885/content.shtml

China Securities Regulatory Commission. (2024). China Securities Regulatory Commission approved the suspension of short selling business in accordance with the law to further strengthen the counter-cyclical adjustment of short selling. http://www.csrc.gov.cn/csrc/c100028/c7493852/content.shtml

Chiu, W. C., Peña, J. I., & Wang, C. W. (2015). Industry characteristics and financial risk contagion. Journal of Banking & Finance, 50, 411–427. https://doi.org/10.1016/j.jbankfin.2014.04.003

Deng, C., & Xie, J. (2020). The correlation dynamics and spillover effects among financial submarket cycle fluctuation in China. Journal of Central South University (Social Sciences), 26(2), 100–110. https://kns.cnki.net/kcms2/article/abstract?v=KqXyGY4RJv0yqk8pxXzOcLJcI9tnD1ww-DzR9fb5R230I0iLhWX8fUfft6SuCZh52chClvr1wzO0WoQsaJFxRpkR7GWqwzPlPHaFov0b_mc4NV-xBTMMgIkw-jAXLPzG5XaCnT2lXSxgJ7yYT3jIQQ0oRw1fPHZK&uniplatform=NZKPT

Diebold, F. X., & Yılmaz, K. (2014). On the network topology of variance decompositions: Measuring the connectedness of financial firms. Journal of Econometrics, 182(1), 119–134. https://doi.org/10.1016/j.jeconom.2014.04.012

Fang, Y., & Shao, Z. Q. (2022). Measurement of imported financial risk under major shocks. Economic Science, 44(2), 13–30. https://kns.cnki.net/kcms2/article/abstract?v=RyaFSLOYMk6rzLL3ltGL1I7C9g6-24RYN1FE-rmrAR40Yv_-ca1NG-Kn7-YlmBEIMvHIAwHM-sLX05aZM2I8VFlunV5FBcQofwWw27PPiCAylXfg89N0qt7s-dSaFNBdrAK3dMGLm0KPuWS94GlcCiw==&uniplatform=NZKPT&language=CHS

Fang, Y., & Wang, Y. R. (2023). Systemic financial risk: Theoretical mechanism, early warning system and dual-pillar policy framework. Journal of Guizhou University (Social Sciences Edition), 41(4), 92–99. https://doi.org/10.15958/j.cnki.gdxbshb.2023.04.11

Fang, Y., He, W. J., & Jin, Z. B. (2021). A study of risk spillovers between China’s real economy and financial markets. Journal of World Economy, 44, 3–27. https://doi.org/10.19985/j.cnki.cassjwe.2021.08.002

Fink, F., & Schuler, Y. S. (2015). The transmission of US systemic financial stress: Evidence for emerging market economies. Journal of International Money and Finance, 55, 6–26. https://doi.org/10.1016/j.jimonfin.2015.02.019

Gao, Y., Li, Y., & Wang, Y. (2021). Risk spillover and network connectedness analysis of China’s green bond and financial markets: Evidence from financial events of 2015–2020. North American Journal of Economics and Finance, 57, Article 101386. https://doi.org/10.1016/j.najef.2021.101386

Guo, H. B., & Du, J. M. (2014). Construction of China’s financial stability conditions index. Journal of Quantitative & Technical Economics, 5, 100–116, 161. https://doi.org/10.13653/j.cnki.jqte.2014.05.007

Härdle, W. K., Wang, W., & Yu, L. (2016). TENET: Tail-event driven network risk. Journal of Econometrics, 192(2), 499–513. https://doi.org/10.1016/j.jeconom.2016.02.013

Hautsch, N., Schaumburg, J., & Schienle, M. (2015). Financial network systemic risk contributions. Review of Finance, 19(2), 685–738. https://doi.org/10.1093/rof/rfu010

He, G. (2022). The impact of stages of strikes by outbreak of large-scale epidemic on Chinese economy. North China University of Technology Journal, 29, 29–36. https://doi.org/10.26926/d.cnki.gbfgu.2022.000120

Hu, C. Y. (2021). Two-way spillover effect of extreme risk between financial institutions and real industry in China: Based on the analysis of network association [Master’s thesis, Tianjin University of Finance and Economics]. https://kns.cnki.net/kcms2/article/abstract?v=FruxrO_GJXK8IUf3Q_P9f7zgRI_OLchqFlAQstpQNOxNRK7--TtXiIAZ01wUduggOI-IgH2wVMSoEDq67SECAjQ-jbLGEXT19_kaEX8zP5XXMFmxW91p4rf27t5FQuWpaX-9LZBsDgo2wUWN3YSEK7A==&uniplatform=NZKPT&language=CHS https://doi.org/10.27354/d.cnki.gtcjy.2021.000893

