Formalism or Substantialism: ESG and Stock Crash Risk

Abstract

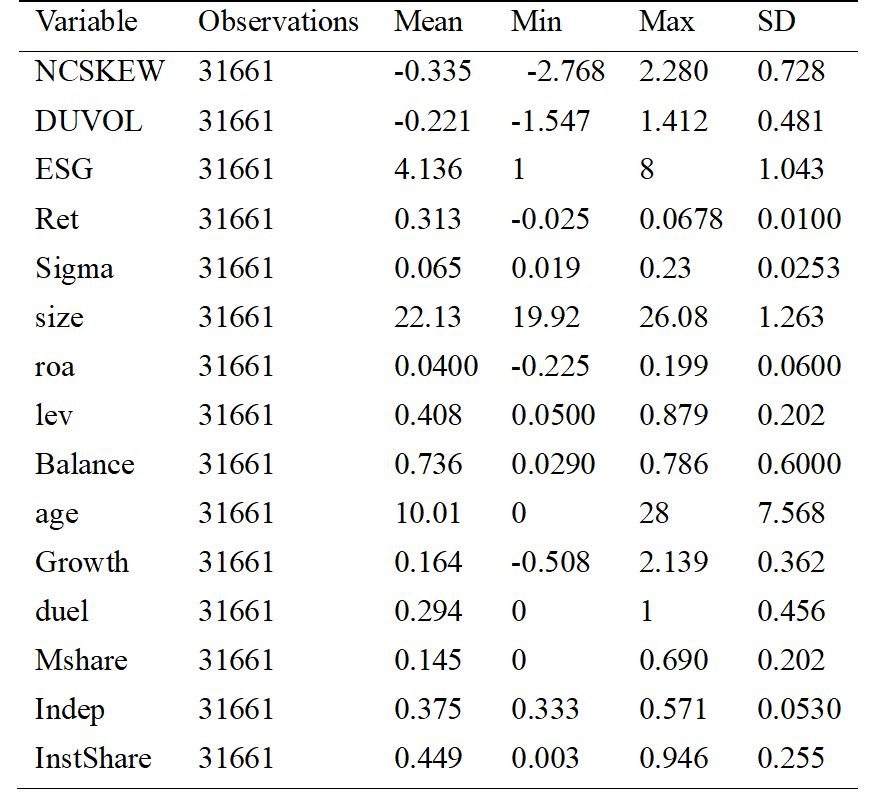

We use a specifically chosen data set of Chinese A-share listed businesses from 2009 to 2022 to investigate the complex relationship between stock crash risk and company Environmental, Social, and Governance (ESG) performance. Based on empirical investigation, a complex U-shaped dynamic is revealed, in which early advances in ESG performance work as a protective factor against stock collapse risk initially, but with ESG performing better, this impact reverses and becomes an enhancer of stock crash risk. We carry out a thorough mediation study to elucidate the underlying mechanisms, revealing the critical roles that business reputation and analyst scrutiny play in mediating the U-shaped link between stock crash risk and ESG. Furthermore, we explore possible moderating factors and find that the adoption of ESG in state-owned organizations and businesses operating in less marketized environments may be motivated by instrumental factors, which would ultimately increase the likelihood of a stock market crash. Thus, by providing a complex and dialectical approach that unites disparate points of view, our work adds to the specialist conversation on the economic consequences of ESG.

References

Edmans, A. (2023). The end of ESG. Financial Management, 52(1), 3–17. https://doi.org/10.1111/fima.12413

Feng, H., Ding, C., Yue, W., & Liu, G. (2023). ESG performance and corporate risk-taking: Evidence from China. International Review of Financial Analysis, 87, 102550. https://doi.org/10.1016/j.irfa.2023.102550

Gibson Brandon, R., Krueger, P., & Schmidt, P. S. (2021). ESG rating disagreement and stock returns. Financial Analysts Journal, 77(4), 104–127. https://doi.org/10.1080/0015198X.2021.1963186

Guan, K., & Zhang, R. (2019). Corporate reputation and earnings management: Efficient contract theory or rent-seeking theory. Accounting Research, 2019(1), 59–64.

Huang, S. (2022). The “green washing” of ESG disclosure. Finance and Accounting Monthly, 2022(1), 3–11. https://doi.org/10.19641/j.cnki.42-1290/f.2022.01.001

Jiang, C., Li, X., Xu, Q., & Liu, J. (2024). Does environmental protection tax impact corporate ESG greenwashing? A quasi-natural experiment in China. Economic Analysis and Policy, 84, 774–786. https://doi.org/10.1016/j.eap.2024.09.029

Lee, C. W., & Zhong, J. (2015). Construction of a responsible investment composite index for renewable energy industry. Renewable & Sustainable Energy Reviews, 51, 288–303. https://doi.org/10.1016/j.rser.2015.05.071

Li, Y., & Li, S. (2024). ESG performance and innovation quality. International Review of Economics & Finance, 92(C), 1361–1373.

Lu, H., Deng, T., & Yu, J. (2019). Can financial subsidies promote the ‘greening’ of enterprises? Research on listed companies from heavy pollution industry in China. Economic Management Journal, 41(4), 5–22. https://doi.org/10.19616/j.cnki.bmj.2019.04.001

Murata, R., & Hamori, S. (2021). ESG disclosures and stock price crash risk. Journal of Risk and Financial Management, 14(2), 70. https://doi.org/10.3390/jrfm14020070

Sun, H., Zhu, S., & Zhang, X. (n.d.). ESG, corporate transparency and corporate reputation. Soft Science, 1–10.

Wei, L., & Chengshu, W. (2024). Company ESG performance and institutional investor ownership preferences. Business Ethics, the Environment & Responsibility, 33(3), 287–307. https://doi.org/10.1111/beer.12602

Xiao, H. J. (2024). Research status on ESG controversies. Economic Perspectives, 2024(3), 145–160.

Yildiz, F., Dayi, F., Yucel, M., & Cilesiz, A. (2024). The impact of ESG criteria on firm value: A strategic analysis of the airline industry. Sustainability, 16(19). https://doi.org/10.3390/su16198300

Zhang, D. (2022). Are firms motivated to greenwash by financial constraints? Evidence from global firms’ data. Journal of International Financial Management & Accounting. https://doi.org/10.1111/jifm.12153

Zhao, C., Chen, S., & Cao, W. (2020). ‘Internet Plus’ information disclosure: Substantive statement or strategic manipulation—Evidence based on the risk of stock price crash. Chinese Industrial Economics, 2020(3), 174–192. https://doi.org/10.19581/j.cnki.ciejournal.2020.03.020

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).