A Study of the Impact of Population Aging on the Effectiveness of Household Financial Asset Allocation

Abstract

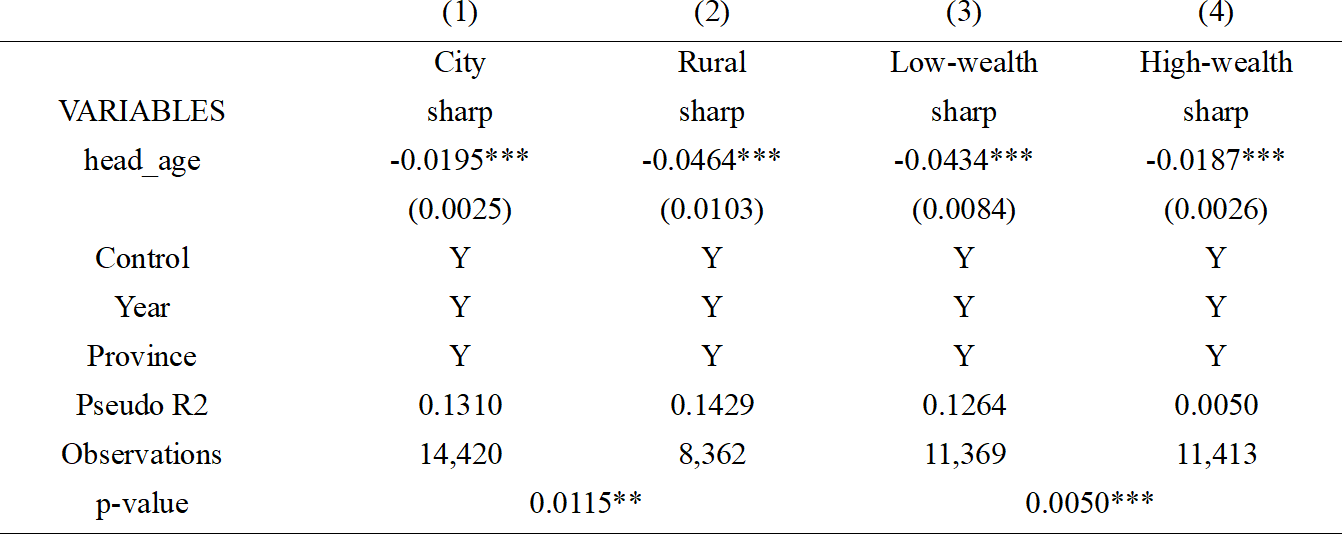

Based on the perspective of population aging, this paper explores the impact of aging shocks on household financial asset allocation behavior, and constructs cross-period tracking panel data based on the 2015, 2017, and 2019 China Household Finance Survey (CHFS) data to empirically investigate the mechanism by which population aging affects different dimensions of household financial asset allocation behavior. The results of the study find that (1) population aging significantly inhibits household portfolio effectiveness; and this conclusion still holds after replacing variables and robustness testing of the model. (2) The mechanism analysis illustrates that population aging affects household financial asset allocation effectiveness through wealth constraints and health risk paths. (3) Heterogeneity analysis illustrates that there is urban-rural and wealth heterogeneity in the impact of population aging on financial asset allocation. The negative impact of population aging on financial asset allocation is more pronounced in rural households and in households with low wealth levels.

References

Bajtelsmit, V. L., & Wang, T. (2018). Household financial planning strategies for managing longevity risk. Financial Planning Review, 1(1–2), e1007.

Gui, W., Chen, D., & Dong, W. (2022). Population aging and family financial asset allocation: An empirical study based on propensity score matching method. Northwest Population, 43(3), 58–68.

Jiang, T. (2022). Mediating and moderating effects in empirical studies of causal inference. China Industrial Economy, 2022(5), 100–120. https://doi.org/10.19581/j.cnki.ciejournal.2022.05.005

Lu, Y., & Xie, J. (2023). The impact of population aging on household financial risk asset allocation. Modern Economic Discussion, 2023(7), 34–43.

Shimizutani, S. (2020). Financial literacy of middle-aged and older individuals: Comparison of Japan and the United States. The Journal of the Economics of Ageing, 16, 100214.

Smith, J. P., McArdle, J. J., & Willis, R. J. (2010). Financial decision making and cognition in a family context. The Economic Journal, 120(548), 363–380.

Wu, Y., Li, X., Li, J., & Zhou, L. (2021). Digital financial development and household financial asset portfolio effectiveness. Management World, 37(7), 92–104+7.

Zhang, J., & Xu, S. (2023). Measurement and judgment of investors' risk tolerance under population aging. Systems Engineering Theory and Practice, 43(8), 2266–2286.

Zhang, Z., Zhao, B., & Cheng, C. (2023). Population aging and household commercial insurance participation: An empirical analysis based on CHFS data. Financial Theory and Practice, 2023(10), 107–118.

Zhou, C. (2021). Life cycle and family portfolio effectiveness: Accumulation of investment experience or decline of cognitive ability. Southern Economy, 2021(6), 101–118.

Zhou, L. (2022). Population aging, life insurance holdings and household asset allocation efficiency. Modern Economic Discussion, 2022(1), 35–46.

Zhou, L. (2023). Does population aging exacerbate the economic vulnerability of Chinese households? International Financial Studies, 2023(10), 28–37.

Zhou, L., Liu, H., & Li, J. (2023). Retirement shock, information acquisition and the efficiency of Chinese households' financial asset allocation: Analyzing households' retirement choice in the context of aging. Fujian Forum (Humanities and Social Sciences Edition, 2023(3), 123–139.

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).