Hu, C. Y., & Ma, Y. M. (2024). The continuous impact of major events on the level of economic and financial risk spillover. Finance & Trade Economics, 1, 1–17. https://doi.org/10.19795/j.cnki.cn11-1166/f.20240712.007

Hu, C. Y., Ma, Y. M., & Ma, J. Y. (2023). Two-way tail risk spillovers between financial markets and real economy under major event shocks. Research in Financial Economics, 38(6), 3–19. https://kns.cnki.net/kcms2/article/abstract?v=5MjHqO3BiXXoAd1ed-SWFuRE1zajBfcFbp1pHpHh3FgFq92AisHjnjyrmfUc2zFZ6tNvLpUSny-ApIVl234vAmUZ4yT1gu-PDLUkCHhw9xyU4w9DkpZMxEBrLHgnwfLHHL6rruZqakn9Kk_MV7njRhhqLVzroiEKmQhIL46fl8bGUFqF7hlxhJxY4dy9KRtKWa85vxS2mG4=&uniplatform=NZKPT&language=CHS

Hu, C., & Ma, Y. (2022). The effect of strong financial supervision on extreme risk bidirectional spillover between financial institutions and real economy. Studies of International Finance, 9, 56–66. https://doi.org/10.16475/j.cnki.1006-1029.2022.09.007

Jiang, H., Ji, J. F., & Tang, S. F. (2021). Tail risk spillover network and systemic financial risk – A multi-angle empirical study based on TENET method. Financial Regulation Research, 11, 18–36. https://doi.org/10.13490/j.cnki.frr.2021.11.003

Jie, Y., & Xiang, Z. (2012). Video object detection and tracking and its applications. Shanghai Jiao Tong University Press. https://xueshu.baidu.com/usercenter/paper/show?paperid=b27435d7ec1f25ee2ca7b839f90126ff&site=xueshu_se

Kewei, H., Yi, A., & Yuan, G. (2023). Financial fragility: Internal spillover and its impact on the real economy. Credit Reference, 41(6), 81–86. https://kns.cnki.net/kcms2/article/abstract?v=vdPasdvfHvuik31jA1h1Zi8JRqiE9WXB86b70Th2u0EYSMWefP2KIsjYzOSBpl4TM9g0rzrcmrd6p8PMy2NiMtrSLkcfuSHNBY8X--0Ea8Y_8yxvg1AV4Dyo-W3kGarpAOTWzCFpGU4=&uniplatform=NZKPT&flag=copy

Lai, Y., & Hu, Y. (2021). A study of systemic risk of global stock markets under COVID-19 based on complex financial networks. Physica A: Statistical Mechanics and its Applications, 566, Article 125613. https://doi.org/10.1016/j.physa.2020.125613

Li, S. W., Wang, H., & Liu, X. X. (2022). Systemic risk: Feedback effect between the financial system and the real economy. Journal of Management Sciences in China, 25(11), 25–42. https://doi.org/10.19920/j.cnki.jmsc.2022.11.002

Li, Z. (2021). Measurement and prevention research on systemic financial risks in China. China Financial Publishing Corporation.

Li, Z., Liu, Q., & Liang, Q. (2019). A study on forestalling China’s systemic risk based on financial industry and real economy interacted network. Statistical Research, 36(2), 15–27. https://doi.org/10.19343/j.cnki.11-1302/c.2019.02.003

Li, Z., Yao, Y. Z., Tang, H. L., & Zhang, J. (2021). Extreme risk spillovers in the Chinese financial system: Based on the spillover index and spillover network. South China Journal of Economics, 12, 80–92. https://kns.cnki.net/kcms2/article/abstract?v=KqXyGY4RJv3DnxBqQDryN8gk3rPAhXvmXUYzvrzwVi4VQyzKLW2Xh9wHSfVsqdAl9lpnyhHAWIP8CuXENMqCx99XRL8MhYMJ2fU7La63-sNMVj7WSr1DgkUup3KoO0J54EItgSchvBuqIflVTyuZ-caCBjqG-I5ixpB7m-jYGwsc-LQhiJo-fC1ZT4872XOc&uniplatform=NZKPT&language=CHS

Liu, J. S. (2020). China’s bond default and systemic risks research [Master’s thesis, Central University of Finance and Economics]. https://kns.cnki.net/kcms2/article/abstract?v=nouGVBS_tgeuB_Vkm1OUHyQDVaWHxhBHV9a1ic9yvn09dcXBgFub8c0E10qsn8ZsjU_fp6gl0FuGbdvFQc_WnaXWD0T0h3lJ10P1rBtS5llSoPqmYC1yvSZPZP6DM45l-F5sEtW9lRWWqFOSMByKsw==&uniplatform=NZKPT&language=CHS

Liu, X. H. (2011). Estimation of probability density for high-dimensional data based on Gaussian mixture models [Doctoral dissertation, Institute of Automation, Chinese Academy of Sciences]. Wanfang Data. https://d.wanfangdata.com.cn/thesis/Y2035224

Ma, Y. M., & Hu, C. Y. (2021). The impact of fictitious-toward economy and strong financial supervision on the extreme risk connection between financial and entity industries. Statistical Research, 38(4), 74–88. https://doi.org/10.19343/j.cnki.11-1302/c.2021.04.006

National Health Commission. (2022). Notice of the NHC on the issuance of the general plan for the implementation of class II management of novel coronavirus infections. http://www.gov.cn/xinwen/2022-12/27/content_5733739.htm

Ouyang, Z. S., & Zhou, X. W. (2022). Spillover effect of systemic financial risk on macro economy: Based on quantile to quantile method. Journal of Statistical Research, 39(10), 68–83. https://kns.cnki.net/kcms2/article/abstract?v=KqXyGY4RJv1ErJ1gHmVoWoTNRlLWGoZ3ARceQrO08A-pIuYRmskJrZgv5-jbNvQ5G7gBKotwQhyqzA2RjODV0fNIh4meIQtFa4hgXeBtU5Rum_DOPNJ283v3cEN4XeNHmcNPLyu-1fiQcyEHdbjNxU4AjsMHWfaKrj_62jIVXxlmZTqPxFwlVvHuTxYP9erx&uniplatform=NZKPT&language=CHS

Pacelli, V., Miglietta, F., & Foglia, M. (2022). The extreme risk connectedness of the new financial system: European evidence. International Review of Financial Analysis, 84, Article 102408. https://doi.org/10.1016/j.irfa.2022.102408

Peng, H. F., & Zhu, Y. Z. (2019). Capital account liberalization, financial stability and economic growth. Studies of International Finance, 2, 5–14. https://doi.org/10.16475/j.cnki.1006-1029.2019.02.001

People’s Bank of China. (2020a). Notice PBC on further strengthening financial support for the prevention and control of novel coronavirus pneumonia epidemic. http://www.gov.cn/zhengce/zhengceku/2020-02/01/content_5473639.htm

People’s Bank of China. (2020b). Notice of the PRC on China’s response to the COVID-19 pandemic. http://www.gov.cn/xinwen/2020-06/07/content_5517737.htm

People’s Republic of China. (2022a). Hold high the great banner of socialism with Chinese characteristics uniting and striving for the comprehensive construction of a modernized socialist country – Report at the 20th National Congress of the Communist Party of China. https://www.gov.cn/xinwen/2022-10/25/content_5721685.htm

People’s Republic of China. (2022b, December 23). Notice of the PRC on the financial support for the real economy continues to increase in strength. Economic Daily. https://www.gov.cn/xinwen/2022-12/23/content_5733198.htm

Pericoli, M., & Yilmaz, K. (2024). Shocks and global asset market connectedness. In Handbook of financial integration (pp. 108–133). Edward Elgar Publishing. https://doi.org/10.4337/9781803926377.00012

Rizan, M., Salim, M. Z., Mukhtar, S., & Daly, K. (2022). Macroeconomics of systemic risk: Transmission channels and technical integration. Risks, 10(9), Article 174. https://doi.org/10.3390/risks10090174

Shanghai Stock Exchange. (2018). Notice on the issuance of the ‘stock pledge repo trading and registration settlement business measures (2018 revision)’. http://www.sse.com.cn/services/tradingservice/stockrepo/business/c/c_20190118_4711978.shtml

Shanghai Stock Exchange. (2020). Notice of the SHSE on regarding the release of Shanghai Stock Exchange securities trading business guide No. 3 – Repurchase agreement securities trading business. http://www.sse.com.cn/lawandrules/guide/hyznlc/c/c_20201207_5274061.shtml

Sun, Y., & Jiang, C. H. (2022). China’s financial real intermediary scale, intermediary quality and economic growth: Based on regional heterogeneity analysis. Journal of Technical Economics & Management, 5, 67–71. https://kns.cnki.net/kcms2/article/abstract?v=vdPasdvfHvvJ3Q5O_7ZdkcDR8NIZ2F-FMW9KGyCBUo5_n10Jr61DKCh6E1nnW293mikosBx2Cd58WOZjUWskxGQIeVVCXjaH_116jguzL6lVcuGLur6kGvsZ8BXoPuP7HUyF1B3RbOjt5gQ7obzt6g==&uniplatform=NZKPT&language=CHS

Tang, J., Ren, Z. Y., Chen, H. H., & Qiao, S. (2024). Multidimensional risk spillover among power, coal, and carbon markets: Empirical evidence from China. Environmental Science and Pollution Research, 31(1), 1244–1259. https://doi.org/10.1007/s11356-023-31099-y

Wang, Z., Gao, X., Huang, S., Sun, Q., Chen, Z., Tang, R., & Di, Z. (2022). Measuring systemic risk contribution of global stock markets: A dynamic tail risk network approach. International Review of Financial Analysis, 84, Article 102361. https://doi.org/10.1016/j.irfa.2022.102361

Yang, Z. H. (2020). The risk contagion relationship between the financial market and the macro economy: A mixed-frequency based empirical research. Social Sciences in China, 12, 160–180, 204. https://kns.cnki.net/kcms2/article/abstract?v=RyaFSLOYMk5zgjOV3V6nIwjDRK50MMmf6eDQ_gz0dqm2hBloGbhWjFDg0aSsE0oXqs6OttUIRnnmHZ_f5vQqZahwTJoyelXBXfl-0NhK7rsetVxR45Ux2aunJraT3a_U_XElxRLndX0knQYs1NfoTA==&uniplatform=NZKPT&language=CHS

Yu, J. X. (2024, April 9). Commercial banks should be good real economy "stabilizer". Newspaper Title Unspecified, 006. https://kns.cnki.net/kcms2/article/abstract?v=4wkQyjAcIEeR7wvj_thdISknqj4D5dY6faOQ5oxciVAyU3Sovz_bkXYq4GcvYjKfSq2pz0HuVGEJisEzYesMkT6DbdEOHbp7yCVfGKty4LON6H4G5emU3yNm08g9XFAATS1_QKuHb7GJtLgtQbCcn4cjYQHTwUDP51bdNnWtshwZgOzT6e0pm9h8aG0VlEPn7v7e5AE3Vw6wNLW2aoQBHF5ndqiWw6ys&uniplatform=NZKPT&language=CHS

Zeng, C., & Tang, S. (2023). The role of state-owned enterprises as economic stabilizers under COVID-19: From the perspective of supply chain support. Economic Research, 58, 78–96. https://kns.cnki.net/kcms2/article/abstract?v=4wkQyjAcIEflEsa1Beqe66CJRnUxDJRmqZpvpuVpGU375heCJrd1JLnswpBSXWypuQ8Ln5CH-Ch3dEhgiy0-LV6fOZJTrEdMcio2VwfxKwKgN0aeRIG_h6wAJYDvDcVxGMAjCjs3qiwreR3RyQPKCi2bwVA5T_ttCiBN4iOHTR_ht3FCQ9bU7l6_Hz-b71oP0_zdn61hjP2ZWdqWuchRBA==&uniplatform=NZKPT&language=CHS

Zhang, W. P., Zhuang, X. T., Wang, J., & Lu, Y. (2020). Connectedness and systemic risk spillovers analysis of Chinese sectors based on tail risk network. North American Journal of Economics and Finance, 54, Article 101248. https://doi.org/10.1016/j.najef.2020.101248

Zhang, Z. X., & Huang, Z. J. (2024). Systematic risk monitoring and risk spillover in capital market: From the perspective of financial stress index. Securities Market Herald, 7, 57–67, 79. https://kns.cnki.net/kcms2/article/abstract?v=O_Pen4SgC0BhSqit5LS3ohUL9eXugLsWu4jUMz98jf8yfgPdvkL93o3gP3p7XLAVoYyDRl-a0DfRqE11on4rd0zbEGfzrJZbpSb75fBMjZvYF2Tr6rdJSP25Dx6P1YlTYzzvZOJCqsAWHzjP85-sCBkT2q31zzc9TNyGe6wDLPX8n0j5Icc377LndoKROE0O&uniplatform=NZKPT&language=CHS

Zhao, M., & Park, H. (2024). Bidirectional risk spillovers between Chinese and Asian stock markets: A dynamic Copula-EVT-CoVaR approach. Journal of Risk and Financial Management, 17(3), Article 110. https://doi.org/10.3390/jrfm17030110

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).